EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

The beta of westbrook corp. Solve this general accounting question

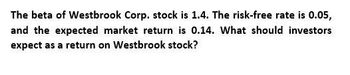

Transcribed Image Text:The beta of Westbrook Corp. stock is 1.4. The risk-free rate is 0.05,

and the expected market return is 0.14. What should investors

expect as a return on Westbrook stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- may i knoow the answer for this questionarrow_forwardIf a stock has a beta of 0.8, what doesthat imply about its risk relative to the market?arrow_forwardHow do you find the market risk premium and market expected return given the expected return of stock, beta, and risk free rate? Example: The expected return of a stock with a beta of 1.2 is 16.2%. Calculate the market risk premium and the market expected return, given a risk-free rate of 3%.arrow_forward

- A stock has an expected return of 0.11, its bets is 0.82, and the risk-free rate is 0.04. What must the expected return on the market be?arrow_forward1) The risk-free rate is 3.7 percent and the expected return on the market is 12.3 percent. Stock A has a beta of 1.1 and an expected return of 13.1 percent. Is this stock correctly priced? (underpriced or overpriced?)arrow_forwardCompany A has a beta of 0.9 , while Company B's beta is 1.4 . The market risk premium is 13.78 %, and the risk-free rate is 4.25%. What is the difference between A's and B's required rates of return? (Hint: find the required returns on each stock and then subtract them.)arrow_forward

- Calcitron Inc. has common stock with a beta of 1.4. The risk-free rate is 3.7 while the market rate of return is 13. What is the equilibrium required rate of return on this stock? Answer:arrow_forwardPlease help with this question with full working out.arrow_forward(Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return0.20 10% 0.15 -4% 0.60 16% 0.35 7%0.20 21% 0.35 13% 0.15 20% a) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, what is the expected rate of return for stock A? What is the standard deviation? b. Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, what is the expected rate of return for stock B? What is the standard deviation? c. Based on the risk (as measured by the standard deviation) and return of each stock, which…arrow_forward

- A) What expected return should an investor expect from investments in common stock? You are given the following information: Risk free rate of return = 4%; market risk premium = 11%; Beta of the stock (assume CAPM holds) = 0.72. B) Stock A with beta of 0.8 offers a 11% return while stock B with a beta of 1.2 offers a 15% return. What is the risk-free rate? What is the common market return? Assume CAPM holds.arrow_forwardYou are using the CAPM to calculate a fair return for Stardust common stock. The shares have a volatility of 36.00%, while the market has a volatility of 19.00%. The correlation between the two sets of returns is 0.30. The risk free rate is 1.00%, while the expected return on the market is 3.90%. What is the fair return for Stardust common stock?arrow_forwardWhat should be the risk premium and return on a stock with a Beta of zerounder the Capital Asset Pricing Model (CAPM)? What about the risk premiumand return on a stock with a Beta of 1?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT