FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

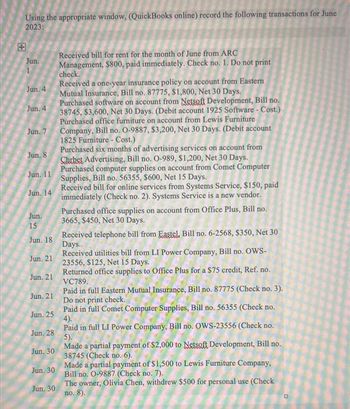

Transcribed Image Text:Using the appropriate window, (QuickBooks online) record the following transactions for June

2023:

Jun.

Jun. 4

Jun. 4

Jun. 7

Jun. 8

Jun. 11

Jun. 14

Jun.

15

Jun. 18

Jun. 21

Jun. 21

Jun. 21

Jun. 25

Jun, 28

Jun. 30

Jun. 30

Jun. 30

Received bill for rent for the month of June from ARC

Management, $800, paid immediately. Check no. 1. Do not print

check.

Received a one-year insurance policy on account from Eastern

Mutual Insurance, Bill no. 87775, $1,800, Net 30 Days.

Purchased software on account from Netsoft Development, Bill no.

38745, $3,600, Net 30 Days. (Debit account 1925 Software - Cost.)

Purchased office furniture on account from Lewis Furniture

Company, Bill no. O-9887, $3,200, Net 30 Days. (Debit account

1825 Furniture - Cost.)

Purchased six months of advertising services on account from

Chrbet Advertising, Bill no. O-989, $1,200, Net 30 Days.

Purchased computer supplies on account from Comet Computer

Supplies, Bill no. 56355, $600, Net 15 Days.

Received bill for online services from Systems Service, $150, paid

immediately (Check no. 2). Systems Service is a new vendor.

Purchased office supplies on account from Office Plus, Bill no.

3665, $450, Net 30 Days.

Received telephone bill from Eastel, Bill no. 6-2568, $350, Net 30

Days.

Received utilities bill from LI Power Company, Bill no. OWS-

23556, $125, Net 15 Days.

Returned office supplies to Office Plus for a $75 credit, Ref. no.

VC789.

Paid in full Eastern Mutual Insurance, Bill no. 87775 (Check no. 3).

Do not print check.

Paid in full Comet Computer Supplies, Bill no. 56355 (Check no.

4).

Paid in full LI Power Company, Bill no. OWS-23556 (Check no.

5).

Made a partial payment of $2,000 to Netsoft Development, Bill no.

38745 (Check no. 6).

Made a partial payment of $1,500 to Lewis Furniture Company,

Bill no. 0-9887 (Check no. 7).

The owner, Olivia Chen, withdrew $500 for personal use (Check

no. 8).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 27, you received your bank statement showing a balance of $1,026.34. Your checkbook shows a balance of $1,056.29. Outstanding checks are $245.50 and $377.20. The account earned $62.59. Deposits in transit amount to $705.24, and there is a service charge of $10.00. Calculate the reconciled balance. $29.95 $943.80 O $1,003.70 O $1,108.88arrow_forwardPLEASE SHOW ALL WORK You purchase goods on an invoice dated July 5 with terms of 4/15, n/45 ROG. If you receive the goods on July 23, calculate(a) the last day of the discount period, and (b) the last day of the credit period.b. Last day of credit period:arrow_forwardDomesticarrow_forward

- A credit sale is made on July 10 for $800, terms 4/10, n/30. On July 12, $150 of goods are returned for credit. Give the journal entry on July 19 to record the receipt of the balance due within the discount period. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation July 19 Debit Creditarrow_forwardDiscount Mart utilizes the allowance method of accounting for uncollectible receivables. On December 12 the company receives a $590 check from Chad Thomas in settlement Thomas's $1,210 outstanding accounts receivable. Due to Thomas's failing health he is closing his company and is expecting to make no further payments to Discount Mart. Journalize this declaration. If an amount box does not require an entry, leave it blank. Dec. 12arrow_forwardJul 13 The owner, Jen Beck, withdrew $2,000 cash for personal use, Check No. 78. Memorize the transaction for payments every two weeks. Next payment is July 27, 2022. Just tell me in quickbooks where do i record this transaction? bill (enter bills window) credit (enter bills window) bill pmt - check (pay bills window) check (write checks window) invoice (create invoices window) payment (receive payments window) sales receipt (enter sales receipts window) deposit (make deposit window) general journal (make general journal entries window) inventory adjust (adjust quantity/value on hand window) sales tax payment (pay sales tax window) paycheck (pay employees window) liability check (pay payroll liabilities window) transfer (transfer funds between accounts window) credit card charge (enter credit card charges window) credit memo (create credit memos/refunds window) discounts (receive payments window)arrow_forward

- Based on the following information, prepare a check and stub: Date: January 15, 20-- Balance brought forward: $2,841.50 Deposit: $962.20 Check to: J. M. Suppliers Amount: $150.00 For: Office Supplies Signature: Sign your namearrow_forwardOn August 2, Jun Co. receives a $7,300, 90-day, 12% note from customer Ryan Albany as payment on his $7,300 account. 1. Compute the maturity date for the above note. multiple choice October 29 October 30 October 31 November 1 November 2 2. Prepare Jun’s journal entry for August 2. 1 Record receipt of note on account.arrow_forwardUse the following bank statement and T-account to prepare any journal entries needed as a result of the May 31 bank recor no entry Is requlred for a transactlon/event, select "No Journal Entry Requlred" In the first account fleld.) BANK STATEMENTarrow_forward

- Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables. Mar. 17: Received $3,190 from Paula Spitler and wrote off the remainder owed of $5,900 as uncollectible. If an amount box does not require an entry, leave it blank. Mar. 17 fill in the blank e83d81f48fed021_2 fill in the blank e83d81f48fed021_3 fill in the blank e83d81f48fed021_5 fill in the blank e83d81f48fed021_6 fill in the blank e83d81f48fed021_8 fill in the blank e83d81f48fed021_9 July 29: Reinstated the account of Paula Spitler and received $5,900 cash in full payment. July 29 fill in the blank cf28d0043fd3fb7_2 fill in the blank cf28d0043fd3fb7_3 fill in the blank cf28d0043fd3fb7_5 fill in the blank cf28d0043fd3fb7_6 July 29 fill in the blank cf28d0043fd3fb7_8 fill in the blank cf28d0043fd3fb7_9 fill in the blank cf28d0043fd3fb7_11 fill in the blank cf28d0043fd3fb7_12arrow_forwardPrepare the entries for transaction below and indicate what journal it is 21 august issued a $600 credit memo to ultracity co. For an allowance on good sold on august 19, 2020arrow_forwardSun City Greenhouse had trouble collecting its account receivable from Sharma Suiza. On June 19, 2025, Sun City Greenhouse finally wrote off Suiza's $700 account receivable. On December 31, Suiza sent a $700 check to Sun City Greenhouse. Journalize the entries required for Sun City Greenhouse, assuming Sun City Greenhouse uses the direct write-off method. On June 19, 2025, Sun City Greenhouse wrote off Suiza's $700 account receivable. Journalize the entry. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Jun. 19 Accounts and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education