FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

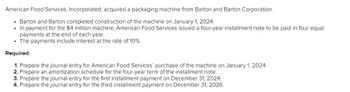

Transcribed Image Text:American Food Services, Incorporated, acquired a packaging machine from Barton and Barton Corporation.

• Barton and Barton completed construction of the machine on January 1, 2024.

• In payment for the $4 million machine, American Food Services issued a four-year installment note to be paid in four equal

payments at the end of each year.

• The payments include interest at the rate of 10%.

Required:

1. Prepare the journal entry for American Food Services' purchase of the machine on January 1, 2024.

2. Prepare an amortization schedule for the four-year term of the installment note.

3. Prepare the journal entry for the first installment payment on December 31, 2024.

4. Prepare the journal entry for the third installment payment on December 31, 2026.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardFinanceCo lent $8 million to Corbin Construction on January 1, 2018, to construct a playground. Corbin signed athree-year, 6% installment note to be paid in three equal payments at the end of each year.Required:1. Prepare the journal entry for FinanceCo’s lending the funds on January 1, 2018.2. Prepare an amortization schedule for the three-year term of the installment note.3. Prepare the journal entry for the first installment payment on December 31, 2018.4. Prepare the journal entry for the third installment payment on December 31, 2020.arrow_forwardSabonis Cosmetics Co. purchased machinery on December 31, 2019, paying $50,000 down and agreeing to pay the balance in four equal installments of $40,000 payable each December 31. An assumed interest of 8% is implicit in the purchase price. Instructions Prepare the journal entries that would be recorded for the purchase and for the payments and interest on the following dates. (Round answers to the nearest cent.) a. December 31, 2019. b. December 31, 2020. c. December 31, 2021. d. December 31, 2022. e. December 31, 2023.arrow_forward

- Cool Globe Inc. entered into two transactions, as follows: Purchased equipment paying $20,000 at the date of purchase and signing a noninterest-bearing note requiring the balance to be paid in four annual installments of $20,000 on the anniversary date of the contract. Based on Cool Globe's 12% borrowing rate for such transactions, the implicit interest cost is $19,253. Purchased a tract of land in exchange for $10,000 cash that was paid immediately and signed a noninterest-bearing note requiring five $10,000 annual payments. The first annual payment of the note is due in one year. The fair value of the land is $46,000. Required:Prepare the journal entries for these transactions.arrow_forward! Required information [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment purchases a building for $580,000, paying $110.000 down and borrowing the remaining $470,000, signing a 9%, 15-year mortgage. Installment payments of $4,767.05 are due at the end of each month, with the first payment due on January 31, 2021. Required: 1. Record the purchase of the building on January 1, 2021. (f no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. No Date General Journal Debit Credit 1 January 01, 2021 Interest Expense 3,525 x Notes Payable 1,242 X Cash 4,767 Xarrow_forwardun.9arrow_forward

- i need the answer quicklyarrow_forwardRequired information [The following information applies to the questions displayed below.] On January 1, 2024, Bloomfield Enterprises purchases a building for $327,000, paying $57,000 down and borrowing the remaining $270,000, signing a 7%, 10-year mortgage. Installment payments of $3,134.93 are due at the end of each month, with the first payment due on January 31, 2024. 3-a. Record the first monthly mortgage payment on January 31, 2024. 3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? Answer is not complete. Complete this question by entering your answers in the tabs below. Req 3a Req 3b Record the first monthly mortgage payment on January 31, 2024. (If no entry is required for select "No Journal Entry Required" in the first account field. Do not round intermediate calcul to 2 decimal places.) No Date General Journal 1 January 31, 2024 Interest Expense Notes Payable Cash Debit 1,559.93( 1,575.00arrow_forwardAt the end of 2022, the following information is available for Great Adventures. Additional interest for five months needs to be accrued on the $32,200, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $12,200 of the $32,200 loan discussed above is due next year. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $27,200 during the year and recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $14,200. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $6,200. No Date General Journal Debit Credit 1 Dec 31 Interest Expense 805 Interest Payable 805…arrow_forward

- Prepare all journal entries and adjusting journal entries necessary to record all of Red Robin's transactions related to the note payable information below: Red Robin purchased the building on January 1, 2019, for $496,300 using a note payable. The loan is a 30-year, 5% installment loan with annual payments due every December 31. See amortization table below: Building Loan Amortization Principal Interest Years Payments/year Payment Date 31-Dec-19 31-Dec-20 31-Dec-21 31-Dec-22 31-Dec-23 31-Dec-24 31-Dec-25 31-Dec-26 31-Dec-27 31-Dec-28 31-Dec-29 31-Dec-30 31-Dec-31 31-Dec-32 31-Dec-33 31-Dec-34 31-Dec-35 31-Dec-36 31-Dec-37 31-Dec-38 31-Dec-39 31-Dec-40 31-Dec-41 31-Dec-42 31-Dec-43 31-Dec-44 31-Dec-45 31-Dec-46 31-Dec-47 31-Dec-48 $496,300 5.00% 30 1 32,285 Interest Principal Payment Balance 496,300 488,830 480,986 7,470 32,285 7,844 32,285 24,815 24,441 24,049 32,285 23,638 32,285 23,205 32,285 22,751 32,285 22,274 10,011 32,285 21,774 10,511 32,285 21,248 11,037 32,285 8,236 8,647…arrow_forwardSheridan Electronics issues a $376,500, 3%, 10-year mortgage note on December 31, 2021. The proceeds from the note are to be used in financing a new research laboratory. The terms of the note provide for annual installment payments, exclusive of real estate taxes and insurance, of $44,137. Payments are due on December 31. Prepare the entries for (1) the loan and (2) the first installment payment.arrow_forwardshj.8arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education