FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

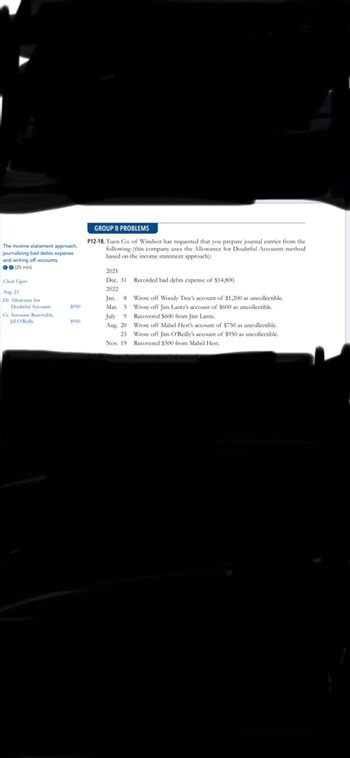

Transcribed Image Text:The income statement approach:

journalizing bad debts expense

and writing off accounts

00 (25 min)

Aug, 23

Dr. Allowance for

Doubtful Accounts

$950

Cr. Accounts Receivable,

Jill O'Reilly

GROUP B PROBLEMS

P12-18. Yuen Co. of Windsor has requested that you prepare journal entries from the

following (this company uses the Allowance for Doubtful Accounts method

based on the income statement approach):

2021

Dec. 31 Recorded bad debts expense of $14,800.

2022

Jan. 8

Mar. 5

Wrote off Woody Tree's account of $1,200 as uncollectible.

Wrote off Jim Lantz's account of $600 as uncollectible.

Recovered $600 from Jim Lantz.

July 9

Aug, 20

23

Wrote off Mabel Hest's account of $750 as uncollectible.

Wrote off Jim O'Reilly's account of $950 as uncollectible.

Recovered $500 from Mabel Hest.

Nov. 19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardRequirement 1. Record the transactions in the journal and post to the Allowance for uncollectible accounts and Bad debt expense ledger accounts that have been opened for you. These accounts have beginning balances of $4.300 (cr.) and so. respectively. Remember to update account balances but ignore posting references. Begin by recording the transactions in the journal. (Record debits first, then credits. Exclude explanations from any journal entries.) Jan 17: Sold inventory to Rick Harrison, $900 on account. Ignore cost of goods sold. Journal Entry Date Accounts Debit Credit Jan 17 Jun 29: Wrote off the Rick Harrison account as uncollectible after repeated efforts to collect from him Journal Entry Date Accounts Debit Credit More Info Jun 29 Jan 17 Sold inventory to Rick Harrison, $900, on account. Ignore cost of goods sold. Jun 29 Wrote off the Rick Harrison account as uncollectible after repeated efforts to collect from him. Aug 6 Received $50 from Rick Harrison, along with a letter…arrow_forwardBeginning balances: Allowance for Doubtful Accounts - $45,000 Accounts Receivable - $3,000,000 Bad Debt percent of credit sales – 1.5% Total Credit Sales – $38,000,000 1) Estimate bad debt expense using percent of sales method 2) Record transaction. 3) Show new adjusted allowance account 4) In January the next year, $48,000 is determined to be uncollectible. Show the entry and adjust accounts.arrow_forward

- Munabhaiarrow_forwardjournalize the adjusting entry at December 31, assuming Macarty determines that Matisse's $900 balance is uncollectible. (b) If Allowance for Doubtful Accounts has a credit balance of $1,100 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 10% of accounts receivable. veb-08.000.SI (c) If Allowance for Doubtful Accounts has a debit balance of $500 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 8% of accounts receivable. 33 E8-5 Godfreid Company has accounts receivebie of 395,400 at March 31, 2017. Credit terms are 2/10, n/30. At March 31, 2017, there is a $2,100 credit balance in Allowance for Doubtful Accounts prior to adjustment. The corpany uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below. Determin prepare t (LO 2), AF d ok) storyand p o teersl2la lgtantg boviooo Balance, March 31…arrow_forwardUncollectible Accounts-Percentage of Sales and Percentage of Receivables At the completion of the current fiscal year ending December 31, the balance of Accounts Receivable for Yang's Gift Shop was $30,000. Credit sales for the year were $355,200. Required: Make the necessary adjusting entry in general journal form under each of the following assumptions. Show the calculation for net realizable value. 1. Allowance for Doubtful Accounts has a credit balance of $330. a. The percentage of sales method is used and bad debt expense is estimated to be 2% of credit sales. Page: DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- 1 Dec. 31 88 Bad Debt Expense V 2 Allowance for Doubtful Accounts - 2. 3 Feedback Accounts receivable, December 31, 20-- Less allowance for doubtful accounts Net realizable value Feedback b. The percentage of receivables method is used and an analysis of the accounts produces an estimate of $6,950 in uncollectible accounts. Page: DOC. POST. NO. REF. DATE ACCOUNT…arrow_forward

- Dd.22.arrow_forwardAllowance Method Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: Oct. 2. Received $2,870 from Ian Kearns and wrote off the remainder owed of $2,960 as uncollectible. If an amount box does not require an entry, leave it blank. Oct. 2 Cash Bad Debt Expense Accounts Receivable-Ian Kearns Dec. 20. Reinstated the account of Ian Kearns and received $2,960 cash in full payment. Reinstate Accounts Receivable-Ian Kearns Bad Debt Expense Collection Casharrow_forwardTB MC Qu. 5-122 (Algo) At December 31, Amy Jo's Appliances... At December 31, Basu's Appliances had account balances in Accounts Receivable of $318,000 and in Allowance for Uncollectible Accounts of $630 (credit) before adjustment. An analysis of Basu's December 31 accounts receivable suggests that the allowance for uncollectible accounts should be 4% of accounts receivable. Bad debt expense for the year should be: Multiple Choice $12,720. $13,350. $13,391. $12,090.arrow_forward

- Do not give solution in imagearrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardRequirement 1. Record the transactions in the journal and post to the Allowance for uncollectible accounts and Bad debt expense ledger accounts that have been opened for you. These accounts have beginning balances of $3,200 (cr.) and $0, respectively. Remember to update account balances but ignore posting references. Begin by recording the transactions in the journal. (Record debits first, then credits. Exclude explanations from any journal entries.) Jan 17: Sold inventory to Riley Brunswick, $500 on account. Ignore cost of goods sold. More Info Journal Entry Date Accounts Debit Credit Jan 17 Sold inventory to Riley Brunswick, $500, on account. Ignore cost of goods sold. Wrote off the Riley Brunswick account as uncollectible after repeated Jan 17 Jun 29 efforts to collect from him Received $175 from Riley Brunswick, along with a letter stating his intention to pay within 30 days. Reinstated his account in full. Aug 6 Sep 4 Received the balance due from Riley Brunswick. Oct 31 Made a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education