FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

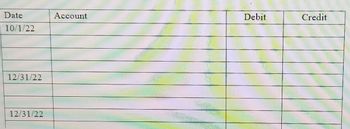

On October 1, 2022, Abbott Inc. purchased equipment costing $700,000 by paying $150,000 cash and signing a $550,000, 10%, 1-year note for the remainder. The face value of the note plus interest is due when the note matures in one year. The equipment will be used in a variety of R&D activities. It is expected to have a useful life of 5-years and a residual value of $20,000. Abbott uses the DDB method for the equipment. Required: In the journal below, record the equipment purchase on October 1, and record

Transcribed Image Text:Date

10/1/22

12/31/22

12/31/22

Account

Wa

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, Marigold, Inc. signed a fixed-price contract to have Builder Associates construct a major plant facility at a cost of $4,419,000. It was estimated that it would take 3 years to complete the project. Also on January 1, 2020, to finance the construction cost, Marigold borrowed $4,419,000 payable in 10 annual installments of $441,900, plus interest at the rate of 10%. During 2020, Marigold made deposit and progress payments totaling $1,657,125 under the contract; the weighted-average amount of accumulated expenditures was $883,800 for the year. The excess borrowed funds were invested in short-term securities, from which Marigold realized investment income of $254,600. What amount should Marigold report as capitalized interest at December 31, 2020?arrow_forwardAmerican Food Services, Incorporated, acquired a packaging machine from Barton and Barton Corporation. • Barton and Barton completed construction of the machine on January 1, 2024. • In payment for the $4 million machine, American Food Services issued a four-year installment note to be paid in four equal payments at the end of each year. • The payments include interest at the rate of 10%. Required: 1. Prepare the journal entry for American Food Services' purchase of the machine on January 1, 2024. 2. Prepare an amortization schedule for the four-year term of the installment note. 3. Prepare the journal entry for the first installment payment on December 31, 2024. 4. Prepare the journal entry for the third installment payment on December 31, 2026.arrow_forwardA company buys a solar panel unit for P105,000. The shipping and installation fees amount to P15,000. If the unit is expected to last for 15 years, with a salvage value of P3,000, what is the depreciation charge during the 12 th year, and the book value at the end of 14 years by the (c) sinking fund method given interest rate at 12.5 percent, and (d) Sum-of-the-Years Digit (SYD) Method.arrow_forward

- Sheridan Company from time to time embarks on a research program when a special project seems to offer possibilities. In 2019, the company expends $323,000 on a research project, but by the end of 2019 it is impossible to determine whether any benefit will be derived from it. (b) The project is completed in 2020, and a successful patent is obtained. The R&D costs to complete the project are $113,000. The administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2020 total $16,000. The patent has an expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forwardNuts & Bolts considers the purchase of a new machine at a cost of $1,070,000 at the end of the current year (year 0). The expected lifetime is 5 years. In addition, at the end of year 3, a major upgrade ($80,000) will be necessary to stay competitive (ATO depreciation schedule calls for 5 years as well). Over this period, the machine will be responsible for $500,000 additional sales per year and $150,000 in additional COGS. The corporate tax rate is flat at 30%. As part of day-to-day operations, it is expected that A/R increase by $30,000 in year 1 and another $40,000 in year 4. Inventory will increase by $20,000 in year 1 and another $10,000 in year 4. A/P will increase by $25,000 and $15,000, respectively. At the end of year 5, there are decommissioning costs of $50,000. The machine is assumed to be sold for $138,000. Working capital changes are assumed to be reversible at the end of the project without loss. Compute the new machine’s incremental cash flows for year 0 through…arrow_forwardOn January 1, 2021, the company obtained a $3 million loan with a 11% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 March 1, 2021 $1,200,000 660,000 520,000 620,000 360,000 675,000 1,080,000 June 30, 2021 October 1, 2021 January 31, 2022 April 30, 2022 August 31, 2022 On January 1, 2021, the company obtained a $3 million construction loan with a 11% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company's other interest-bearing debt included two long-term notes of $4,200,000 and $6.200,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: 1. Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the weighted-average method. 2.…arrow_forward

- 8. ABC Company purchased a building on January 1, 2018 for P10, 000,000. The building has been depreciated using the straight-line method with a 25-year useful life with no residual value. On December 31, 2021, ABC is evaluating the building for possible impairment. The building has a remaining useful life of 15 years and is expected to generate cash inflows of P700,000 per year. The applicable discount rate is 8%. Round off present value factor to two decimal places. The fair value of the building on December 31, 2021 is P5, 300,000. What amount should be recognized as impairment loss on December 31, 2021?arrow_forwardOn January 1, 2021, the company obtained a $3 million loan with a 10% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,080,000 March 1, 2021 900,000 June 30, 2021 320,000 October 1, 2021 700,000 January 31, 2022 720,000 April 30, 2022 1,035,000 August 31, 2022 1,800,000 On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $5,000,000 and $7,000,000 with interest rates of 5% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Calculate the amount of interest that Mason should…arrow_forwardLO, Inc., is considering an investment of $440,000 in an asset with an economic life of five years. The firm estimates that the nominal annual cash revenues and expenses at the end of the first year will be $279,500 and $88,000, respectively. Both revenues and expenses will grow thereafter at the annual inflation rate of 2 percent. The company will use the straight-line method to depreciate its asset to zero over five years. The salvage value of the asset is estimated to be $60,000 in nominal terms at that time. The one-time net working capital investment of $17,500 is required immediately and will be recovered at the end of the project. The corporate tax rate is 25 percent. What is the project's total nominal cash flow from assets for each year? (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Cash flowarrow_forward

- On January 1, 2020, Northeast USA Transportation Company purchased a used aircraft at a cost of $64,400,000. Northeast USA expects the plane to remain useful for five years (6.000,000 miles) and to have a residual value of $6,400,000. Northeast USA expects to fly the plane 725,000 miles the first year, 1,300,000 miles each year during the second, third, and fourth years, and 1,375,000 miles the last year. Read the requirements 1. Compute Northeast USA's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method. a. Straight-line method Using the straight-line method, depreciation is for 2020 and for 2021.arrow_forwardOn January 1, 2020, QuickAir Transportation Company purchased a used aircraft at a cost of $64,400,000. QuickAir expects the plane to remain useful for five years (7,000,000 miles) and to have a residual value of $6,400,000. QuickAir expects to fly the plane 925,000 miles the first year, 1,225,000 miles each year during the second, third, and fourth years, and 2,400,000 miles the last year. Read the requirements. 1. Compute QuickAir's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method. a. Straight-line method Using the straight-line method, depreciation is for 2020 and for 2021.arrow_forwardOn January 2, 2020, Bonita Industries began construction of a new citrus processing plant. The automated plant was finished and ready for use on September 30, 2021. Expenditures for the construction were as follows: January 2, 2020 $ 609000 September 1, 2020 1802400 December 31, 2020 1802400 March 31, 2021 1802400 September 30, 2021 1203000 Bonita Industries borrowed $3400000 on a construction loan at 12% interest on January 2, 2020. This loan was outstanding during the construction period. The company also had $13320000 in 9% bonds outstanding in 2020 and 2021.The interest capitalized for 2020 was: A)$505656 B)$108882 C)$145176 D)$289368arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education