On December 31, 20X2, your company's Mexican subsidiary sold land at a selling price of 3.100,000 pesos. The land had been purchased for 2.1 million pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S. dollar. The exchange rate for 1 U.S. dollar was 11 pesos on December 31, 20X1, and 12 pesos on December 31, 20X2. Assume that the subsidiary had no other assets and no liabilities during the two years that it owned the land.

On December 31, 20X2, your company's Mexican subsidiary sold land at a selling price of 3.100,000 pesos. The land had been purchased for 2.1 million pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S. dollar. The exchange rate for 1 U.S. dollar was 11 pesos on December 31, 20X1, and 12 pesos on December 31, 20X2. Assume that the subsidiary had no other assets and no liabilities during the two years that it owned the land.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 26PC

Related questions

Question

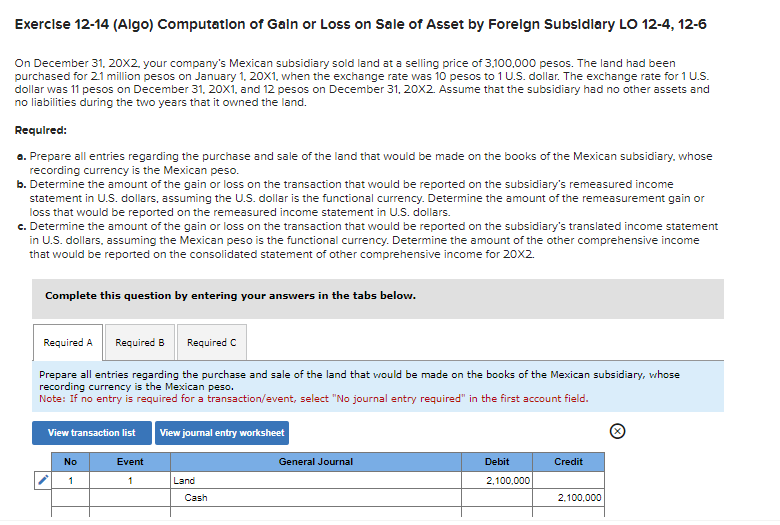

Transcribed Image Text:Exercise 12-14 (Algo) Computation of Gain or Loss on Sale of Asset by Foreign Subsidiary LO 12-4, 12-6

On December 31, 20X2, your company's Mexican subsidiary sold land at a selling price of 3.100,000 pesos. The land had been

purchased for 2.1 million pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S. dollar. The exchange rate for 1 U.S.

dollar was 11 pesos on December 31, 20X1, and 12 pesos on December 31, 20X2. Assume that the subsidiary had no other assets and

no liabilities during the two years that it owned the land.

Required:

a. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose

recording currency is the Mexican peso.

b. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income

statement in U.S. dollars, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement gain or

loss that would be reported on the remeasured income statement in U.S. dollars.

c. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's translated income statement

in U.S. dollars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive income

that would be reported on the consolidated statement of other comprehensive income for 20x2.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose

recording currency is the Mexican peso.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

No

1

Event

1

View journal entry worksheet

Land

Cash

General Journal

Debit

2,100,000

Credit

2,100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning