FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

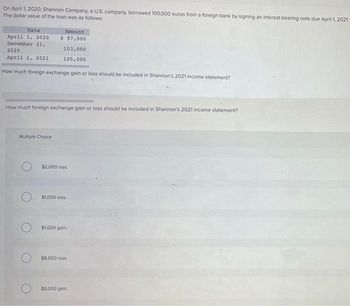

Transcribed Image Text:On April 1, 2020, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2021.

The dollar value of the loan was as follows:

Date

April 1, 2020

December 31,

Amount

$ 97,000

103,000

105,000

How much foreign exchange gain or loss should be included in Shannon's 2021 income statement?

2020

April 1, 2021

How much foreign exchange gain or loss should be included in Shannon's 2021 income statement?

Multiple Choice

$2,000 loss.

$1,000 loss.

O $1,000 gain,

$8.000 loss.

$2,000 gain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A U.S. company sells a product to a British company with the transaction listed in British pounds. On the date of the sale, the transaction total of $14,500 is billed as £10,000, reflecting an exchange rate of 1.45 (that is, $1.45 per pound). Prepare the entry to record (1) the sale and (2) the receipt of payment in pounds when the exchange rate is 1.35.arrow_forwardCedar Co., a U.S. corporation, sold inventory on December 1, 2023, with payment of 12,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows: Date December 1, 2023 December 31, 2023 January 30, 2024 O $0 Spot Rate (U.S. Dollar per British pound) O $756 loss O $1,740 gain O $2,496 loss $1.831 $1.976 What amount of foreign exchange transaction gain or loss should be recorded on January 30, 2024? $1.768arrow_forwardBrandt Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2020, with payment of 10 million South Korean won to be received on March 31, 2021. The following exchange rates apply: Date Spot Rate Forward Rate(to March 31, 2021) December 1, 2020 $ 0.0035 $ 0.0034 December 31, 2020 0.0033 0.0032 March 31, 2021 0.0038 N/A 1. Assuming that Brandt did not hedge his foreign exchange risk, how much foreign exchange gain or loss should it report on its 2020 income statement with regard to this transaction? a. 3000 gain b. 2000 loss c. 5000 gain d. 1000 loss 2. Assuming that Brandt entered into a forward contract to sell 10 million South Korean won on December 1, 2020, as a fair value hedge of a foreign currency receivable, what is the net impact on its net income in 2020 resulting from a fluctuation in the value of the won? Brandt amortizes forward points on a monthly basis using a straight-line method. Ignore…arrow_forward

- 1arrow_forwardOn January 31, 2020 Fred has a 50,000 foreign currency denominated Accounts Payable due in 1 month. This payable is not hedged. The following exchange rates were in effect. January 31, 2020 : spot rate 5 US = 1 FC January 31, 2020: one month forward rate 2.5 US = 1FC February 28, 2020 spot rate 4 US = 1 FC February 28, 2020 one month forward rate 3 US = 1FC How much is the FX gain or loss on February 28, 2020. a. FX gain $10,000 b. FX gain $50,000 c. FX loss $2,500 d. FX loss $50,000 e. FX gain $2,500arrow_forwardOn December 1, 2022, GAZA Company purchased Equipment from Ispanya by 100,000 Euro payable on March 31, 2023. At the same time GAZA entered into a 120-day forward contract with :ALQUDS Bank to purchase 100,000 Euro in March 31, 2023 to hedge risk of changes in exchange rates. GAZA's fiscal year ends on December 31. The direct exchange rates follow Date Spot Rate Forward Rate December 1, 20X1 December 31, 20X1 0.600 0.610 0.609 0.612 March 31, 20X2 0.602 Required: Prepare all journal entries for GAZAarrow_forward

- Winston Corp., a U.S. company, had the following foreign currency transactions during 2021: ( 1.) Purchased merchandise from a foreign supplier on July 16, 2021 for the U.S. dollar equivalent of $47,000 and paid the invoice on August 3, 2021 at the U.S. dollar equivalent of $54,000. (2.) On October 15, 2021 borrowed the U.S. dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15, 2022. The U.S. dollar equivalent of the note amount was $295,000 on December 31, 2021, and $299,000 on October 15, 2022. What amount should be included as a foreign exchange gain or loss from the two transactions for 2022?arrow_forwardASSUME THAT THE LOCAL CURRENCY UNIT IS THE FUNCTIONAL CURRENCY. Cade Inc. had a debit adjustment of $6400 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Cade had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Cade's balance sheet at $121000. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $123800. In Cade's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forwardDd5.arrow_forward

- ABC Corp., a US corporation, purchased goods on credit from a British company on April 8, 2007. ABC made a payment of 10,000FC on May 8, 2007. The exchange rate was $1= FC .50 on April 8 and $1= FC .60 on May 8. What amount of foreign exchange gain or loss should be recognized on May 8 ?arrow_forwardFlynn Corporation purchased bicycles from a British manufacturer at a price of 45,000 British pounds on November 15, Year 1with payment due in 60 daysUsing the following exchange rateswhat gain or loss from currency fluctuations should be recognized in Year 1 and Year 2 respectively? Nov. 15, Year 1 1.70 per British pound Dec. 31, Year 1 1.75 per British pound Jan. 15, Year 2 $1.73 per British poundarrow_forwardForeign currency transactions Melbourne Ltd purchased goods from France on 3 April 2022 on credit shipped FOB Paris. The cost of good is Euro 500,000 and outstanding as of 31 April 2021. On 3 April 2022, the exchange rate is A$1.00 = Euro 0.67. On 30 April 2022, exchange rate is A$1.00 = Euro 0.66 REQUIRED Provide the accounting entries necessary to account for the above purchase transaction for the month ending 30 April 2022.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education