Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Financial Account

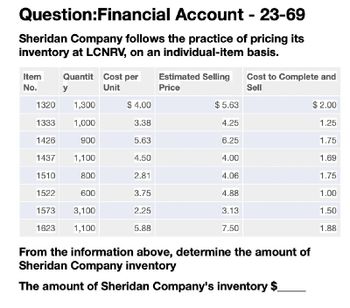

Transcribed Image Text:Question:Financial Account - 23-69

Sheridan Company follows the practice of pricing its

inventory at LCNRV, on an individual-item basis.

Quantit Cost per

Item

Estimated Selling

No.

y

Unit

Price

Cost to Complete and

Sell

1320

1,300

$4.00

$5.63

$2.00

1333

1,000

3.38

4.25

1.25

1426

900

5.63

6.25

1.75

1437

1,100

4.50

4.00

1.69

1510

800

2.81

4.06

1.75

1522

600

3.75

4.88

1.00

1573

3,100

2.25

3.13

1.50

1623

1,100

5.88

7.50

1.88

From the information above, determine the amount of

Sheridan Company inventory

The amount of Sheridan Company's inventory $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Match the following statements to the appropriate terms!arrow_forwardThe Amount of Sheridan company's inventory?arrow_forwardInstructions Journalize the following merchandise transactions. Refer to the chart of accounts for the exact wording of the account itles. CNOW journals do not use ines for jounal explanations. Every Nne on a journal page is used for debit or aredit ents. CNOW journals will automaticaly indent a credit entry when a credit amount s entered. 1 Sold merchandise on account, $94,800 with terms 2/10, n30. The sost.ot the merchandise nold was Mar. $56,900. Received payment les the discount. 13 Issued a $500 oredit memo for damaged merchandise. The customer agreed to keep the merchandisearrow_forward

- Question 18 and 19: Presented below is information related to Carnation with, Incorporated: Cost P 250,000 898,500 60,000 18,000 Retail P 390,000 1,460,000 80,000 Inventory, January 1, 2015 Purchases Purchase returns Purchase discounts Sales (net of 2% discounts) Sales returns 0- -0- -0- 80,000 1,234,800 95,550 -0- Freight-in 18. Assuming that Camation, Inc, uses the average retail inventory method, how much would be the cost of its ending inventory at December 31, 2015? 19. Assuming that Carnation, Inc. uses the FIFO retail inventory method, how much would be the cost of its ending inventory at December 31, 20157arrow_forwardA-7arrow_forwardw.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inp Merchandise subject to terms 1/10, n/30, FOB shipping point, is sold on account, to a customer for $19,600. What is the amount of the sales discount allowable? a. $98 b. $392 c. $196 d. $490arrow_forward

- Please provide Multi-step form of SCIarrow_forwardProblem 11-4 (IAA) Gross Company provided the following purchases and sales for the month of March: 000 Units Unit cost March 1 Beginning 6 Purchase 14 Purchase 25 Purchase March 9 Sale 31 Sale 270 1,000 3,000 6,000 250 280 210 4,000 2,000 8,000 Required: COs of Assuming the entity used perpetual system, compute ending inventory and cost of goods sold under: 1. FIFO て.て 3,030, 00 2. Moving average 4 to O0 50 323 257.50 1,01000arrow_forwardignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator3&inprogress%=false ParaphraX BLOG 31 X + Pierce Company sold mnerchandise to Stanton Company on account FOB shipping point, 2/10, net 30, for $10,800. Pierce prepaid the $215 shipping charge. Which of the following entries does Pierce make to record this sale? a. Accounts Receivable-Stanton, debit $10,584; Sales, credit $10,584, and Accounts Receivable-Stanton, debit $215; Cash, credit $215 Ob. Accounts Receivable-Stanton, debit $10,800; Sales, credit $10,800, and Delivery Expense, debit $215; Cash, credit $215 Oc. Accounts Receivable-Stanton, debit $10,800; Sales, credit $10,800 Od. Accounts Receivable-Stanton, debit $11,015; Sales, credit $11,015 Nex Previous Submit Test for C Email Instructor All work saved. 64"F へ回 目急后 99+arrow_forward

- еВook Print Item Revenue Section, Multiple-Step Income Statement Instructions Income Statement Instructions Based on the information that follows: Sales $86,300 Sales Returns and Allowances 2,330 Sales Discounts 1,726 Required: Prepare the revenue section of a multiple-step income statement. %3Darrow_forwardFinancial Accountarrow_forwardFinancial Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning