EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting

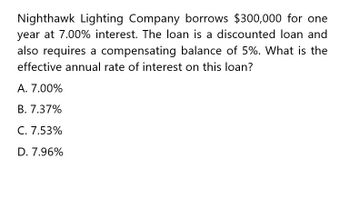

Transcribed Image Text:Nighthawk Lighting Company borrows $300,000 for one

year at 7.00% interest. The loan is a discounted loan and

also requires a compensating balance of 5%. What is the

effective annual rate of interest on this loan?

A. 7.00%

B. 7.37%

C. 7.53%

D. 7.96%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A financing company charges 1.5% per month on a loan. Find the equivalent effective rate of interest. 19.5618% 18.5618% 17.5618% 16.5618%arrow_forwardRaymond borrowed $3,000.00 from Loans R Us Company. The line of credit agreement provided for repayment of the loan in equal monthly payments of $668.76 which includes interest of 9.00 % per annum calculated on the unpaid balance. a. What is the monthly rate of interest? b. Calculate the outstanding loan balance at the end of the third payment c. What are the total interest charges? d. How many payments are required to pay off the loan e. What is the final Paymentarrow_forwardYou plan to borrow $47.400 at a 7.5% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2? a. $3,623.01 b. $2,992.92 c. $2,835.40 Od. $2,520.35 e. $3,150.44arrow_forward

- What is the effective annual interest rate on the loan? Car purchased for $29,000 with a 5 year loan with an annual interest rate of 9% with monthly payments of $601.99. A. .0075% B. .75% C. 9.381% D. 11.5% E. None of the abovearrow_forwardInterest of $429.48 was charged on a loan of $9500 over a period of 7 months. What simple rate of interest was charged on the loan? Select one: A. 4.38% B. 7.75% C. 3.48% D. 2.64% E. 4.52%arrow_forwardNavy Bank requires borrowers to keep a 13 percent compensating balance. Gorman Jewels borrow $380,000 at a 6 percent stated APR. What is the effective interest rate on the loan? (Round answer to 2 decimal places, e.g. 12.25%.) Effective interest rate ________ %arrow_forward

- Given the annual interest rate and a line of an amortization schedule for that loan, complete the next line of the schedule. Assume that payments are made monthly. Annual Interest Rate Payment 6.7% $468.39 Fill out the amortization schedule below. Interest Paid $42.28 Annual Interest Rate 6.7% Interest Paid $42.28 $ (Round to the nearest cent as needed.) Payment $468.39 Paid on Principal $426.11 Paid on Principal $426.11 $ Balance $7,150.14 Balance $7,150.14 $arrow_forwardAssume a $250,000 mortgage loan with 15-year term. The lender is charging an annual interest rate of 8% and three discount points at origination. Other up-front financing costs paid to other service providers (i.e., not the lender) total $1,000. What is the lender's yield on the loan? Assume monthly payments and no prepayment prior to loan maturity. 8.80% O 8.51% O 0.71% ○ 8.58%arrow_forwardYou have taken a loan of $78,000.00 for 20 years at 4.9% compounded quarterly. Fill in the table below, rounding all values to the nearest cent. Note that the principal column is listed before the interest column even though the interest calculation is done first. Many lending institutions use this order in the amortization schedules they provide to their customers. Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) $ S $ $ s Balance $78,000.00 $arrow_forward

- Dinero Bank offers you a $39,000, 8-year term loan at 7 percent annual interest. Required: What will your annual loan payment be? (Do not round your intermediate calculations.) $7,475.82 $6,531.24 $6,988.43 $6,786.58 $6,280.40arrow_forwardA Forward Rate Agreement contains an agreed interest rate of 5.75% on a 6-month loan. If settled at the time of borrowing, what amount would the borrower pay or receive on an $850,000 loan if the prevailing 6-month interest rate is 4.25%? $11,500.76 receipt $12.056.74 receipt $12,056.74 payment $12.230.22 payment O$12.230.22 receipt $11.500.76 paymentarrow_forwardA loan carries a simple interest rate of 5.25 % . The loan was fully repaid by two $5000 payments made 8 and 11 months after the original date of the loan. How much was borrowed at the start? Multiple Choice $10,000 $9601.34 $9661.84 $9540.85 $9329.44arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT