Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

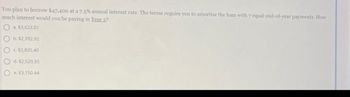

Transcribed Image Text:You plan to borrow $47.400 at a 7.5% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How

much interest would you be paying in Year 2?

a. $3,623.01

b. $2,992.92

c. $2,835.40

Od. $2,520.35

e. $3,150.44

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Investigate the effect of the term on simple interest amortized auto loans by finding the monthly payment and the total interest for a loan of $13,000 at 8 and 7/8% interest if the term is the following. (Round all answers to the nearest cent.) (a) 3 years. Payment $16461.25 Total interest $3461.25 (b) 4 years. Payment $17615 Total interest $ 4615 (c) 5 years. Payment $18768.75 Total interest $ 5768.75 X X XX XXarrow_forwardDetermine the monthly payment for the installment loan. Use the installment payment formula m = 1- Amount Financed (P) $1,440 O A. $179.15 B. $35.15 O C. $125.26 O D. $366.02 P n 1+) - not Annual Percentage Rate (r) 8% Number of Payments per Year (n) 12 Time in Years (t) 4arrow_forwardConsider a loan of $8,000 charging interest at j12-6% with monthly payments of $321.50 Calculate the missing amounts in the amortization table. Place the value for A in the first answer box, B in the second and C in the third. PMT Interest Principall Balance 8,000.00 1321.50 40.00 281.50 7,718.50 2 321.50 A Carrow_forward

- Suppose you have $2,300 and plan to purchase a 10-year certificate of deposit (CD) that pays 10.4% interest, compounded annually. How much will you have when the CD matures? a. $2,539.20 O b. $6,896.80 O c. $6,186.12 O d. $6,339.32 e. $5,603.37 Oarrow_forwardConsider a 30-year, fixed-rate mortgage for $120,000 at a nominal rate of 6% with monthly payments. If the borrower pays an additional $120 with each monthly payment, what will be the amount of the last monthly payment? A. $839.46 B. $357.77 C. $843.66 D. $419.85 E. $355.99 F. $420.90 G. $418.81 H. $841.55arrow_forwardToyota S murang auto finance company is prepared to offer you a loan of $38,000 to buy a new Toyota Corolla. The repayments are at the end of every year for a period of 7 years. If the interest rate on the loan is 12%, perform loan amortization calculation that will allow you to determine the amount of the loan outstanding after making the second installment. PV of ordinary annuity-= C/r x [1-1(1+r)n]arrow_forward

- A floating rate mortgage loan is made for $185,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of $1,480. Required: a. What will be the loan balance at the end of year 1? b. If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,480?arrow_forwardPlease explain each step, step by steparrow_forwardA borrower takes out a 30-year mortgage loan for $150,000 with an interest rate of 6% plus 4 points. What is the effective annual interest rate on the loan if the loan is carried for all 30 years? 5.63% 5.35% 6.36% Ⓒ 5.00%arrow_forward

- A floating rate mortgage loan is made for $170,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of $1,360. Required: a. What will be the loan balance at the end of year 1? b. If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,360? Complete this question by entering your answers in the tabs below. Required A Required B What will be the loan balance at the end of year 1? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Loan balancearrow_forwardyou have just borrowed $51,107 at an annual interest of 7.6% and must repay the loan in equal installments at the end of each of the next 7 years. By how much would you reduce the amount you owe (that is, principal) at the end of the first year? (Hint: Compute annual loan payment first and then the loan amortization schedule for the first year.) Group of answer choices $5,798.23 $5,790.23 $5,792.23 $5,796.23 $5,794.23arrow_forwardAmortizing Loan Consider a 4-year amortizing loan. You borrow $351,000 initially, and repay it in four equal annual year-end payments. a. If the interest rate is 4.55%, calculate the annual payment. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Annual payment b. Prepare an amortization schedule. (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) Time 0 Loan Balance Year-End Interest Due on Balance Year-End Payment Amortization of Loan $ $ $ $ 1234arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education