SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

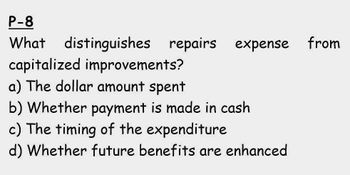

P-8

Transcribed Image Text:P-8

What

distinguishes repairs expense from

capitalized improvements?

a) The dollar amount spent

b) Whether payment is made in cash

c) The timing of the expenditure

d) Whether future benefits are enhanced

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 7 Which of the following characteristics represent an advantage of the internal rate of return techniques over the accounting rate of return technique in evaluating a project? I Recognition of the project’s salvage value. II Emphasis on cash flows. III Recognition of the time value of money. Group of answer choices II and III I, II, and III I only I and IIarrow_forwardGENERAL ACCOUNTING 45 QUESTIONarrow_forwardDepreciated replacement cost is equal to the * a. Sound Value b. Net appreciation c. Depreciable amount d. Carrying amountarrow_forward

- What if value increase in the future for impairment loss assets, what will happen/effect?arrow_forwardPlease help to pick which is the correct optionarrow_forwardPlease answer with reason for all why the option is correct and why the other options are incorrect 74. An expenditure whose benefit is finished or enjoyed immediately is called A.Expense B.Liability C.Cost D.Incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning