FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

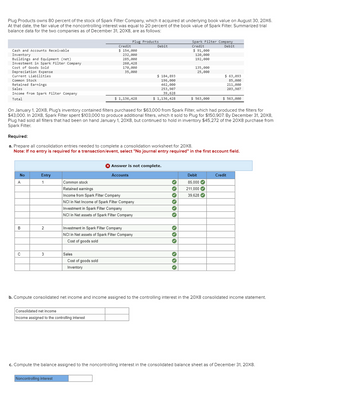

Transcribed Image Text:Plug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book value on August 30, 20X6.

At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Spark Filter. Summarized trial

balance data for the two companies as of December 31, 20X8, are as follows:

Cash and Accounts Receivable

Inventory

Buildings and Equipment (net)

Investment in Spark Filter Company

Cost of Goods Sold

Depreciation Expense

Current Liabilities

Common Stock

Retained Earnings

Sales

Income from Spark Filter Company

Total

No

A

B

C

Entry

1

2

3

Plug Products

Credit

$ 154,000

232,000

285,000

On January 1, 20X8, Plug's inventory contained filters purchased for $63,000 from Spark Filter, which had produced the filters for

$43,000. In 20X8, Spark Filter spent $103,000 to produce additional filters, which it sold to Plug for $150,907. By December 31, 20X8,

Plug had sold all filters that had been on hand January 1, 20X8, but continued to hold in inventory $45,272 of the 20X8 purchase from

Spark Filter.

Noncontrolling interest

260,428

170,000

35,000

Required:

a. Prepare all consolidation entries needed to complete a consolidation worksheet for 20X8.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Sales

$ 1,136,428

Cost of goods sold

Inventory

Consolidated net income

Income assigned to the controlling interest

Common stock

Retained earnings

Income from Spark Filter Company

NCI in Net Income of Spark Filter Company

Accounts

Investment in Spark Filter Company

NCI in Net assets of Spark Filter Company

Investment in Spark Filter Company

NCI in Net assets of Spark Filter Company

Cost of goods sold

Debit

X Answer is not complete.

$184,893

196,000

462,000

253,907

39,628

$ 1,136,428

›› › › ››

✓

Spark Filter Company

Credit

Debit

✓

$ 91,000

120,000

192,000

✓

135,000

25,000

$ 563,000

$ 63,093

85,000

211,000

203,907

$ 563,000

Debit

85,000✔

211,000✔

39,628✔

b. Compute consolidated net income and income assigned to the controlling interest in the 20X8 consolidated income statement.

Credit

c. Compute the balance assigned to the noncontrolling interest in the consolidated balance sheet as of December 31, 20X8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Define 'Consolidation':

VIEW Step 2: (a) Prepare all consolidation entries needed to complete a consolidation worksheet for 20X8:

VIEW Step 3: (b) Determine the consolidated net income and income assigned to the controlling interest:

VIEW Step 4: (c) Compute he balance assigned to non-controlling interest in the consolidated balance sheet:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ice Corporation owns 30% of Idea Company and applies the equity method. In 2XX0, Ice Corp. sells merchandise costing $288,000 to Idea for $360,000. Idea's ending inventory includes $60,000 purchased from Ice. Which of the following is the correct equity method entry to record the realization of the gross profit in 2XX1? Select one: O a. O Equity Investment Cost of Goods Sold b. Equity Income Equity Investment C. d. Equity Income Debit Credit 60,000 Equity Investment 3,600 Equity Income Equity Investment 60,000 Debit Credit 3,600 Debit Credit 3,600 3,600 Debit Credit 60,000 60,000arrow_forwardFollowing are preacquisition financial balances for Padre Company and Sol Company as of December 31. Also included are fair values for Sol Company accounts. Cash Receivables Inventory Land Building and equipment (net) Franchise agreements Accounts payable Accrued expenses Longterm liabilities Common stock-$20 par value Common stock-$5 par value Additional paid-in capital Retained earnings, 1/1 Revenues Expenses Inventory Land Accounts Buildings and equipment Franchise agreements Goodwill Revenues Additional paid-in capital $ Expenses Retained earnings, 1/1 Retained earnings, 12/31 Padre Company Amounts Sol Company Book Values Book Values Fair Values 12/31 12/31 84, 100 392,000 249,000 200,000 237,000 Note: Parentheses indicate a credit balance. On December 31, Padre acquires Sol's outstanding stock by paying $349,000 in cash and issuing 11,400 shares of its own common stock with a fair value of $40 per share. Padre paid legal and accounting fees of $23,400 as well as $12,800 in stock…arrow_forwardManjiarrow_forward

- Following are preacquisition financial balances for Padre Company and Sol Company as of December 31. Also included are fair values for Sol Company accounts. Cash Receivables Inventory Land Building and equipment (net) Franchise agreements Accounts payable Accrued expenses Longterm liabilities Common stock-$20 par value Common stock-$5 par value Additional paid-in capital Retained earnings, 1/1 Revenues Expenses Inventory Land Accounts Buildings and equipment Franchise agreements Goodwill $ Revenues Additional paid-in capital Expenses Retained earnings, 1/1 Retained earnings, 12/31 Padre Company Book Values 12/31 Amounts Sol Company Book Values 12/31 Fair Values 12/31 59,400 381,000 349, 100 142,900 387,500 268,800 (149,000) (40,000) (1,132,500) (660,000) (660,000) (660,000) 317,000 240,000 381,000 520,000 296,000 762,500 170,000 672,500 321,000 Note: Parentheses indicate a credit balance. On December 31, Padre acquires Sol's outstanding stock by paying $219,000 in cash and issuing…arrow_forwardThe subsidiary was acquired at the beginning of the year. Its sales, inventory purchases, and out-of-pocket seling and administrative expenses occurred evenly during the year. Equipment was purchased for €10,000 when the exchange rate was $1.23 Depreciation for the year includes C200 related to the equipment purchased during the year. The ending inventory was purchased at the end of the year, and the beginning inventory was purchased at the end of the previous year. If the subsidury's functional currency is the euro, what is translated cost of sales for the year? Select one: O $11,750 b.$10.530 $11,590 d. $11.425 Darrow_forwardPeanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $310,500 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $345,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit $ 174,000 181,000 211,000 353,700 206,000 707,000 187,000 41,000 220,000 89.000 $2,369,700 Credit $450,000 63,000 188,000 492,000 313,900 789,000 73.800 $2,369,700 Snoopy Company Debit $ 87,000 82,000 76,000 95,000 188,000 120,000 9,000 27,000 34,000 $718,000 Credit $18,000 48,000 69,000 196,000 149,000 238,000 0 $718,000 Required: a. Prepare any equity…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education