Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hello tutor please provide this question solution general accounting

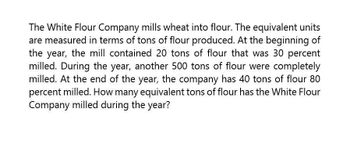

Transcribed Image Text:The White Flour Company mills wheat into flour. The equivalent units

are measured in terms of tons of flour produced. At the beginning of

the year, the mill contained 20 tons of flour that was 30 percent

milled. During the year, another 500 tons of flour were completely

milled. At the end of the year, the company has 40 tons of flour 80

percent milled. How many equivalent tons of flour has the White Flour

Company milled during the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you please help with this accounting question?arrow_forward[The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $77 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 48,000 units and sold 43,000 units.arrow_forwardPremium, Inc. produced 1,000 units of the company's product in 2024. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.00 per yard. The accounting records showed that 2.400 yards of cloth were used and the company paid $1.05 per yard. Standard time was two direct labor hours per unit at a standard rate of $13.00 per direct labor hour. Employees worked 1,600 hours and were paid $12.50 per hour. - X Read the requirements. Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following: Direct materials cost variance Direct labor cost variance Requirements 1. What are the benefits of setting cost standards? 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances Direct materials efficiency variance Direct labor efficiency variance Requirement 2. Calculate the direct materials cost variance and the…arrow_forward

- During its first year of operations, Silverman Company paid $10,285 for direct materials and $9,800 for production workers' wages. Lease payments and utilities on the production facilities amounted to $8,800 while general, selling, and administrative expenses totaled $4,300. The company produced 5,450 units and sold 3,300 units at a price of $7.80 a unit. What is the amount of finished goods Inventory on the balance sheet at year-end? Multiple Choice O O O O $11,395 $5,698 $2,150 $8,250arrow_forwardGoodrow Industries is calculating its Cost of Goods Manufactured at year-end. The company's accounting records show the following: The Raw Materials Inventory account had a beginning balance of $19,000 and an ending balance of $14,000. During the year, the company purchased $56,000 of direct materials. Direct labor for the year totaled $125,000, while manufacturing overhead amounted to $152,000. The Work in Process Inventory account had a beginning balance of $22,000 and an ending balance of $18,000. Assume that Raw Materials Inventory contains only direct materials. Compute the Cost of Goods Manufactured for the year. (Hint: The first step is to calculate the direct materials used during the year.) Start by calculating the direct materials used during the year. Goodrow Industries Calculation of Direct Materials Used For Current Year Plus: Less: Direct materials usedarrow_forwardIn its first year of operation, the Clayton Publishing Company sells 52,000 units and has 1,700 units in stock at year end. The cost of goods sold are $3,100,000. What are the total manufacturing costs for the year if the average unit cost is $8.50? $3,114,450 $3,100,000 $3,085,550 4. $14,450arrow_forward

- During its first year of operations, Silverman Company paid $16,360 for direct materials and $10,300 for production workers' wages. Lease payments and utilities on the production facilities amounted to $9,300 while general, selling, and administrative expenses totaled $4,800. The company produced 6,200 units and sold 3,800 units at a price of $8.30 a unit. What is Silverman's cost of goods sold for the year?arrow_forwardMurry, Inc. produced 1,000 units of company's product in 2024. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.35 per yard. The accounting records showed that 2,500 yards of cloth were used and the company paid $1.40 per yard. Standard time was two direct labor hours per unit at a standard rate of $12.00 per direct labor hour. Employees worked 1,700 hours and were paid $10.50 per hour. What are the benefits of setting cost standards? Calculate the direct materials cost variance and the direct material effeciency variance as well as the direct labor cost and effeciency variances.arrow_forwardKelvin Industries is calculating its Cost of Goods Manufactured at year-end. The company's accounting records show the following: The Raw Materials Inventory account had a beginning balance of $16,000 and an ending balance of $21,000. During the year, the company purchased $51,000 of direct materials. Direct labor for the year totaled $125,000, while manufacturing overhead amounted to $152,000. The Work in Process Inventory account had a beginning balance of $24,000 and an ending balance of $23,000. Assume that Raw Materials Inventory contains only direct materials. Compute the Cost of Goods Manufactured for the year. (Hint: The first step is to calculate the direct materials used during the year.) Start by calculating the direct materials used during the year. Kelvin Industries Calculation of Direct Materials Used For Current Year Plus: Less: Direct materials used iarrow_forward

- Best, Inc. produced 1,000 units of the company's product in 2024. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.40 per yard. The accounting records showed that 2,700 yards of cloth were used and the company paid $1.45 per yard. Standard time was two direct labor hours per unit at a standard rate of $14.50 per direct labor hour. Employees worked 1,600 hours and were paid $13.50 per hour. Read the requirements. Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following Darrow_forwardThe Pacific Lumber Company and Mill processes 10,000 logs annually, operating 250 days peryear. Immediately upon receiving an order, the logging company’s supplier begins delivery tothe lumber mill, at a rate of 60 logs per day. The lumber mill has determined that the orderingcost is $1,600 per order and the cost of carrying logs in inventory before they are processed is$15 per log on an annual basis. Determine The number of operating days required to receive an orderarrow_forwardplease answer botharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning