FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

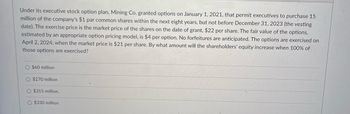

Transcribed Image Text:Under its executive stock option plan, Mining Co. granted options on January 1, 2021, that permit executives to purchase 15

million of the company's $1 par common shares within the next eight years, but not before December 31, 2023 (the vesting

date). The exercise price is the market price of the shares on the date of grant, $22 per share. The fair value of the options,

estimated by an appropriate option pricing model, is $4 per option. No forfeitures are anticipated. The options are exercised on

April 2, 2024, when the market price is $21 per share. By what amount will the shareholders' equity increase when 100% of

those options are exercised?

O $60 million

$270 million

O $315 million.

O $330 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bells, Inc.'s board authorized 150,000 stock options for the company's design team. The options can only be used to purchase shares of Bells, Inc's common stock for $9 per share and will vest in 3 years. Assuming that the options were authorized on January 1st of 2023, that the fair value of the options is $6, and that the company's tax rate is 20%, what will the amount of the net tax effect of these options in 2023? (NIE 15)$300,000$120,000$180,000$60,000arrow_forwardOn March 1, 2022, Hudson Corp. purchased a put option on shares of ICA stock. The contract was for 100 shares at a strike price of $130 per share, with an expiration date of May 31, 2022. The option contract premium (the amount paid to enter the contract at signing) was $40. On March 31, a market appraisal estimated the time value of the option to be $30. Hudson settled the option contract on May 10. Prices of ICA stock during the option period are provided below. Price of ICA stocks March 1 $130 March 31 $120 May 10 $125 At what amount would Hudson report as the value of the put option in its March 31, 2022 balance sheet? Put Option account balance as of March 31, 2022 4,000arrow_forwardWalters Audio Visual, Inc., offers a stock option plan to its regional managers. On January 1, 2021, 40 million options were granted for 40 million $1 par common shares. The exercise price is the market price on the grant date, $8 per share. Options cannot be exercised prior to January 1, 2023, and expire December 31, 2027. The fair value of the options, estimated by an appropriate option pricing model, is $2 per option. Because the plan does not qualify as an incentive plan, Walters will receive a tax deduction upon exercise of the options equal to the excess of the market price at exercise over the exercise price. The income tax rate is 25%. 4. Record the exercise of the options and their tax effect if all of the options are exercised on March 20, 2026, when the market price is $12 per share.5. Assume the option plan qualifies as an incentive plan. Prepare the appropriate journal entries to record compensation expense and its tax effect on December 31, 2021.6. Assuming the option…arrow_forward

- Fortune Brands granted options on January 1, 2024, that allows the recipient to purchase 15.0 million of the company's $1 par common shares within the next eight years, but not before December 31, 2026 (the vesting date). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. No forfeitures are anticipated. Ignoring taxes, what is the effect on earnings in the year after the options are granted to executives? Note: Round your answer to 1 decimal place. Multiple Choice O $60.0 million $90.0 million $0 $20.0 millionarrow_forwardNewmont Corp grants stock options to its top executives. On January 1, 2021, 24 million options were granted, each giving the executive owning them the right to acquire five $1 par common shares. The exercise price is the market price on the grant date – $30 per share ($120 per option). Options vest on January 1, 2025. They cannot be exercised before that date and will expire on December 31, 2027. The fair value of the 24 million options, estimated by an appropriate option pricing model, is $42 per option. Ignore income tax. Newmont's compensation expense in 2021 for these stock options was: (Round your answer to nearest whole dollar amount.) rev: 04_13_2020_QC_CS-207906 Multiple Choice $504 million. $1,008 million. $252 million. $0.arrow_forwardOrange Inc. issued 20,000 nonqualified stock options valued at $20,000 (in total). The options vest over two years-half in 2019 (the year of issue) and half in 2020. One thousand options are exercised in 2020 with a bargain element on each option of $6. What is the 2020 book-tax difference associated with the stock options? Part I: A) $15,000 favorable B) $ 6,000 favorable C) $15,000 unfavorable D) $ 4,000 unfavorable Part II: What is the permanent difference related to this exercise of 1,000 option?arrow_forward

- Can you help me with step by step explanation, please? Thank you :)arrow_forwardqw.128. On January 1, 2021, Adams-Meneke Corporation granted 60 million incentive stock options to division managers, each permitting holders to purchase one share of the company’s $1 par common shares within the next six years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, currently $16 per share. The fair value of the options, estimated by an appropriate option pricing model, is $3 per option. Management’s 1.) Total Compensation Cost 2.) Record compensation expense on December 31, 2021. 3.) Record the compensation expense.arrow_forwardUnder its executive stock option plan, National Corporation granted 15 million options on January 1, 2021, that permit executives to purchase 15 million of the company’s $1 par common shares within the next six years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. Suppose that unexpected turnover during 2022 caused the forfeiture of 5% of the stock options. Compute the amount of compensation expense for 2022 and 2023arrow_forward

- Please help and show formulaarrow_forwardUnion Pacific Corp uses stock options as a major compensation incentive for its top executives. On January 1, 2021, 23 million options were granted, each giving the executive owning them the right to acquire five $1 par common shares. The exercise price is the market price on the grant date – $30 per share ($120 per option). Options vest on January 1, 2025. They cannot be exercised before that date and will expire on December 31, 2027. The fair value of the 23 million options, estimated by an appropriate option pricing model, is $43 per option. Ignore income tax. Union Pacific Corp's compensation expense in 2021 for these stock options was: (Round your answer to nearest whole dollar amount.) Multiple Choice $247 million. $989 million. $494 million. $0.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education