FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

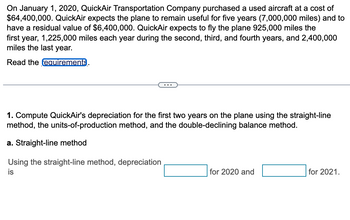

Transcribed Image Text:On January 1, 2020, QuickAir Transportation Company purchased a used aircraft at a cost of

$64,400,000. QuickAir expects the plane to remain useful for five years (7,000,000 miles) and to

have a residual value of $6,400,000. QuickAir expects to fly the plane 925,000 miles the

first year, 1,225,000 miles each year during the second, third, and fourth years, and 2,400,000

miles the last year.

Read the requirements.

1. Compute QuickAir's depreciation for the first two years on the plane using the straight-line

method, the units-of-production method, and the double-declining balance method.

a. Straight-line method

Using the straight-line method, depreciation

is

for 2020 and

for 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Assume that at the beginning of 2020, Porter Airlines purchased a Bombardier Q400 aircraft at a cost of $25,000,000. Porter expects the plane to remain useful for five years (5,000,000 km) and to have a residual value of $5,000,000. Porter expects the plane to be flown 750,000 km the first year and 1,250,000 km each year during years 2 through 4, and 500,000 km the last year. 1. Compute Porter’s first-year depreciation on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-diminishing-balance (Why do you have to x by 2 for this answer?)arrow_forwardOn March 1, 2024, a company entered into an agreement with the state to obtain the rights to operate a mineral mine for $6 million. The mine is expected to produce 155,000 tons of mineral. As part of the agreement, the company agrees to restore the land to its original condition after mining operations are completed in approximately five years. Management has provided the following possible outflows for the restoration costs that will occur five years from now: (PV of $1. PVA of $1) Cash Outflow $ 520,000 675,000 830,000 Probability 20% 30% 50% The company's credit-adjusted risk-free interest rate is 9%. During 2024, the company extracted 27,900 tons of ore from the mine. How much accretion expense will the company record in its income statement for the 2024 calendar year? Multiple Choicearrow_forwardOn January 1, 2020, Bing Company acquired equipment on credit. The terms were $8,000 cash down payment plus payments of $6,000 on January 1 for each of the next four years. The implicit interest rate was 6%. The equipment’s list price was $30,000. Additional costs of $2,000 were incurred to install the equipment. Determine the value at which Ling should report the acquired asset. Show your calculations. For any measurement involving present value concepts, provide your calculations.arrow_forward

- K On January 1, 2020, QuickAir Transportation Company purchased a used aircraft at a cost of $52,400,000 QuickAir expects the plane to remain useful for five years (7,000,000 miles) and to have a residual value of $6,400,000 QuickAir expects to fly the plane 925,000 miles the first year, 1,300,000 miles each year during the second, third, and fourth years, and 2,175,000 miles the last year. Read the requirements Using the straight-line method, depreciation is $ 9,200,000 for 2020 and $9,200,000 for 2021 b. Units-of-production method (Round the depreciation per unit of output to two decimal places to compute your final answers.) Using the units-of-production method, depreciation is $ 6,077,250 for 2020 and $ 8,541,000 for 2021. c. Double-declining balance method Using the double-declining-balance method, depreciation Book Value: CELE 2. Show the airplane's book value at the end of the first year under each method Less Book Value Etext pages Get more help $ 20,960,000 for 2020 and $…arrow_forwardWe purchase a delivery truck for $70,000 cash. We estimate the following: Cost $70,000 Residual Value $10,000 Life in years 6 years Life in miles 300,000 miles Number of tires 8. 1: IF we have a fiscal year end of 12/31, and we purchase the truck in year 1 on March 1", calculate the depreciation for the first 3 years using the straight-line method:arrow_forwardVaibhavarrow_forward

- On January 1, 2018, Spring Co. purchased a land for $12,000,000. Thecompany expected to extract 2,000,000 tons of mine from this land overthe next 20 years at which time, the residual value of the asset shall bezero. During 2018 and 2019 operations, 60,000 tons were mined each yearand sold for P80 per ton. The estimate of the remaining lifetime capacityof the mine was raised to 2,400,000 tons at the start of 2020 and theresidual value was to be $960,000. How much should be recognized asdepletion in 2020 if the total production for 2020 is 100,000 tons?arrow_forwardssssssssssssssarrow_forwardHELP MEarrow_forward

- Your company is contemplating the purchase of a large stamping machine. The machine will cost $167,000. With additional transportation and installation costs of $5,000 and $11,000, respectively, the cost basis for depreciation purposes is $183,000. Its MV at the end of five years is estimated as $34,000. The IRS has assured you that this machine will fall under a three year MACRS class life category. The justifications for this machine include $45,000 savings per year in labor and $29,000 savings per year in reduced materials. The before-tax MARR is 24% per year, and the effective income tax rate is 28%. Assume the stamping machine will be used for only three years, owing to the company's losing several government contracts. The MV at the end of year three is $47,000. What is the income tax owed at the end of year three owing to depreciation recapture (capital gain)? E Click the icon to view the GDS Recovery Rates (rg) for the 3-year property class. Choose the correct answer below. O…arrow_forwardKmarrow_forwardAn asset with a purchase price of $501,013 falls in the 3-year MACRS asset class. The asset will be sold at the end of a three year project for $180,745. What is the book value of the asset at the end of the project? Round your answer to the nearest dollar. Year Depreciable Allowance 1 33% 2 45 3 15 4 7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education