FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

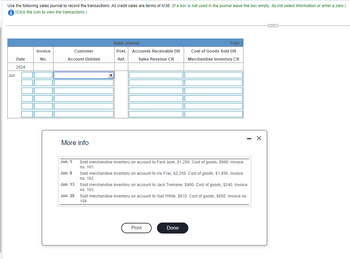

Transcribed Image Text:Use the following sales journal to record the transactions. All credit sales are terms of n/30. (If a box is not used in the journal leave the box empty; do not select information or enter a zero.)

i (Click the icon to view the transactions.)

Jun

Date

2024

Invoice

No.

Account Debited

More info

Jun. 1

Jun. 8

Customer

Jun. 13

Jun. 28

Sales Journal

Post.

Ref.

Accounts Receivable DR

Sales Revenue CR

Sold merchandise inventory on account to Ford Junk, $1,250. Cost of goods, $960. Invoice

no. 101.

Page

Cost of Goods Sold DR

Merchandise Inventory CR

Sold merchandise inventory on account to Iris Fray, $2,250. Cost of goods, $1,650. Invoice

no. 102.

Sold merchandise inventory on account to Jack Tremane, $400. Cost of goods, $240. Invoice

no. 103.

Sold merchandise inventory on account to Gail White, $810. Cost of goods, $650. Invoice no.

104.

Print

Done

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Post the following General Journal entries into the General Ledger: Hint: you may not need to fill in every box GENERAL JOURNAL Page 1 Date Description Post Debit Credit 1/1 Insurance Expense 20,000 Cash 20,000 1/5 Supplies Expense 5,000 Cash 5,000 1/7 Cash 6,000 Accounts Receivable 6,000arrow_forwardSubmit it in excel form E9.3arrow_forward! Required information [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 180 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Units Acquired at Cost @ Date Activities Units sold at Retail Beginning inventory $ 6.00 = $ 840 January 1 January 10 January 20 January 25 January 30 140 units Sales 100 units @ $ 15 Purchase 60 units $ 5.00 = 300 Sales 80 units @ $ 15 Purchase 180 units $ 4.50 = 810 Totals 380 units $ 1,950 180 units Record journal entries for Laker Company's sales and purchases transactions. Assume for this assignment that the company uses a perpetual inventory system and FIFO. All sales and purchases are made on account, and no discounts are offered.arrow_forward

- Please don't give answers in image and give correct answer thankuarrow_forwardReview the sales journal below. (Click the icon to view the sales journal.) Read the requirements. Requirement 1. Total each column of the sales journal. Date 2024 Jun. Jun. 1 8 101 Fletcher Jay 102 Iliana Flower 13 103 Jesse Thomas 28 104 George Westerberg 30 Totals 1. 2. Invoice No. Requirements 3. 4. Customer Account Debited Sales Journa Post. Accounts Receivable DR Ref. Sales Revenue CR Total each column of the sales journal. The following four-column accounts in the accounts receivable subsidiary ledger have been opened for you: Accounts Receivable-Flower; Accounts Receivable Jay; Accounts Receivable-Thomas; Accounts Receivable-Westerberg. Post the transactions to the accounts receivable subsidiary ledger. 1,260 2,225 360 900 Print The following selected four-column accounts in the general ledger have been opened for you: Accounts Receivable (112); Merchandise Inventory (118), Bal. $4,800; Sales Revenue (411); Cost of Goods Sold (511). Post the total of each column to the general…arrow_forwardSelect a description for each transaction recorded in the following T accounts: Cash (c) 5,042.10 Accounts Receivable (a) 5,320 (b) 175 (c) 5,145 Sales (a) 5,320 Sales Returns andAllowances (b) 175 Sales Discounts (c) 102.90 descriptions available: Issued credit memo for merchandise returned or as an allowance for damaged merchandise. Received check from customer for amount paid within the discount period less the return. Sold merchandise for cash. Sold merchandise on account. Sold supplies for cash.arrow_forward

- Direct Write-Off Method Williams & Hendricks Distributors uses the direct write-off method in accounting for uncollectible accounts. 20-1 Feb. Sold merchandise on account to Merry Merchants, $17,500. 18 Mar. Sold merchandise on account to Utter Unicorns, $14,300. 22 June Received $10,000 from Merry Merchants and wrote off the remainder owed on the 3 sale of February 18 as uncollectible. Received $8,000 from Utter Unicorns and wrote off the remainder owed on the sale Sept. of March 22 as uncollectible. Nov. Reinstated the account of Merry Merchants, which had been written off on June 3, 13 and received $7,500 cash in full settlement. 20-2 Jan. Reinstated the account of Utter Unicorns, which had been written off on September 9 of the previous year, and received $6,300 cash in full settlement. 17arrow_forwardThe accounting system of B. Ellen includes a sales journal, a purchases journal, a cash receipts journal, a cash payments journal and a general journal. The chart of accounts shows the following titles. Sales Returns and Allowances I Discount Received 100 Cash at Bank 410 I 110 I Accounts Receivable Control 1 420 --- --- i Prepaid Insurance Office Equipment i Accounts Payable Control Loan Payable I 115 1 500 i Purchases 150 503 Purchases Returns i Discount Allowed Rent Expense Insurance Expense 570 Sundry Expenses I 201 i 510 210 550 B. Ellen, Capital I 400 1 300 560 Sales During July, the transactions were as follows (ignore GST). July' 3 I Borrowed $35,000 from a bank. ---- .-. Purchased inventory on credit from Kelly Ltd. $4400, Invoice 312, terms 1/10, n/30 18 Sold inventory on credit to Leschev Ltd, $4500, terms 2/20, n/60, invoice 532 Received a credit note from Kelly Ltd. for inventory returned due to a defective unit i purchased on 6 July, $250 12 Issued a cheque (cheque no.…arrow_forwardJournalizing Purchases Returns and Allowances and Posting to General Ledger and Accounts Payable Ledger Transactions for July and the beginning balances for selected general ledger and accounts payable ledger accounts are shown. July 7 Returned merchandise to Starcraft Industries, $750. 15 Returned merchandise to XYZ, Inc., $530. 27 Returned merchandise to Datamagic, $820. General Ledger Account No. Account Balance July 1, 20-- 202 Accounts Payable $10,640 501.1 Purchases Returns and Allowances Accounts Payable Ledger Name Balance July 1, 20-- Datamagic $2,680 Starcraft Industries 4,310 XYZ, Inc. 3,650 Required: Using page 3 of a general journal and the general ledger accounts and accounts payable ledger accounts, journalize and post the transactions. GENERAL JOURNAL PAGE 3 DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Jul. 7 Jul. 15 Jul. 27 GENERAL LEDGER ACCOUNT Accounts Payable ACCOUNT NO. 202 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20-- Jul. 1 Balance 10,640.00arrow_forward

- Accounting Questionarrow_forwardACCOUNTS RECEIVABLE LEDGER NAME: E. McKenzie ADDRESS: 4717 Erin St, Madison, WI 53713 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 3 J60 3,816.00 3,816.00 Aug. 18 J60 4,589.80 fill in the blank 1 J60 105.00 fill in the blank 2 ACCOUNTS RECEIVABLE LEDGER NAME: S. Rottier ADDRESS: 1008 S. 9TH St, Monona, WI 53715 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 7 J60 1,484.00 1,484.00 Aug. 10 J60 400.00 fill in the blank 3 ACCOUNTS RECEIVABLE LEDGER NAME: L. Franklin ADDRESS: 2815 Main St, Cottage Grove, WI 53711 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 1 J60 1,272.00 1,272.00 Aug. 22 J60 2,120.00 fill in the blank 4 Using the information from the ledgers, prepare a schedule of accounts receivable as of August 31. If required, round your intermediate and final answers to the nearest cent. Willis Spas and PoolsSchedule of Accounts ReceivableAugust 31, 20-- E. McKenzie $fill…arrow_forwardPA4. Use the journals and ledgers that follow. Total the journals. Post the transactions to the subsidiary ledger and (using T-accounts) to the general ledger accounts. Then prepare a schedule of accounts receivable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education