FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

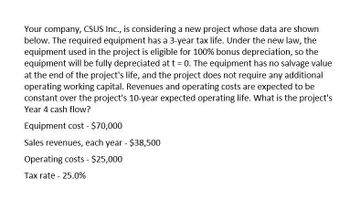

Transcribed Image Text:Your company, CSUS Inc., is considering a new project whose data are shown

below. The required equipment has a 3-year tax life. Under the new law, the

equipment used in the project is eligible for 100% bonus depreciation, so the

equipment will be fully depreciated at t = 0. The equipment has no salvage value

at the end of the project's life, and the project does not require any additional

operating working capital. Revenues and operating costs are expected to be

constant over the project's 10-year expected operating life. What is the project's

Year 4 cash flow?

Equipment cost - $70,000

Sales revenues, each year - $38,500

Operating costs - $25,000

Tax rate - 25.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Florida Car Wash is considering a new project whose data are shown below. The equipment to be used has a 3-year tax life. Under the new tax law, the equipment is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. At the end of the project's 3 - year life, it would have zero salvage value. No change in net operating working capital (NOWC) would be required for the project. Revenues and operating costs will be constant over the project's life, and this is just one of the firm's many projects, so any losses on it can be used to offset profits in other units. If the number of cars washed declined by 40% from the expected level, by how much would the project's NPV change? (Hint: Note that cash flows are constant at the Year 1 level, whatever that level is.) Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Equipment cost $48,000 Number of cars washed 3,000 Average price per car $24.00 Fixed op. cost…arrow_forwardFlorida Car Wash is considering a new project whose data are shown below. The equipment to be used has a 3-year tax life. Under the new tax law, the equipment is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. At the end of the project's 3-year life, it would have zero salvage value. No change in net operating working capital (NOWC) would be required for the project. Revenues and operating costs will be constant over the project's life, and this is just one of the firm's many projects, so any losses on it can be used to offset profits in other units. If the number of cars washed declined by 40% from the expected level, by how much would the project's NPV change? (Hint: Note that cash flows are constant at the Year 1 level, whatever that level is.) Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Equipmentcost $60,000 Number of cars washed 2,960 Average price per car…arrow_forwardTemple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life. Under the new tax law, the equipment used in the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t = o. The equipment would have a zero salvage value at the end of the project's life. No change in net operating working capital (NOWC) would be required. Revenues and operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. Risk-adjusted WACC Equipment cost Sales revenues, each year Annual operating costs Tax rate a. $7,918 b. $12,268 c. $13,494 d. $5,189 e. $10,557 10.0% $63,800 $51,400 $21,500 25.0%arrow_forward

- Foley Systems is considering a new project whose data are shown below. Under the new tax law, the equipment for the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. After the project's 3-year life, the equipment would have zero salvage value. The project would require additional net operating working capital (NOWC) that would be recovered at the end of the project's life. Revenues and operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows from operations are constant in Years 1 to 3.) Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC Equipment cost 10.0% $58,000 Required net operating working capital (NOWC) $17,000 Annual sales revenues $72,000 Annual operating costs $30,000 Tax rate 25.0% a. $5,063 b. $34,836 c. $36,108 d. $30,608 e. $33,472arrow_forwardFoley Systems is considering a new project whose data are shown below. Under the new tax law, the equipment for the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. After the project's 3-year life, the equipment would have zero salvage value. The project would require additional net operating working capital (NOWC) that would be recovered at the end of the project's life. Revenues and operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows from operations are constant in Years 1 to 3.) Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Equipment cost $75,000 Required net operating working capital (NOWC) $15,000 Annual sales revenues $73,000 Annual operating costs $25,000 Tax rate 25.0% Question options: $2,549 $18,970 $4,571…arrow_forwardYour company csus inc. is considering this question solutionarrow_forward

- Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No change in net operating working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. Risk - adjusted WACC10.0% Net investment cost (depreciable basis) $65,000 Straight-line depr. rate33.3333% Sales revenues, each year$58,000 Annual operating costs (excl. depr.)$25,000 Tax rate35.0% a. $6,265 b. S 5,401 c. $5,689 d. $7,202 e. $7,274arrow_forwardThomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life. Under the new tax law, the equipment is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. The equipment would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, additional net operating working capital (NOWC) would be required, but it would be recovered at the end of the project's life. Revenues and operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Equipment cost $70,000 Required net operating working capital (NOWC) $10,000 Annual sales revenues $61,000 Annual operating costs $30,000 Expected pre-tax salvage value $5,000 Tax rate 25.0%arrow_forwardThomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life. Under the new tax law, the equipment is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. The equipment would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, additional net operating working capital (NOWC) would be required, but it would be recovered at the end of the project's life. Revenues and operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Equipment cost $70,000 Required net operating working capital (NOWC) $10,000 Annual sales revenues $61,000 Annual operating costs $30,000 Expected pre-tax salvage value $5,000 Tax rate 25.0% Please explain and provide calculations.arrow_forward

- Thomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life. Under the new tax law, the equipment is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. The equipment would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, additional net operating working capital (NOWC) would be required, but it would be recovered at the end of the project's life. Revenues and operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Equipment cost $70,000 Required net operating working capital (NOWC) $10,000 Annual sales revenues $61,000 Annual operating costs $30,000 Expected pre-tax salvage value $5,000 Tax rate 25.0% a. $3,772 b. $5,319 c. $5,650…arrow_forwardThomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, additional net operating working capital would be required, but it would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Net investment in fixed assets (depreciable basis) $70,000 Required net operating working capital $10,000 Straight-line depreciation rate 33.333% Annual sales revenues $57,000 Annual operating costs (excl. depreciation) $30,000 Expected pre-tax salvage value $5,000 Tax rate 35.0% Choices: $–6,092 $-6,518 $-7,371 $-6,213 $-7,005 Give typing…arrow_forwardThomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, additional net operating working capital would be required, but it would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Net investment in fixed assets (depreciable basis) $70,000 Required net operating working capital $10,000 Straight-line depreciation rate 33.333% Annual sales revenues $70,000 Annual operating costs (excl. depreciation) $30,000 Expected pre-tax salvage value $5,000 Tax rate 35.0% a. 0$14,773…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education