FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

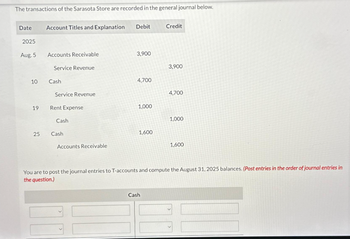

Transcribed Image Text:The transactions of the Sarasota Store are recorded in the general journal below.

Date Account Titles and Explanation

2025

Aug. 5

10

19

25

Accounts Receivable

Service Revenue

Cash

Service Revenue

Rent Expense

Cash

Cash

Accounts Receivable

Debit

3,900

4,700

1,000

1,600

Credit

Cash

3,900

4,700

1,000

1,600

You are to post the journal entries to T-accounts and compute the August 31, 2025 balances. (Post entries in the order of journal entries in

the question.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information You did only the t-accounts for the ansewr when i asked before so I was wondering if you would please help me out with the journal entries this time. You can see down there what the last person who helped said. So no t accounts this time just journal entry please. [The following information applies to the questions displayed below.] The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: Accounts Debits Credits Cash $ 4,500 Accounts Receivable 9,500 Supplies 3,500 Equipment 36,000 Accumulated Depreciation $ 8,000 Accounts Payable 6,000 Utilities Payable 7,000 Deferred Revenue 0 Common Stock 23,000 Retained Earnings 9,500 Totals $ 53,500 $ 53,500 The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services…arrow_forwardJournalizing Purchases Returns and Allowances and Posting to General Ledger and Accounts Payable Ledger Transactions for July and the beginning balances for selected general ledger and accounts payable ledger accounts are shown. July 7 Returned merchandise to Starcraft Industries, $750. 15 Returned merchandise to XYZ, Inc., $530. 27 Returned merchandise to Datamagic, $820. General Ledger Account No. Account Balance July 1, 20-- 202 Accounts Payable $10,640 501.1 Purchases Returns and Allowances Accounts Payable Ledger Name Balance July 1, 20-- Datamagic $2,680 Starcraft Industries 4,310 XYZ, Inc. 3,650 Required: Using page 3 of a general journal and the general ledger accounts and accounts payable ledger accounts, journalize and post the transactions. GENERAL JOURNAL PAGE 3 DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Jul. 7 Jul. 15 Jul. 27 GENERAL LEDGER ACCOUNT Accounts Payable ACCOUNT NO. 202 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20-- Jul. 1 Balance 10,640.00arrow_forwardACCOUNTS RECEIVABLE LEDGER NAME: E. McKenzie ADDRESS: 4717 Erin St, Madison, WI 53713 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 3 J60 3,816.00 3,816.00 Aug. 18 J60 4,589.80 fill in the blank 1 J60 105.00 fill in the blank 2 ACCOUNTS RECEIVABLE LEDGER NAME: S. Rottier ADDRESS: 1008 S. 9TH St, Monona, WI 53715 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 7 J60 1,484.00 1,484.00 Aug. 10 J60 400.00 fill in the blank 3 ACCOUNTS RECEIVABLE LEDGER NAME: L. Franklin ADDRESS: 2815 Main St, Cottage Grove, WI 53711 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 1 J60 1,272.00 1,272.00 Aug. 22 J60 2,120.00 fill in the blank 4 Using the information from the ledgers, prepare a schedule of accounts receivable as of August 31. If required, round your intermediate and final answers to the nearest cent. Willis Spas and PoolsSchedule of Accounts ReceivableAugust 31, 20-- E. McKenzie $fill…arrow_forward

- need help finding the net payment and credit towards account still due invoice amount= $538.42 date of invoice= April 23 Date of payment= May 14 credit terms= 3/10,1/15, n/30 E.O.M Net price= ?arrow_forwardThe accompanying table, Data table Date Deposit (Withdrawal) Date Deposit (Withdrawal) 1/1/20 $8,000 1/1/22 $3,272 1/1/21 $(6,540) 1/1/23 $5,255 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) , shows a series of transactions in a savings account. The account pays 5% simple interest, and the account owner withdraws interest as soon as it is paid. Calculate the following: a. The account balance at the end of each year. (Assume that the account balance at December 31, 2019, is zero.) b. The interest earned each year. c. The true rate of interest that the investor earns in this account. Question content area bottom Part 1 a. The account balance at the end of 2020 is $8,0008,000. (Round to the nearest dollar.) Part 2 The account balance at the end of 2021 is $1,9531,953. (Round to the nearest dollar.)arrow_forwardRequired information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: January 9 February 12 April 25 May 6 July 15 September 10 October 31 November 20 December 30 Provide storage services for cash, $135, 100, and on account, $52, 700. Collect on accounts receivable, $51, 600. Receive cash in advance from customers, $13,000. Purchase supplies on account, $9, 400. Pay property taxes, $8,600. Pay on accounts payable, $11,500. Pay salaries, $124, 600. Issue shares of common stock in exchange for $28,000 cash. Pay $2,900 cash dividends to stockholders.Prepare an unadjusted trial balance.arrow_forward

- eBook Using the following information, prepare the journal entries to reconcile the bank statement. Bank balance: $4,678 Book balance: $2,351 Deposits in transit: $325 Outstanding checks: $108 and $534 Bank service charges: $25 Notes receivable: $2,000; Interest income: $35 If an amount box does not require an entry, leave it blank.arrow_forwardNeed help on figuring out what to put for account/explanation for the journal entryarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education