Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please Solve This Finance Question

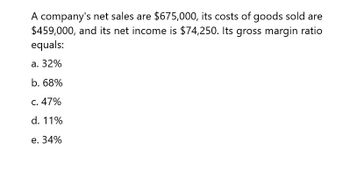

Transcribed Image Text:A company's net sales are $675,000, its costs of goods sold are

$459,000, and its net income is $74,250. Its gross margin ratio

equals:

a. 32%

b. 68%

c. 47%

d. 11%

e. 34%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company's net sales were $677,900, its cost of goods sold was $223,810, and its net income was $35,050. Its gross margin ratio equals: A. 302.9% B. 33% C. 67% D. 5.2% E. 10.7%arrow_forwardA company's gross profit (or gross margin) was $73,920 and its net sales were $352, 000. Its gross margin ratio is: A.21% B.73, 670 C.66% D.276, 130 E.1%arrow_forwardA company's net sales are $817,990, its costs of goods sold are $449,895, and its profit is $112,475. Its gross profit margin ratio equals: Multiple Choice 45.0%. 55.0%. 13.75%. 31.25% 25.0%.arrow_forward

- A company’s net sales were $221,100, its cost of goods sold was $75,800, and its gross profit was $145,300. Calculate the gross margin ratio.arrow_forwardA company has $550,000 in net sales and $193,000 in gross profit. This means its cost of goods sold equals a. $743,000. c. $357,000. e. $(193,000). b. $550,000. d. $193,000.arrow_forwardX-1 Corp's total assets at the end of last year were $395,000 and its EBIT was $52,500. What was its basic earning power (BEP) ratio? a. 11.30% b. 16.35% c. 13.29% d. 11.70% e. 15.55%arrow_forward

- A company has a net profit margin of 5%, an operating profit margin of 10%, and a gross profit margin of 25%. Sales revenue amounted P7,500,000. The general and administrative, and selling expenses are P1,125,000. Determine the amount of cost of goods sold. * Garrow_forwardCalculationarrow_forwardHelparrow_forward

- Amir Company’s net income and net sales are $18,000 and $1,100,000, respectively,and average total assets are $100,000. What is Amir’s return on assets?a. 20.0%b. 18.0%c. 3.7%d. 7.0%arrow_forwardSuppose the net sales is 1,60,000 for a firm and cost of goods sold is 40,000. Calculate gross profit ratio,arrow_forwarda company has net sales of 814100 and cost of goods sold of 588100 its net income is 32410 the company’s gross margin and operating expenses respectivelyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning