Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

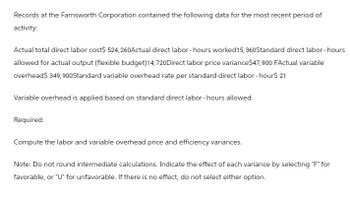

Transcribed Image Text:Records at the Farnsworth Corporation contained the following data for the most recent period of

activity:

Actual total direct labor cost$ 524,260Actual direct labor-hours worked 15, 360Standard direct labor-hours

allowed for actual output (flexible budget) 14,720 Direct labor price variance$47,900 FActual variable

overhead$ 349,900Standard variable overhead rate per standard direct labor-hour$ 21

Variable overhead is applied based on standard direct labor-hours allowed.

Required:

Compute the labor and variable overhead price and efficiency variances.

Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for

favorable, or "U" for unfavorable. If there is no effect, do not select either option.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardFlaherty, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows: During the year, the company had the following activity: Actual fixed overhead was 12,000 less than budgeted fixed overhead. Budgeted variable overhead was 5,000 less than the actual variable overhead. The company used an expected actual activity level of 12,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold. Required: 1. Compute the unit cost using (a) absorption costing and (b) variable costing. 2. Prepare an absorption-costing income statement. 3. Prepare a variable-costing income statement. 4. Reconcile the difference between the two income statements.arrow_forwardMulliner Company showed the following information for the year: Required: 1. Calculate the standard direct labor hours for actual production. 2. Calculate the applied variable overhead. 3. Calculate the total variable overhead variance.arrow_forward

- Rath Company showed the following information for the year: Required: 1. Calculate the standard direct labor hours for actual production. 2. Calculate the applied variable overhead. 3. Calculate the total variable overhead variance.arrow_forwardCushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forwardEagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forward

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardRecords at the Farnsworth Corporation contained the following data for the most recent period of activity: Actual total direct labor cost Actual direct labor-hours worked $ 506,800 15,280 Standard direct labor-hours allowed for actual output (flexible budget) Direct labor price variance Actual variable overhead Standard variable overhead rate per standard direct labor-hour 14,560 $47,100 F $ 349,100- $ 21 Variable overhead is applied based on standard direct labor-hours allowed. Required: Compute the labor and variable overhead price and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Direct labor: Price variance Efficiency variance Variable overhead: Price variance Efficiency variancearrow_forwardNonearrow_forward

- Dineshbhaiarrow_forwardPrimara Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours (denominator level of activity) Actual direct labor-hours. Standard direct labor-hours allowed for the actual output $ 481,600 $ 472,000 56,000 57,000 54,000 Required: 1. Compute the fixed portion of the predetermined overhead rate for the year. (Round Fixed portion of the predetermined overhead rate to 2 decimal places.) 2. Compute the fixed overhead budget variance and volume variance. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.). Input all amounts as positive values.)arrow_forwardPrimara Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours (denominator level of activity) Actual direct labor-hours Standard direct labor-hours allowed for the actual output $ 426,4e0 $ 420,400 52,ee0 53,000 50,000 Requlred: 1. Compute the fixed portion of the predetermined overhead rate for the year. (Round Flxed portion of the predetermIned overhead rate to 2 declmal places.) 2 Compute the fixed overhead budget variance and volume variance.. (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (1.e., zero varlance.). Input ell amounts as positlve values.) 1. Fixed portion of the predetermined overhead rate per DLH 2. Budget variance Volume…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College