Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't use

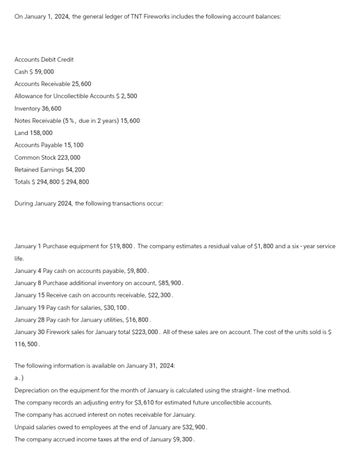

Transcribed Image Text:On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances:

Accounts Debit Credit

Cash $ 59,000

Accounts Receivable 25, 600

Allowance for Uncollectible Accounts $ 2,500

Inventory 36,600

Notes Receivable (5%, due in 2 years) 15,600

Land 158,000

Accounts Payable 15, 100

Common Stock 223,000

Retained Earnings 54,200

Totals $294,800 $294,800

During January 2024, the following transactions occur:

January 1 Purchase equipment for $19,800. The company estimates a residual value of $1,800 and a six-year service

life.

January 4 Pay cash on accounts payable, $9,800.

January 8 Purchase additional inventory on account, $85,900.

January 15 Receive cash on accounts receivable, $22,300.

January 19 Pay cash for salaries, $30,100.

January 28 Pay cash for January utilities, $16,800.

January 30 Firework sales for January total $223,000. All of these sales are on account. The cost of the units sold is $

116,500.

The following information is available on January 31, 2024:

a.)

Depreciation on the equipment for the month of January is calculated using the straight-line method.

The company records an adjusting entry for $3,610 for estimated future uncollectible accounts.

The company has accrued interest on notes receivable for January.

Unpaid salaries owed to employees at the end of January are $32,900.

The company accrued income taxes at the end of January $9,300.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ernst Companys balance sheet shows total liabilities of 32,500,000, total stockholders equity of 8,125,000, and total assets of 40,625,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forwardOn January 1, 2021, the general ledger of TNT Fireworks includes the following account balances:Accounts Debit CreditCash $ 58,700Accounts Receivable 25,000Allowance for Uncollectible Accounts $ 2,200Inventory 36,300Notes Receivable (5%, due in 2 years) 12,000Land 155,000Accounts Payable 14,800Common Stock 220,000Retained Earnings 50,000Totals $ 287,000 $ 287,000During January 2021, the following transactions occur:January 1 Purchase equipment for $19,500. The company estimates a residual value of $1,500…arrow_forwardOn January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:Accounts Debit CreditCash $ 21,900Accounts Receivable 36,500Allowance for Uncollectible Accounts $ 3,100Inventory 30,000Land 61,600Accounts Payable 32,400Notes Payable (8%, due in 3 years) 30,000Common Stock 56,000Retained Earnings 28,500Totals $150,000 $150,000The $30,000 beginning balance of inventory consists of 300 units, each costing…arrow_forward

- Required Information On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: Accounts Cash Debit Credit Accounts Receivable $ 58,800 25,200 Allowance for Uncollectible Accounts $ 2,300 Inventory 36,480 Notes Receivable (5%, due in 2 years) 13,200 Land 156,000 Accounts Payable Common Stock Retained Earnings 14,900 221,200 51,408 Totals $ 289,680 $ 289,600 During January 2024, the following transactions occur. January 1 Purchase equipment for $19,600. The company estimates a residual value of $1,608 and a six-year service life. January 4 Pay cash on accounts payable, $9,600. January 8 Purchase additional inventory on account, $83,980. January 15 Receive cash on accounts receivable, $22,100. January 19 Pay cash for salaries, $29,900. January 28 Pay cash for January utilities, $16,600. January 30 Firework sales for January total $221,000. All of these sales are on account. The cost of the units sold is $115,500. Information for adjusting entries: a.…arrow_forwardOn January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $ 23,300 Accounts Receivable Allowance for Uncollectible Accounts 40,000 $ 4,500 Inventory Land 37,000 72,100 Accounts Payable Notes Payable (6%, due in 3 years) Common Stock 28,900 37,000 63,000 39, 000 Retained Earnings Totals $172,480 $172,400 The $37,000 beginning balance of Inventory consists of 370 units, each costing $100. During January 2021, Big Blast Fireworks had the following Inventory transactions: January 3 Purchase 1,600 units for $168,000 on account ($105 each). January 8 Purchase 1,700 units for $187,000 on account ($110 each). January 12 Purchase 1,800 units for $207,000 on account ($115 each). January 15 Return 135 of the units purchased on January 12 because of defects. January 19 Sell 5, 200 units on account for $78e, e00. The cost of the units sold is determined using a FIFO perpetual inventory system. January 22 Receive $753,800 from…arrow_forwardRequired Information On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: Accounts Cash Accounts Receivable Debit Credit $ 58,800 25,200 Allowance for Uncollectible Accounts $ 2,300 Inventory 36,400 Notes Receivable (5%, due in 2 years) 13,200 156,000 Common Stock 14,900 221,800 51,488 Land Accounts Payable Retained Earnings Totals $ 289,600 $ 289,600 During January 2024, the following transactions occur: January 1 Purchase equipment for $19,600. The company estimates a residual value of $1,608 and a six-year service life. January 4 Pay cash on accounts payable, $9,600. January 8 Purchase additional inventory on account, $83,980. January 15 Receive cash on accounts receivable, $22,100. January 19 Pay cash for salaries, $29,900. January 28 Pay cash for January utilities, $16,500. January 30 Firework sales for January total $221,088. All of these sales are on account. The cost of the units sold is $115,500. Information for adjusting entries: a.…arrow_forward

- On January 1, 2021, the general ledger of Big Bles: Fireworks includes the following account balances: Accounts Cash Debit Credit $ 23, 308 48, e0e Accounts Receivable Allowance for Uncollectible Accounts $ 4, 580 37, eee Inventory Land 72,100 Accounts Payable Notes Payable (6%, duc in 3 years) 28,98e 37,eee 63,0ee 39,8ee Comnon Stock Retained Earnings Totals $172,400 $172, 400 The $37,000 beginning belance of inventory consists of 370 units, each costing $100. During January 2021, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,680 units for $168,89e on account ($185 cach). January 8 Purchase 1,78e units for $187, e0e on account ($110 each). January 12 Purchase 1,88e units for $207, B00 on account ($115 cach). January 15 Return 135 of the units purchased on January 12 because of defects. January 19 Sell 5,2ee units on account for $788, eee. The cost of the units sold is deternined using a FIFO perpetual inventory syston. January 22 Receive $753, eee…arrow_forwardOn January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:Accounts Debit CreditCash $ 11,200Accounts Receivable 34,000Allowance for Uncollectible Accounts $ 1,800Inventory 152,000Land 67,300Buildings 120,000Accumulated Depreciation 9,600Accounts Payable 17,700Common Stock 200,000Retained Earnings 155,400Totals $384,500 $384,500During January 2021, the…arrow_forwardOn January 1, 2021, the general ledger of TNT Fireworks includes the following account balances: Accounts Debit Credit Cash $ 59,000 Accounts Receivable 25,600 Allowance for Uncollectible Accounts $ 2,500 Inventory Notes Receivable (5%, due in 2 years) 36,600 15,600 Land 158,000 Accounts Payable 15,100 223,000 Common Stock Retained Earnings 54,200 Totals $294,800 $294,800 During January 2021, the following transactions occur: January 1 Purchase equipment for $19,800. The company estimates a residual value of $1,800 and a six-year service life. January 4 Pay cash on accounts payable, $9,800. January 8 Purchase additional inventory on account, $85,900. January 15 Receive cash on accounts receivable, $22,30O. January 19 Pay cash for salaries, $30,100. January 28 Pay cash for January utilities, $16,800. January 30 Sales for January total $223,000. All of these sales are on account. The cost of the units sold is $116,500. Information for adjusting entries: a. Depreciation on the equipment…arrow_forward

- On January 1, 2021, the general ledger of Big Blast Fireworks Includes the following account balances: Accounts Debit Credit Cash $ 23, 300 Accounts Receivable Allowance for Uncollectible Accounts 40, 000 $ 4,500 Inventory 37, 000 72,108 Land Accounts Payable Notes Payable (6%, due in 3 years) 28,900 37,e00 Common Stock 63,000 Retained Earnings 39,e00 Totals $172,480 $172,400 The $37,000 beginning balance of Inventory consists of 370 units, each costing $100. During January 2021. Big Blast Fireworks had the following Inventory transactions: January 3 Purchase 1,680 units for $168,8ee on account ($185 each). January 8 Purchase 1,700 units for $187,0ee on account ($11e each). January 12 Purchase 1,800 units for $207,0ee on account ($115 each). January 15 Return 135 of the units purchased on January 12 because of defects. January 19 Sell 5,200 units on account for $788,00e. The cost of the units sold is deternined using a FIF0 perpetual inventory system. January 22 Receive $753,80e from…arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardRequired Information On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: Accounts Cash Accounts Receivable Debit $ 58,800 25,200 Credit Allowance for Uncollectible Accounts $ 2,300 Inventory 36,400 Notes Receivable (5%, due in 2 years) 13,200 Land 156,000 Accounts Payable Common Stock 14,900 221,000 51,400 $ 289,600 $ 289,608 Retained Earnings Totals During January 2024, the following transactions occur. January 1 Purchase equipment for $19,680. The company estimates a residual value of $1,600 and a six-year service life. January 4 Pay cash on accounts payable, $9,600. January 8 Purchase additional inventory on account, $83,980. January 15 Receive cash on accounts receivable, $22,100. January 19 Pay cash for salaries, $29,980. January 28 Pay cash for January utilities, $16,500. January 38 Firework sales for January total $221,008. All of these sales are on account. The cost of the units sold is $115,580. Information for adjusting entries: a.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning