FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

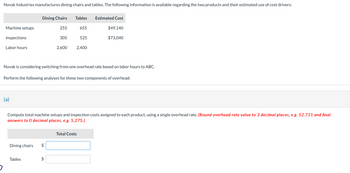

Transcribed Image Text:Novak Industries manufactures dining chairs and tables. The following information is available regarding the two products and their estimated use of cost drivers:

Machine setups

Inspections

Labor hours

(a)

Dining Chairs

Dining chairs

255

Tables

305

Tables Estimated Cost

$

Novak is considering switching from one overhead rate based on labor hours to ABC.

655

Perform the following analyses for these two components of overhead:

525

2,600 2,400

Compute total machine setups and inspection costs assigned to each product, using a single overhead rate. (Round overhead rate value to 3 decimal places, e.g. 52.711 and final

answers to 0 decimal places, e.g. 5,275.)

$49,140

$73,040

Total Costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hayward Industries manufactures dining chairs and tables. The following information is available: Dining Chairs Tables Total Cost Machine setups 200 Inspections Labor hours 250 600 $48,000 470 $72,000 2,600 2,400 Hayward is considering switching from one overhead rate based on labor hours to activity-based costing. Perform the following analyses for these two components of overhead: Compute total machine setups and inspection costs assigned to each product, using a single overhead rate. Total Costs Dining chairs $_ $_ Tables Compute total machine setups and inspection costs assigned to each product, using activity-based costing. Total Costs Dining chairs $_ Tables $_arrow_forwardManjiarrow_forwardAssume that company makes only two products: Product A and Product B. The company’s activity-based costing system has allocated $144,000 to an activity called machine setups. It is considering allocating the machine setups cost to its products using either the number of setups or setup hours as the activity measure. It gathered the following data with respect to these two potential activity measures: Product A Product B Number of machine setups 30 45 Number of setup hours per setup 6 6 If the company uses number of setup hours as the activity measure, what is the activity rate for machine setups? rev: 10_30_2021_QC_CS-283805 Garrison 17e Rechecks 2021-11-13 Multiple Choice $11,825 $12,000 $320 $350arrow_forward

- North Street Corporation manufactures two models of motorized go-carts, a standard and a deluxe model. The following activity and cost information has been compiled Number of Number of Number of Components Setups 16 26 $15,120 Product Standard Deluxe Overhead costs 7 OA. $16,150 O.B. $27,790 OC. $24,100. OD. $20,170 19 $25,220 Direct Labor Hours 780 400 Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead cost assigned to the deluxe model? errearrow_forwardGreenwood Company manufactures two products—14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 192,000 10,000 MHs Machine setups Number of setups $ 50,400 120 setups Production design Number of products $ 76,000 2 products General factory Direct labor-hours $ 387,200 16,000 DLHs Activity Measure Product Y Product Z Machining 7,200 2,800 Number of setups 50 70 Number of products 1 1 Direct labor-hours 7,200 8,800 What is the activity rate for the Product Design activity cost pool? What is the activity rate for the General Factory…arrow_forwardMunoz Manufacturing produces two keyboards, one for laptop computers and the other for desktop computers. The production process is automated, and the company has found activity-based costing useful in assigning overhead costs to its products. The company has identified five major activities involved in producing the keyboards. Activity Materials receiving & handling Production setup Quality inspection Assembly Packing and shipping Allocation Base Cost of material Number of setups Number of parts Inspection time Number of orders Activity measures for the two kinds of keyboards follow: Allocation Rate 2% of material cost $112.00 per setup $7.00 per part $1.20 per minute $ 8.00 per order Laptops. Desktops Labor Cost $ 1,350 Material Cost Number of Setups 1,240 $ 6,500 7,100 31 Number of Parts 50 13 28 Inspection Time 6,800 minutes 4,600 minutes Number of Orders 62 22 Required a. Compute the cost per unit of laptop and desktop keyboards, assuming that Munoz made 200 units of each type of…arrow_forward

- Amazon Company manufactures two products that can be produced on two different production lines; DVDs and Videotapes. The following activity and cost information has been accumulated: Number of Product Supervision Inspection Direct Labor Hours DVDs 48 480 5,200 Videotapes 112 800 2800 Overhead costs $160,000 $480,000 Required: If Amazon was using the traditional costing system with direct labor hours as the overhead costs allocation base: Calculate the total amount of overhead costs assigned to the DVDs and Videotapes Managers have decided to revise their current assignment of overhead costs; Supervision and Inspection are identified as the activity-cost drivers…arrow_forwardSampson Jewelry Corporation manufactures custom jewelry. In the past, Sampson has been using a traditional overhead allocation system based solely on direct labor hours. Sensing that this system was distorting costs and selling prices, Sampson has decided to switch to an activity-based costing system using three activity cost pools. Information on these activity cost pools are as follows: Activity Cost Pool Total Cost Total Activity Labor Related $40,000 8,000 Direct labor hours Machine Related $50,000 12,500 Machine Hours Quality Control $12,000 800 Inspections Sampson has received an order and will complete as Job #309 and expect to incur $900 of direct material, 30 hours of direct labor at $40 per hour, 80 machine hours, and 5 inspections. Sampson needs a markup of 40% on the job.Required:A). Calculate the activity rate and compute is the expected cost of job#309 under the activity-based costing system? What should be the quote on this job?…arrow_forwardCompute the cost that is assigned to the car wheels and truck wheels product lines using an activity-based costing system, given the following information. Use of Cost Drivers per Product Number of setups Direct labor hours Number of inspections Setting up machines Assembling Inspection Total cost assigned LA LA $ +A Car 200 39,000 100 Truck 800 33,000 1,100 Car Wheels ta $ tA $ Truck Wheelsarrow_forward

- Carlise Corp., which manufactures ceiling fans, currently has two product lines, the Indoor and the Outdoor. Carlise has to overhead of $132,720. Carlise has identified the following information about its overhead activity cost pools and the two product lines: Quantity/Amount Consumed by Indoor Line Quantity/Amount Consumed by Outdoor Line Activity Cost Pools Cost Driver Materials handling Number of moves Quality control Number of inspections Machine maintenance Number of machine hours Required: 1. Suppose Carlise used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) Indoor Model Outdoor Model Total Cost Assigned to Pool $21, 120 $71,760 4,600 inspections $39,840 29,000 machine hours 19,000 machine hours 600 moves 500 moves 5,800 inspections Overhead Assignedarrow_forwardBluefield Corporation has two product lines, A and B. Bluefield has identified the following information about its overhead and potential cost drivers: Total overhead Cost drivers Number of labor hours Number of machine hours Required: 1. Suppose Bluefield Corporation uses a traditional costing system with number of labor hours as the cost driver. Determine the amount of overhead assigned to each product line if Product A requires 64 percent of the labor hours and Product B requires 36 percent. 2. Suppose Bluefield uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line if Product A requires 17,500 machine hours and Product B requires 32,500. Complete this question by entering your answers in the tabs below. Required 1 Required 2 $ 79,000 2,200 50,000 Suppose Bluefield Corporation uses a traditional costing system with number of labor hours as the cost driver. Determine the amount of overhead assigned to…arrow_forwardMaxey & Sons manufactures two types of storage cabinets-Type A and Type B—and applies manufacturing overhead to all units at the rate of $140 per machine hour. Production information follows. Descriptions Anticipated volume (units) Direct-material cost per unit Direct-labor cost per unit Descriptions The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities' three respective cost drivers, follow. Setups Machine hours Outgoing shipments Туре А 160 56,000 200 Туре А 28,000 $38 43 Required 1 Required 2 Required 3 Туре В Unit manufacturing costs 120 78,750 150 The firm's total overhead of $18,865,000 is subdivided as follows: manufacturing setups, $4,116,000; machine processing, $11,319,000 and product shipping, $3,430,000. Required: 1. Compute…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education