Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!

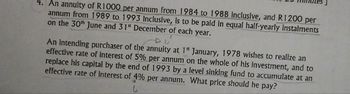

Transcribed Image Text:4. An annuity of R1000 per annum from 1984 to 1988 inclusive, and R1200 per

annum from 1989 to 1993 Inclusive, is to be paid in equal half-yearly instalments

on the 30th June and 31st December of each year.

An intending purchaser of the annuity at 1st January, 1978 wishes to realize an

effective rate of interest of 5% per annum on the whole of his investment, and to

replace his capital by the end of 1993 by a level sinking fund to accumulate at an

effective rate of Interest of 4% per annum. What price should he pay?

9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company will receive payments of $8,000 per year for the next five years under a subscription contract. The first payment will be made at the beginning of the contract. Assuming an annual interest rate of 4% is appropriate, the present value of an ordinary annuity is 4.45182 x $8,000 = $35,615, and the present value of an annuity due is 4.62990 x $8,000 = $37,039. Which amount must the company record for this sale in accordance with generally accepted accounting principles (GAAP) if collection is reasonably assured? $37,039 $0 $40,000 $35,615arrow_forwardFind the accumulated value of an annuity-immediate which pays 1 at the end of each half-year for five years, if the rate of interest is 7% convertible semi-annually for the first two years, 9% convertible semi-annually for the next two years, and 8% convertible semi-annually for the last year.arrow_forwardAn annuity pays out on 1 January in every year, from 1 January 2011 up to (and including) 1 January 2030. The annuity pays £1000 in odd years (2011, 2013, 2015, etc.) and £2000 in even years (2012, 2014, 2016, etc.). Compute the present value of this annuity on 1 January 2011 on the basis on an interest rate of 6% p.a. Answer: £18,060.12. could you show me how to answer this , its a varaying annuityarrow_forward

- Using the information provided, what transaction represents the best application of the present value of an annuity due of $1? A. Falcon Products leases an office building for 8 years with annual lease payments of $100,000 to be made at the beginning of each year. B. Compass, Inc., signs a note of $32,000, which requires the company to pay back the principal plus interest in four years. C. Bahwat Company plans to deposit a lump sum of $100.000 for the construction of a solar farm In 4 years. D. NYC Industries leases a car for 4 yearly annual lease payments of $12,000, where payments are made at the end of each year.arrow_forward13. A businessman borrowed P750,000 with interest at a rate of 7% compounded semi- annually. He agrees to discharge his obligation by paying a series of 6 equal semi-annual payments, the first being due at the end of 6 ½ years. Find the semi-annual payment?arrow_forwardWhat's the present value of a 4-year ordinary annuity of $2,250 per year plus an additional $3,000 at the end of Year 4 if the interest rate is 5%? $8,509 $8,957 $9,428 $9,924 $10,446arrow_forward

- 2) A 15-Year annuity is purchased for 10,000 with level annual payment 800. what is the effective annual interest rate?arrow_forwardBoth ques... Jones can deposit $5,700 at the end of each six-month period for the next 12 years and earn interest at an annual rate of 8 percent, compounded semiannually. Required: a. What will the value of the investment be after 12 years?b. If the deposits were made at the beginning of each year, what would the value of the investment be after 12 years? Note: For all requirements, do not round intermediate calculations and round your final answers to the nearest whole dollar amount.arrow_forwardWhat is the accumulated amount of a 8-year annuity paying ₱ 3,838 at the end of each year, with interest at 4% compounded annually?arrow_forward

- For $10,000, you can purchase a five-year annuity that will pay $ 2,504.57 per year for five years. The payments occur at the end of each year. Calculate the effective annual interest rate implied by this arrangement.arrow_forwardHector will receive 1,500 at the end of each year for 5 years. Jill will receive 1,000 at the end of each year for 10 years. At an annual effective interest rate of i, the present values of the two annuities are equal. Calculate i. a. 2754 O b. .1487 O c. .0718 O d. .9603 O e. 1.1487arrow_forwardValue of an Annuity Using the appropriate tables, solve each of the following. Required: 1. Beginning December 31, 2020, 5 equal withdrawals are to be made. Determine the equal annual withdrawals if 30,000 is invested at 10% interest compounded annually on December 31, 2019. 2. Ten payments of 3,000 are due at annual intervals beginning June 30, 2020. What amount will be accepted in cancellation of this series of payments on June 30, 2019, assuming a discount rate of 14% compounded annually? 3. Ten payments of 2,000 are due at annual intervals beginning December 31, 2019. What amount will be accepted in cancellation of this series of payments on January 1, 2019, assuming a discount rate of 12% compounded annually?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT