FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

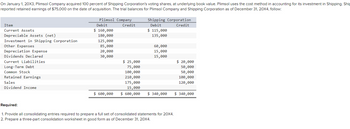

Transcribed Image Text:On January 1, 20X3, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Ship

reported retained earnings of $75,000 on the date of acquisition. The trial balances for Plimsol Company and Shipping Corporation as of December 31, 20X4, follow:

Item

Current Assets

Depreciable Assets (net)

Investment in Shipping Corporation

Other Expenses

Depreciation Expense

Dividends Declared

Current Liabilities.

Long-Term Debt

Common Stock

Retained Earnings

Sales

Dividend Income

Plimsol Company

Debit

Credit

$ 160,000

180,000

125,000

85,000

20,000

30,000

$ 600,000

$ 25,000

75,000

100,000

210,000

175,000

15,000

$ 600,000

Shipping Corporation

Debit

Credit

$ 115,000

135,000

60,000

15,000

15,000

$ 20,000

50,000

50,000

100,000

120,000

$ 340,000 $ 340,000

Required:

1. Provide all consolidating entries required to prepare a full set of consolidated statements for 20X4.

2. Prepare a three-part consolidation worksheet in good form as of December 31, 20X4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A Chapter 11 reorganization plan must be approved by those creditors representing at least one-half of the total dollar amount due that class. True or Falsearrow_forwardA number of factors led to the development of double entry bookkeeping, detail and discuss with justification what you consider to be the six most important of these.arrow_forwardA schedule set up to combine similar general ledger accounts, the total of which appears on the working trial balance as a single amount, is referred to as a: Supporting schedule, Lead schedule, Corrobrating schedule, or Reconciling schedulearrow_forward

- In the FASB Accounting Standards Codification some of the sections may have the letter "S" next to it. What does the "S" indicate? Question 24 options: a) Superceded Guidance b) SEC Guidance c) SME Guidance d) Simplified Guidancearrow_forwardCan you help me with the match terms, please? Thank u :) Modified retrospective approach Prospective approach and retrospective approach are the optionsarrow_forwardGovernment Accounting-you will do a 5 page power point slide presentation and use the GASB codification as your guidance. Please include the following: Explain what the CAFR is Provide an outline for the minimum content of a CAFR Select a local CAFR (I can help you with this step) and identify the following: a. the entity’s most significant source of revenues and most significant expense; b. the entity’s most significant asset, and its most significant liability; c. two of the individual funds used by the government d. who prepared the report; e. who audited the report, and using what auditing standards.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education