FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

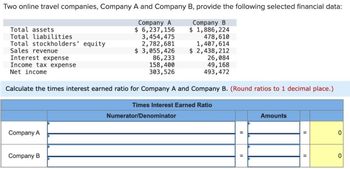

Transcribed Image Text:Two online travel companies, Company A and Company B, provide the following selected financial data:

Company A

$ 6,237, 156

3,454,475

2,782,681

$ 3,055,426

86,233

Company B

$ 1,886,224

478,610

1,407,614

$ 2,438,212

158,400

303,526

Total assets.

Total liabilities

Total stockholders' equity

Sales revenue

Interest expense

Income tax expense

Net income

Calculate the times interest earned ratio for Company A and Company B. (Round ratios to 1 decimal place.)

Company A

Company B

26,084

49, 168

493,472

Times Interest Earned Ratio

Numerator/Denominator

||

II

Amounts

II

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Three major transportation segments and a major company within each segment are as follows: Segment Company Railroads Company R, Inc. (CORI) Motor carriers Company M, Inc. (COMI) Transportation Arrangement Company T, Inc. (COTI) Company R Company M Company T Sales $5,070,961 $3,748,940 $3,487,549 Average long-term operating assets 1,370,530 720,950 591,110 a. Determine the asset turnover for all three companies. Round to one decimal place. Company R fill in the blank 1 Company M fill in the blank 2 Company T fill in the blank 3 Do not give solution in imagearrow_forwardSubject - account Please help me. Thankyou.arrow_forwardPrepare a balance sheet with the information below Debit Credit $ $ Sales 1,000,000 Sales returns 10,000 Selling expenses 150,000 Administration expenses 205,000 Financial expenses 50,000 Purchases 320,000 Cash at bank 77,000 Accounts receivable 22,000 Provision for Doubtful Debts 2,500 Inventories 42,000 Motor Vehicles 80,000 Furniture 42,000 Plant and Equipment 276,500 Accumulated Depreciation Plant 1,500 Accounts payable 56,000 Bank Loan 12,000 Capital - Bennett 75,000 Capital - Barney 112,500 Current - Bennett 25,000 Current - Barney 35,000 Drawings - Bennett 20,000 Drawings - Barney 25,000arrow_forward

- Divisional Income Statements and Return on Investment Analysis E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 20Y8, are as follows: Mutual FundDivision ElectronicBrokerageDivision InvestmentBankingDivision Fee revenue $1,120,000 $1,160,000 $1,130,000 Operating expenses 603,400 486,800 854,000 Invested assets 4,100,000 3,400,000 2,300,000 The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations. Required: 1. Prepare condensed divisional income statements for the three divisions, assuming that there were no support department allocations. E.F. Lynch Company Divisional Income Statements For the Year Ended June 30, 20Y8 MutualFundDivision ElectronicBrokerageDivision InvestmentBankingDivision Fee revenue $fill in…arrow_forwardUsing the data below for the Ace Guitar Company: A Region B Region Sales $521,500 $968,500 Cost of goods sold 198,200 368,000 Selling expenses 125,200 232,400 Service department expenses Purchasing $250,300 Payroll accounting 166,900 Allocate service department expenses proportional to the sales of each region. Determine the divisional income from operations for the A and B regions. For interim calculations, round percentages to one decimal place. A Region $ B Region $arrow_forwardPlease see below. Use the accounts listed to create a multistep income statement.arrow_forward

- Divisional Income Statements and Return on Investment Analysis E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 20Y8, are as follows: Mutual FundDivision ElectronicBrokerageDivision InvestmentBankingDivision Fee revenue $1,010,000 $1,060,000 $1,030,000 Operating expenses 492,000 390,400 727,600 Invested assets 3,700,000 3,100,000 2,100,000 The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations. Required: Question Content Area 1. Prepare condensed divisional income statements for the three divisions, assuming that there were no service department cost allocations. E.F. Lynch CompanyDivisional Income StatementsFor the Year Ended June 30, 20Y8 MutualFundDivision ElectronicBrokerageDivision InvestmentBankingDivision Fee…arrow_forwardSolve this problemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education