Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Given answer accounting questions

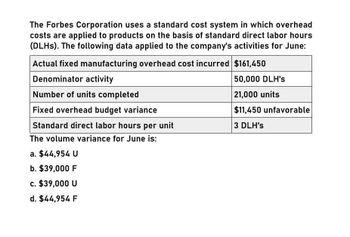

Transcribed Image Text:The Forbes Corporation uses a standard cost system in which overhead

costs are applied to products on the basis of standard direct labor hours

(DLHs). The following data applied to the company's activities for June:

Actual fixed manufacturing overhead cost incurred $161,450

Denominator activity

Number of units completed

Fixed overhead budget variance

Standard direct labor hours per unit

The volume variance for June is:

a. $44,954 U

b. $39,000 F

50,000 DLH's

21,000 units

$11,450 unfavorable

3 DLH's

c. $39,000 U

d. $44,954 F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardGeorgia Gasket Co. budgets 8,000 direct labor hours for the year. The total overhead budget is expected to amount to 20,000. The standard cost for a unit of the companys product estimates the variable overhead as follows: The actual data for the period follow: Using the four-variance method, calculate the overhead variances. (Hint: First compute the budgeted fixed overhead rate.)arrow_forwardEscuchar Products, a producer of DVD players, has established a labor standard for its productdirect labor: 2 hrs at 9.65 per hour. During January, Escuchar produced 12,800 DVD players. The actual direct labor used was 25,040 hours at a total cost of 245,392. Required: 1. Compute the labor rate and efficiency variances. 2. Prepare journal entries for all activities relating to labor.arrow_forward

- The cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardYohan Company has the following balances in its direct materials and direct labor variance accounts at year-end: Unadjusted Cost of Goods Sold equals 1,500,000, unadjusted Work in Process equals 236,000, and unadjusted Finished Goods equals 180,000. Required: 1. Assume that the ending balances in the variance accounts are immaterial and prepare the journal entries to close them to Cost of Goods Sold. What is the adjusted balance in Cost of Goods Sold after closing out the variances? 2. What if any ending balance in a variance account that exceeds 10,000 is considered material? Close the immaterial variance accounts to Cost of Goods Sold and prorate the material variances among Cost of Goods Sold, Work in Process, and Finished Goods on the basis of prime costs in these accounts. The prime cost in Cost of Goods Sold is 1,050,000, the prime cost in Work in Process is 165,200, and the prime cost in Finished Goods is 126,000. What are the adjusted balances in Work in Process, Finished Goods, and Cost of Goods Sold after closing out all variances? (Round ratios to four significant digits. Round journal entries to the nearest dollar.)arrow_forwardCost and production data for Binghamton Beverages Inc. are presented as follows: Required: Calculate net variances for materials, labor, and factory overhead. Calculate specific materials and labor variances by department, using the diagram format in Figure 8-4. Comment on the possible causes for each of the variances that you computed. Make all journal entries to record production costs in Work in Process and Finished Goods. Determine the balance of ending Work in Process in each department. Assume that 4,000 units were sold at $40 each. Calculate the gross margin based on standard cost. Calculate the gross margin based on actual cost. Why does the gross margin at actual cost differ from the gross margin at standard cost. As the plant controller, you present the variance report in Item 1 above to Paul Crooke, the plant manager. After reading it, Paul states: “If we present this performance report to corporate with that large unfavorable labor variance in Blending, nobody in the plant will receive a bonus. Those standard hours of 5,500 are way too tight for this production process. Fifty-eight hundred hours would be more reasonable, and that would result in a favorable labor efficiency variance that would more than offset the unfavorable labor rate variance. Please redo the variance calculations using 5,800 hours as the standard.” You object, but Paul ends the conversation with, “That is an order.” What standards of ethical professional practice would be violated if you adhered to Paul’s order? How would you attempt to resolve this ethical conflict?arrow_forward

- Smith Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for the cost of one basket (unit): Smith Industries made 3,000 baskets in July and used 15,500 pounds of material to make these units. Smith Industries paid $39,370 for the 15,500 pounds of material. A. What was the direct materials price variance for July? B. What was the direct materials quantity variance for July? C. What is the total direct materials cost variance? D. If Smith Industries used 15,750 pounds to make the baskets, what would be the direct materials quantity variance?arrow_forwardEagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forwardEllis Companys labor information for September is as follows: A. Compute the standard direct labor rate per hour. B. Compute the direct labor time variance. C. Compute the standard direct labor rate if the direct labor rate variance was $2,712.30 (unfavorable).arrow_forward

- Materials and labor variances Fausto Fabricators Inc. uses a standard cost system to account for its single product. The standards established for the product include the following: The following operating data came from the records for the month: In process, beginning inventory, none. In process, ending inventory, 800 units, 80% complete as to labor; material is issued at the beginning of processing. Completed during the month, 5,600 units. Materials issued to production were 51,680 lb @ .55 per pound. Direct labor was 384,000 for 40,000 hours worked. Required: Calculate the following variances, using the diagram format in Figure 8-4. 1. Materials price. 2. Materials quantity. 3. Net materials variance. 4. Labor rate. 5. Labor efficiency. 6. Net labor variance. (Hint: Before determining the standard quantity for materials and labor, you must first compute the equivalent units of production for materials and labor.)arrow_forwardA company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000arrow_forwardFlaherty, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows: During the year, the company had the following activity: Actual fixed overhead was 12,000 less than budgeted fixed overhead. Budgeted variable overhead was 5,000 less than the actual variable overhead. The company used an expected actual activity level of 12,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold. Required: 1. Compute the unit cost using (a) absorption costing and (b) variable costing. 2. Prepare an absorption-costing income statement. 3. Prepare a variable-costing income statement. 4. Reconcile the difference between the two income statements.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,