Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

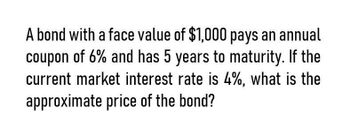

Transcribed Image Text:A bond with a face value of $1,000 pays an annual

coupon of 6% and has 5 years to maturity. If the

current market interest rate is 4%, what is the

approximate price of the bond?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What would be the value of the bond described in Part d if, just after it had been issued, the expected inflation rate rose by 3 percentage points, causing investors to require a 13% return? Would we now have a discount or a premium bond? What would happen to the bond’s value if inflation fell and rd declined to 7%? Would we now have a premium or a discount bond? What would happen to the value of the 10-year bond over time if the required rate of return remained at 13%? If it remained at 7%? (Hint: With a financial calculator, enter PMT, I/YR, FV, and N, and then change N to see what happens to the PV as the bond approaches maturity.)arrow_forwardAssume a bond with a 10% annual rate has 8 years left to maturity when market rates are at 12%. Assume semi-annual payments. What is the price of the bond at 3 different points in time - today, in 1 year, and in 2 years. Is this a discount or premium bond, and what do you notice about the relationship between the price and maturity value (FV) over time?arrow_forwardA bond has 10 years until maturity, carries a coupon rate of 9%, and sells for $1,100. Interest is paid annually. a) If the bond has a yeild to maturity of 9% 1 year from now, what will its price be at that time? b) What will be the rate of return on the bond? c) Now assume that interest is paid semannually. What will be the rate of return on the bond? d) If the inflation rate during the year is 3% what is the real rate of return on the bond?arrow_forward

- Consider a two-year bond with a face value $1000 and a coupon rate 4.2%paid annually.(a) On the market, the 2-year interest rate is 3%. What is the fair marketprice for this bond?(b) When the interest rate increases to 5%, what would the bond pricebecome?(c) What if the interest rate falls to 1%?arrow_forwardSuppose the yield on a two-year-old Treasury bond is 5 percent and the yield on a one-year Treasury bond is a 4 percent. If the maturity risk premium (MRP) on these bonds is zero (0), what is the expected one-year interest rate during the second year (Year 2)?arrow_forwardConsider a 10-year bond with a face value of $1,000 that has a coupon rate of 5.9%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline. a. What is the coupon payment for this bond? The coupon payment for this bond is $ (Round to the nearest cent.)arrow_forward

- Bond G is a semi-annual bond with an annual coupon of 8% and 15 years to maturity. What is the market interest rate if the bond is priced at $1,100?arrow_forwardSuppose a 9-year bond has a face value of $1,000 and has a semi-annual YTM of 0.085. It pays semi-annual coupons of 8%. What is the bond’s price?arrow_forwardA bond with a face value of $1,000 pays 6% annual coupon on a semiannual basis. The maturity is 8 years. The Yield to Maturity is 12%. What's the duration of this Bond? What is the convexity of the bond?arrow_forward

- A bond has a 25-year maturity, an 8% annual coupon paid semiannually, and a face value of p1,000. The going nominal annual interest rate (rd) is 6%. What is the bond’s price?arrow_forwardA bond has the following features: Coupon rate of interest (paid annually): 6 percent Principal: $1,000 Term to maturity: 12 years What will the holder receive when the bond matures? Principal or All coupon payments? If the current rate of interest on comparable debt is 9 percent, what should be the price of this bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. $ Would you expect the firm to call this bond? Why? -Yes or No, since the bond is selling for a discount or premium? If the bond has a sinking fund that requires the firm to set aside annually with a trustee sufficient funds to retire the entire issue at maturity, how much must the firm remit each year for twelve years if the funds earn 9 percent annually and there is $120 million outstanding? Use Appendix C to answer the question. Round your answer to the nearest dollar. $arrow_forwardA 15 year, semi-annual bond has a coupon rate of 4%. The YTM is 4%. What is the bond's duration and is it selling at a premium, par, or discount?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning