FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

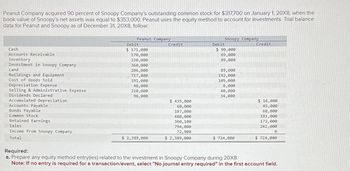

Transcribed Image Text:Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $317,700 on January 1, 20X8, when the

book value of Snoopy's net assets was equal to $353,000. Peanut uses the equity method to account for investments. Trial balance

data for Peanut and Snoopy as of December 31, 20X8, follow:

Cash

Accounts Receivable

Inventory

Investment in Snoopy Company

Land

Buildings and Equipment

Cost of Goods Sold

Depreciation Expense

Selling & Administrative Expense

Dividends Declared

Accumulated Depreciation

Accounts Payable

Bonds Payable

Common Stock

Retained Earnings

Sales

Income from Snoopy Company

Total

Peanut Company

Debit

$ 171,000

170,000

220,000

360,000

206,000

717,000

191,000

48,000

210,000

96,000

$ 2,389,000

Credit

$ 435,000

60,000

187,000

480,000

360,100

794,000

72,900

$ 2,389,000

Debit

Snoopy Company

$ 90,000

69,000

89,000

89,000

192,000

105,000

8,000

48,000

34,000

$724,000

Credit

$ 16,000

45,000

68,000

181,000

172,000

242,000

0

$724,000

Required:

a. Prepare any equity method entry(ies) related to the investment in Snoopy Company during 20X8.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Following are preacquisition financial balances for Padre Company and Sol Company as of December 31. Also included are fair values for Sol Company accounts. Cash Receivables Inventory Land Building and equipment (net) Franchise agreements Accounts payable Accrued expenses Longterm liabilities Common stock-$20 par value Common stock-$5 par value Additional paid-in capital Retained earnings, 1/1 Revenues Expenses Inventory Land Accounts Buildings and equipment Franchise agreements Goodwill Revenues Additional paid-in capital $ Expenses Retained earnings, 1/1 Retained earnings, 12/31 Padre Company Amounts Sol Company Book Values Book Values Fair Values 12/31 12/31 84, 100 392,000 249,000 200,000 237,000 Note: Parentheses indicate a credit balance. On December 31, Padre acquires Sol's outstanding stock by paying $349,000 in cash and issuing 11,400 shares of its own common stock with a fair value of $40 per share. Padre paid legal and accounting fees of $23,400 as well as $12,800 in stock…arrow_forwardSandhill Corporation purchased for $288,000 a 25% interest in Murphy, Inc. This investment enables Sandhill to exert significant influence over Murphy. During the year, Murphy earned net income of $173,000 and paid dividends of $54,000. Prepare Sandhill's journal entries related to this investment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forwardAcme Company owns 35% of Superior Company. Superior Company declared and paid $44,000 cash dividends for the year. Acme Company's journal entry to record the dividends includes a: Ocredit to the Investment account for $44.000. credit to Dividend Revenue for $15.400. credit to the Investment account for $15,400. credit to Dividend Revenue for $44,000. None of the above. Carrow_forward

- Manjiarrow_forwardFollowing are preacquisition financial balances for Padre Company and Sol Company as of December 31. Also included are fair values for Sol Company accounts. Cash Receivables Inventory Land Building and equipment (net) Franchise agreements Accounts payable Accrued expenses Longterm liabilities Common stock-$20 par value Common stock-$5 par value Additional paid-in capital Retained earnings, 1/1 Revenues Expenses Inventory Land Accounts Buildings and equipment Franchise agreements Goodwill $ Revenues Additional paid-in capital Expenses Retained earnings, 1/1 Retained earnings, 12/31 Padre Company Book Values 12/31 Amounts Sol Company Book Values 12/31 Fair Values 12/31 59,400 381,000 349, 100 142,900 387,500 268,800 (149,000) (40,000) (1,132,500) (660,000) (660,000) (660,000) 317,000 240,000 381,000 520,000 296,000 762,500 170,000 672,500 321,000 Note: Parentheses indicate a credit balance. On December 31, Padre acquires Sol's outstanding stock by paying $219,000 in cash and issuing…arrow_forwardSwifty Company reported net income of $481000 for the year ended 12/31/25. Included in the computation of net income were the following: depreciation expense, $59400; amortization of a patent, $32000; income from an investment in the common stock of Blue Inc., accounted for under the equity method, $ 48400; and amortization of bond discount, $12000. Swifty also paid an $81000 dividend during the year. The net cash provided by operating activities would be reported at (a) $455000 (b) 423000 (c)342000 (d ) 536000arrow_forward

- Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $310,500 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $345,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit $ 174,000 181,000 211,000 353,700 206,000 707,000 187,000 41,000 220,000 89.000 $2,369,700 Credit $450,000 63,000 188,000 492,000 313,900 789,000 73.800 $2,369,700 Snoopy Company Debit $ 87,000 82,000 76,000 95,000 188,000 120,000 9,000 27,000 34,000 $718,000 Credit $18,000 48,000 69,000 196,000 149,000 238,000 0 $718,000 Required: a. Prepare any equity…arrow_forwardOn January 2, 20Y4, Whitworth Company acquired 40% of the outstanding stock of Aloof Company for $340,000. For the year ended December 31, 20Y4, Aloof Company earned income of $180,000 and paid dividends of $10,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $405,000. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase Dec. 31, 20Y4 - Income Dec. 31, 20Y4 - Dividends Jan. 31, 20Y5 - Salearrow_forwardPeanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, are as follows: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 130,000 $ 80,000 Accounts Receivable 165,000 65,000 Inventory 200,000 75,000 Investment in Snoopy Company 355,000 0 Land 200,000 100,000 Buildings and Equipment 700,000 200,000 Cost of Goods Sold 200,000 125,000 Depreciation Expense 50,000 10,000 Selling and Administrative Expense 225,000 40,000 Dividends Declared 100,000 20,000 Accumulated Depreciation $ 450,000 $ 20,000 Accounts Payable 75,000 60,000 Bonds Payable 200,000 85,000 Common Stock 500,000 200,000 Retained Earnings 225,000 100,000 Sales 800,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education