Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:es

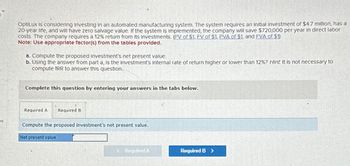

OptiLux is considering Investing in an automated manufacturing system. The system requires an initial Investment of $4.7 million, has a

20-year life, and will have zero salvage value. If the system is implemented, the company will save $720,000 per year in direct labor

costs. The company requires a 12% return from its Investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1)

Note: Use appropriate factor(s) from the tables provided.

a. Compute the proposed investment's net present value.

b. Using the answer from part a, is the investment's Internal rate of return higher or lower than 12% ? Hint. It is not necessary to

compute TRR to answer this question.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute the proposed investment's net present value.

Net present value

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Sunshine Corporation has to make a choice between two different solutions to its current production bottleneck. It can purchase the Superduper Model XT, which is more expensive but will have a useful life of 6 years, or it can purchase the Mediocre Model UX, which is less expensive but will only have a useful life of 3 years. The company requires a 10 percent rate of return on its investments. The Superduper’s cash flows are: Yr0 = -75, Yr1 = 10, Yr2 = 15, Yr3 = 25, Yr4 = 30, Yr5 = 25, Yr6 = 20. The Mediocre’s cash flows are: Yr0 = -50, Yr1 = 25, Yr2 = 30, Yr3 = 13. Using the replacement chain method, which of these two alternatives is better?arrow_forward10031.arrow_forwardYou are the financial analyst for a tennis racket manufacturer. The company is considering using a graphitelike material in its tennis rackets. The company has estimated the information in the following table about the market for a racket with the new material. The company expects to sell the racket for 6 years. The equipment required for the project will be depreciated on a straight-line basis and has no salvage value. The required return for projects of this type is 13 percent and the company has a 23 percent tax rate. Market size Market share Selling price Variable costs per unit Fixed costs per year Initial investment Pessimistic 113,000 19% $164 $ 106 $978,000 $ 1,968,000 Expected 123,000 23% $ 169 $ 102 $ 923,000 $1,818,000 Optimistic 135,000 25% $ 173 $ 99 $ 893,000 $ 1,798,000 Calculate the NPV for each case for this project. Assume a negative taxable income generates a tax credit. (A negative amount should be indicated by a minus sign. Do not round intermediate calculations…arrow_forward

- Webmasters.com has developed a powerful new server that would be used for corporations' Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example, NWC = 10% (Sales). The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 3%. The company's nonvariable costs would be $1 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project's returns are expected to be highly correlated with returns on the firm's other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated…arrow_forwardAn assembly operation at a software company now requires $250,000 per year in labor costs. A robot can be purchased and installed to automate the operation. The robot will cost $800,000, have an economic life of ten years, and have no residual value at the end of its life. Maintenance and operating expenses of $64,000 per year for the robot are estimated. MARR is 15%. Determine whether this is a viable project. Solve the problem by: (a) Present worth analysis (b) Annual cash flow analysis+- (c) Rate of return analysisarrow_forwardSarasota Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $450,000 and has an estimated useful life of 8 years with zero salvage value. Management estimates that the new bottling machine will provide net annual cash flows of $78,750. Management also believes that the new bottling machine will save the company money because it is expected to be more reliable than other machines, and thus will reduce downtime. Click here to view PV tables. How much would the reduction in downtime have to be worth in order for the project to be acceptable? Sarasota's discount rate is 10%. (Use the above table.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 5,275.) Reduction in downtime would have to have a present value $arrow_forward

- Dynamic is considering investing in a rooftop solar network to generate its own power. Any unused power will be sold back to the local utility company. Between cost savings and new revenues, the company expects to generate $1,460,000 per year in net cash inflows from the solar network installation. The solar network would cost $7.2 million and is expected to have a 18-year useful life with no residual value. Calculate (i) the internal rate of return (IRR) and (ii) the net present value (NPV) assuming the company uses a 13% hurdle rate. (i) Calculate the internal rate of return (IRR). Use technology to find this value. (Enter a percentage rounded to two decimal places, X.XX%.) The IRR is %.arrow_forwardAll American Telephones Inc. is considering the productionof a new cell phone. The project will require an investment of $13 million. If the phone iswell received, the project will produce cash flows of $8 million a year for 3 years, but ifthe market does not like the product, the cash flows will be only $2 million per year. Thereis a 50% probability of both good and bad market conditions. All American can delay theproject a year while it conducts a test to determine whether demand will be strong or weak.The delay will not affect the dollar amounts involved for the project’s investment or its cashflows—only their timing. Because of the anticipated shifts in technology, the 1-year delaymeans that cash flows will continue only 2 years after the initial investment is made. AllAmerican’s WACC is 8%. What action do you recommend?arrow_forwardA company is investing in a solar panel system to reduce its electricity costs. The system requires a cash payment of $125,374.60 today. The system is expected to generate net cash flows of $13,000 per year for the next 35 years. The investment has zero salvage value. The company requires an 8% return on its investments. Compute the net present value of this investment.arrow_forward

- 9arrow_forwardThreeRivers Corp. is considering the purchase of a new piece of equipment with a life of 12 years. The internal rate of return of the project is 20%. ThreeRivers has a required rate of return (hurdle rate) of 17%. The project would have: Multiple Choice a net present value greater than zero. a payback period more than 12 years. a net present value of zero. an accounting rate of return greater than 17%.arrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education