FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

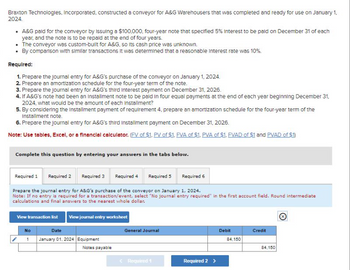

Transcribed Image Text:Braxton Technologies, Incorporated, constructed a conveyor for A&G Warehousers that was completed and ready for use on January 1,

2024.

• A&G paid for the conveyor by Issuing a $100,000, four-year note that specified 5% Interest to be paid on December 31 of each

year, and the note is to be repaid at the end of four years.

• The conveyor was custom-built for A&G, so Its cash price was unknown.

• By comparison with similar transactions it was determined that a reasonable Interest rate was 10%.

Required:

1. Prepare the journal entry for A&G's purchase of the conveyor on January 1, 2024.

2. Prepare an amortization schedule for the four-year term of the note.

3. Prepare the journal entry for A&G's third Interest payment on December 31, 2026.

4. If A&G's note had been an installment note to be paid in four equal payments at the end of each year beginning December 31,

2024, what would be the amount of each installment?

5. By considering the installment payment of requirement 4, prepare an amortization schedule for the four-year term of the

Installment note.

6. Prepare the journal entry for A&G's third Installment payment on December 31, 2026.

Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1)

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3 Required 4 Required 5 Required 6

Prepare the journal entry for A&G's purchase of the conveyor on January 1, 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate

calculations and final answers to the nearest whole dollar.

View journal entry worksheet

View transaction list

No

Date

1 January 01, 2024 Equipment

Notes payable

General Journal

< Required 1

Required 2 >

Debit

84,150

Credit

84,150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Meaning on interest on notes payable and amortization schedule

VIEW Step 2: Journal entries for A&G purchase of the conveyor on Jan 1, 2024

VIEW Step 3: Amortization schedule for the four year term of note

VIEW Step 4: Journal entries for A&G third year interest payment on December31,2026

VIEW Solution

VIEW Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Moustache Company is replacing most of the windows in its Alden factory by purchasing them under a note agreement with the Blattner Window Design Company on January 1, 2019. Moustache financed $37,908,000, and the note agreement will require $10 million in annual payments starting on December 31, 2019 and continuing for a total of four more years(final payment December 31, 2023). Blattner will charge Moustache the market interest rate of 10% compounded annually. What is the amount of the 2020 interest expense? A. $3,290,800 B. $2,790,800 C. $4,000,000 D. $3,169,880arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $25.1 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 12%. Questions: 1. & 2. Prepare the journal entries for LCD’s purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardOn January 1, 2021, the company obtained a $3 million loan with a 10% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,080,000 March 1, 2021 900,000 June 30, 2021 320,000 October 1, 2021 700,000 January 31, 2022 720,000 April 30, 2022 1,035,000 August 31, 2022 1,800,000 On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $5,000,000 and $7,000,000 with interest rates of 5% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Calculate the amount of interest that Mason should…arrow_forward

- On November 1, 2024, Quantum Technology, a geothermal energy supplier, borrowed $5 million cash to fund a geological survey. The loan was made by Nevada BancCorp under a noncommitted short-term line of credit arrangement. Quantum issued a nine-month, 6% promissory note. Interest was payable at maturity. Quantum’s fiscal period is the calendar year. Required: 1. Prepare the journal entry for the issuance of the note by Quantum Technology. 2. & 3. Prepare the appropriate adjusting entry for the note by Quantum on December 31, 2024 and journal entry for the payment of the note at maturity. Note: For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.arrow_forwardRequired information [The following information applies to the questions displayed below.) On January 1, 2024, Monster Corporation borrowed $19 million from a local bank to construct a new highway over the next four years. The loan will be paid back in four equal installments of $5,609,334 on December 31 of each year. The payments include interest at a rate of 7%. 2. Prepare an amortization schedule over the four-year life of the installment note. (Round your final answers to the nearest dollar amount. Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000.).) Date 12/31/2024 12/31/2025 12/31/2026 12/31/2026 Cash Paid Interest Expense Decrease in Carrying Value Carrying Valuearrow_forwardi need the answer quicklyarrow_forward

- At the end of 2022, the following information is available for Great Adventures. Additional interest for five months needs to be accrued on the $32,200, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $12,200 of the $32,200 loan discussed above is due next year. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $27,200 during the year and recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $14,200. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $6,200. No Date General Journal Debit Credit 1 Dec 31 Interest Expense 805 Interest Payable 805…arrow_forwardLucky Strike, a bowling alley, purchased new equipment from Brunswick in the amount of $850,000. Brunswick is allowing Luck Strike me to amortize the cost of the equipment with monthly payments over 2 years at 12% interest. What equal monthly payment will be required to amortize this loan?arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $24.7 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 24%. Required: 1. & 2. Prepare the journal entries for LCD’s purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024?arrow_forward

- Murphy Company purchased a new machine for $120,000 on December 31, 2020. They obtained a loan at the bank to finance the purchase. The terms of the loan were: 5 years, 5% interest, annual payments of principal and interest on December 31 of each year. a. Using the table provided, calculate the annual payment on the loan. b. Record the purchase of the new machine on December 31, 2020. c. Record the loan payment on December 31, 2021. d. Record the loan payment on December 31, 2022. d. Calculate the loan balance for December 31, 2022 after the payment. a. Using the table below, calculate the annual payment on the loan. Loan Amount…arrow_forwardOn January 1, 2023, Marigold Inc. signed a fixed-price contract to have Builder Associates construct a major head office facility a a cost of $4 million. It was estimated that it would take three years to complete the project. Also, on January 1, 2023, to finance the construction cost, Marigold borrowed $4 million that is repayable in 10 annual instalments of $400,000, plus interest at the rate of 10%. During 2023, Marigold made deposit and progress payments totalling $1.5 million under the contract; the weighted average amount of accumulated expenditures was $791,000 for the year. The excess amount of borrowed funds was invested in short-term securities, from which Marigold realized investment income of $24,300. For situation 1, what amount should Marigold report as capitalized borrowing costs at December 31, 2023? (If an answer is zero, please enter O. Do not leave any fields blank.) Capitalized borrowing $ 375700arrow_forwardEdward purchased a new piece of equipment to be used in its new facility. The $445,000 piece of equipment was purchased with a $66,750 down payment and with cash received through the issuance of a $378,250, 9%, 5-year mortgage payable issued on January 1, 2022. The terms provide for annual installment payments of $97,245 on December 31. 1. Prepare an installment payments schedule for the first five payments of the notes payable 2. Prepare the journal entry related to the notes payable for December 31, 2022. 3. Show the balance sheet presentation for this obligation for December 31, 2022. (Hint: Be sure to distinguish between the current and long-term portions of the note.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education