EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Hi expart Provide correct answer

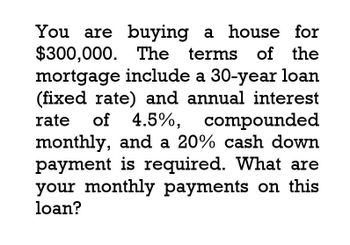

Transcribed Image Text:You are buying a house for

$300,000. The

The terms of the

mortgage include a 30-year loan

(fixed rate) and annual interest

rate of 4.5%, compounded

monthly, and a 20% cash down

payment is required. What are

your monthly payments on this

loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- What are your monthly payments on this loan?arrow_forwardNeed helparrow_forwardYou are offered an add-on loan for $4,500 at 18% for 5 years. What is the monthly payment? What is the amount of interest? What is the true interest rate cost of this loan? If you could pay the same loan above at a compound rate: What would the monthly payment be? What would the amount of interest be? Prepare a monthly payment schedule for each loan above using Excel, and submit it. Suppose that you are only allowed to make a balloon payment to the principal of the compound interest loan. You have $1,000 to put down at the beginning of year three. How many payments will you save?arrow_forward

- You want to buy a $226,000 home. You plan to pay 5% as a down payment, and take out a 30-year loan at 6.55% interest for the rest. a) How much is the loan amount going to be? b) What will your monthly payments be? c) How much of the first payment is interest?arrow_forwardYou want to buy a house valued at $200,000. AFter a down payment, you can finance the house with a 20 year mortgage at 4.2% APR compounded monthly. If you have a monthly payment of $1000, how much of the second payment goes towards the blance on the loan?arrow_forwardSuppose you want to borrow $90,000 and you find a bank offering a 20-year term for a loan of that amount, with an APR of 7%. Complete parts (a) and (b) below. (a) What are your monthly payments? PMT=$ (Round to the nearest cent as needed.) Questionarrow_forward

- you wish to purchase real property. the lender will give you a 250000 fixed rate 30 year mortgage at 3.5% per annum. suppose that before you can make any payments you receive a pay raise so you can pay an extra 200 per month with your normal payment. how many payments are required to fully amortize the loan assuming the extra 200 is paid each month?arrow_forwardYou are purchasing a home for $ 395,000. The loan requires a down payment of 15% of the purchase price. There are no other fees. The rest will be borrowed through a 7.35% (CIA ) amortized loan with annual payments for 20 years. What will the annual payment be on the loan?arrow_forwardYou want to buy a car, and a local bank will lend you $33,000. The loan would be fully amortized over 6 years (72 months), and the nominal interest rate would be 13%, with interest paid monthly. What is the monthly loan payment? What is the loan’s EFF%?arrow_forward

- You want to purchase a house valued at $200,000. After a downpayment, you can finance the house with a 20 year mortgage at 4.2% APR, compounded monthly. What percentage of the house will you need to finance in order to have monthly payments of $1,000? Round to two decimal places. What is the downpayment?arrow_forwardYou want to buy a $214,000 home. You plan to pay 10% as a down payment, and take out a 30 year loan at 5.6% interest for the rest.a) How much is the loan amount going to be?b) What will your monthly payments be?c) How much of the first payment is interest?arrow_forwardSuppose you are buying your first condo for $190,000, and you will make a $10,000 down payment. You have arranged to finance the remainder with a 30-year, monthly payment, amortized mortgage at 3.5% nominal interest rate, with the first payment due in one month. What will your monthly payments be? You are not required to show calculations. However to receive credit you must provide the inputs used (N, PMT, FV, I/Y, PV) to solve. If you utilize a template, you can copy and paste the section used in the submission. $808.28 $853.18 $527.78arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT