FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

![**PA4-4 (Algo) Identifying and Preparing Adjusting Journal Entries [LO 4-1, LO 4-2, LO 4-3, LO 4-6]**

*The following information applies to the questions displayed below.*

Val’s Hair Emporium operates a hair salon. Its unadjusted trial balance as of December 31, 2021, follows, along with information about selected accounts:

| **Account Names** | **Debit** | **Credit** |

|----------------------------------|-----------|-------------|

| Cash | $3,500 | |

| Supplies | $4,000 | |

| Prepaid Rent | $5,100 | |

| Accounts Payable | | $1,350 |

| Salaries and Wages Payable | | 0 |

| Income Tax Payable | | 0 |

| Common Stock | $1,700 | |

| Retained Earnings | $800 | |

| Service Revenue | | $70,950 |

| Salaries and Wages Expense | $28,800 | |

| Utilities Expense | $11,900 | |

| Rent Expense | $17,000 | |

| Supplies Expense | $4,500 | |

| Income Tax Expense | 0 | |

| **Totals** | **$74,800** | **$74,800** |

### Further Information

- **Cash**: As reported on the December 31 bank statement.

- **Supplies**: Based on count, only $1,150 of supplies still exist.

- **Prepaid Rent**: This amount was paid November 1 for rent through the end of January.

- **Accounts Payable**: This represents the total amount of bills received for supplies and utilities through December 15. Val estimates that the company has received $420 of utility services through December 31 for which it has not yet been billed.

- **Salaries and Wages Payable**: Stylists have not yet been paid $200 for their work on December 31.

- **Income Tax Payable**: The company has paid last year’s income taxes but not this year’s taxes.

- **Common Stock**: This amount was contributed for common stock in prior years.

- **](https://content.bartleby.com/qna-images/question/cb76c74f-33f9-4776-941a-47446e3aad13/b933e154-f148-41d6-bb74-cf53e7583a48/llg8si9_thumbnail.jpeg)

Transcribed Image Text:**PA4-4 (Algo) Identifying and Preparing Adjusting Journal Entries [LO 4-1, LO 4-2, LO 4-3, LO 4-6]**

*The following information applies to the questions displayed below.*

Val’s Hair Emporium operates a hair salon. Its unadjusted trial balance as of December 31, 2021, follows, along with information about selected accounts:

| **Account Names** | **Debit** | **Credit** |

|----------------------------------|-----------|-------------|

| Cash | $3,500 | |

| Supplies | $4,000 | |

| Prepaid Rent | $5,100 | |

| Accounts Payable | | $1,350 |

| Salaries and Wages Payable | | 0 |

| Income Tax Payable | | 0 |

| Common Stock | $1,700 | |

| Retained Earnings | $800 | |

| Service Revenue | | $70,950 |

| Salaries and Wages Expense | $28,800 | |

| Utilities Expense | $11,900 | |

| Rent Expense | $17,000 | |

| Supplies Expense | $4,500 | |

| Income Tax Expense | 0 | |

| **Totals** | **$74,800** | **$74,800** |

### Further Information

- **Cash**: As reported on the December 31 bank statement.

- **Supplies**: Based on count, only $1,150 of supplies still exist.

- **Prepaid Rent**: This amount was paid November 1 for rent through the end of January.

- **Accounts Payable**: This represents the total amount of bills received for supplies and utilities through December 15. Val estimates that the company has received $420 of utility services through December 31 for which it has not yet been billed.

- **Salaries and Wages Payable**: Stylists have not yet been paid $200 for their work on December 31.

- **Income Tax Payable**: The company has paid last year’s income taxes but not this year’s taxes.

- **Common Stock**: This amount was contributed for common stock in prior years.

- **

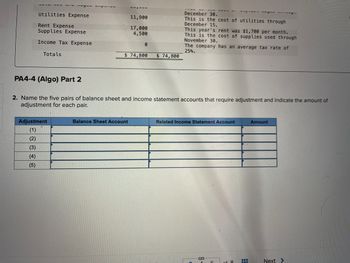

Transcribed Image Text:### Adjustments to Financial Statements

**Objective:** Understand the adjustments required for accurate reflection of balance sheet and income statement accounts.

#### Instructions:

2. Name the five pairs of balance sheet and income statement accounts that require adjustment and indicate the amount of adjustment for each pair.

#### Adjustment Table:

| Adjustment | Balance Sheet Account | Related Income Statement Account | Amount |

|------------|----------------------------|----------------------------------|--------|

| (1) | | | |

| (2) | | | |

| (3) | | | |

| (4) | | | |

| (5) | | | |

### Example Accounts and Adjustments:

1. **Adjustment for Prepaid Expenses:**

- **Balance Sheet Account:** Prepaid Rent

- **Related Income Statement Account:** Rent Expense

- **Amount:** $17,000

2. **Adjustment for Supplies:**

- **Balance Sheet Account:** Supplies

- **Related Income Statement Account:** Supplies Expense

- **Amount:** $4,500

3. **Adjustment for Accrued Expenses:**

- **Balance Sheet Account:** Accrued Salaries

- **Related Income Statement Account:** Salaries and Wages Expense

- **Amount:** To be determined

4. **Adjustment for Utilities:**

- **Balance Sheet Account:** Utilities Payable

- **Related Income Statement Account:** Utilities Expense

- **Amount:** $11,900

5. **Adjustment for Income Tax:**

- **Balance Sheet Account:** Income Tax Payable

- **Related Income Statement Account:** Income Tax Expense

- **Amount:** To be calculated based on average tax rate (25%)

#### Additional Notes:

- Ensure all adjustments are accurately recorded to maintain consistency in financial reporting.

- Double-check amounts and accounts to avoid any discrepancies.

By understanding and applying these adjustments, you can ensure that the financial statements reflect a true and fair view of the company’s financial position and performance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Also answer the Analysis pleasearrow_forwardUse the following sales journal to record the transactions. All credit sales are terms of n/30. (If a box is not used in the journal leave the box empty; do not select information or enter a zero.) i (Click the icon to view the transactions.) Jun Date 2024 Invoice No. Account Debited More info Jun. 1 Jun. 8 Customer Jun. 13 Jun. 28 Sales Journal Post. Ref. Accounts Receivable DR Sales Revenue CR Sold merchandise inventory on account to Ford Junk, $1,250. Cost of goods, $960. Invoice no. 101. Page Cost of Goods Sold DR Merchandise Inventory CR Sold merchandise inventory on account to Iris Fray, $2,250. Cost of goods, $1,650. Invoice no. 102. Sold merchandise inventory on account to Jack Tremane, $400. Cost of goods, $240. Invoice no. 103. Sold merchandise inventory on account to Gail White, $810. Cost of goods, $650. Invoice no. 104. Print Done Xarrow_forwardNeed help with this questiin please. Thank youarrow_forward

- business issued a credit memo $235 to NECinc.regarding the sales on oct 1 give journal entryarrow_forwardPrepare a journal entry on December 23 for the withdrawal of $22,500 by Graeme Schneider for personal use. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardTB MC Qu. 07-94 (Algo) Gideon Company uses... Gideon Company uses the allowance method of accounting for uncollectible accounts. On May 3, the Gideon Company wrote off the $2,300 uncollectible account of its customer, A. Hopkins. The entry or entries Gideon makes to record the write off of the account on May 3 is: Multiple Choice Account Title Debit Credit Accounts Receivable-A. Hopkins Allowance for Doubtful Accounts 2,300 2,300 Account Title Allowance for Doubtful Accounts Debit Credit 2,300 Bad debts expense 2,300 Account Title Debit Credit Accounts Receivable-A. Hopkins 2,300 ( Prev 14 of 20 Next > MAR 15 tv MacBook Air DD F2 F4 F5 F6 F7 F8 F9 # %24 & 2 3 8. W R T Y D F G H J Karrow_forward

- Prepare the entries for transaction below and indicate what journal it is 21 august issued a $600 credit memo to ultracity co. For an allowance on good sold on august 19, 2020arrow_forwardFill in the missing amounts in the accounts payable subsidiary ledgers for Al's Tractor Supply. NAME: B. Mario ACCOUNTS PAYABLE LEDGER ADDRESS: 1230 Rose Ave, Watertown, WI 53094 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- July 8 P7 1,900.00 1,900.00 July 15 J3 400.00 NAME: Denson & Soldner ACCOUNTS PAYABLE LEDGER ADDRESS: 111 Chase St, Johnson Creek, WI 53081 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- July 3 P7 3,100.00 3,100.00 July 13 CP9 3,100.00 July 29 P7 3,460.00 ACCOUNTS PAYABLE LEDGER NAME: Hutchinson Supplies ADDRESS: 1985 County Road, Lake Mills, WI 53577 DATE TTEM POST. REF. DEBIT CREDIT BALANCEarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education