FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

rmn

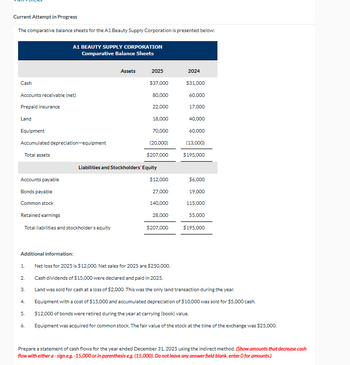

Transcribed Image Text:Current Attempt in Progress

The comparative balance sheets for the A1 Beauty Supply Corporation is presented below:

A1 BEAUTY SUPPLY CORPORATION

Comparative Balance Sheets

Assets

2025

2024

Cash

Accounts receivable (net)

Prepaid insurance

$37,000

$31,000

80,000

60,000

22,000

17,000

Land

18,000

40,000

Equipment

Accumulated depreciation-equipment

Total assets

70,000

60,000

(20,000)

(13,000)

$207,000

$195,000

Liabilities and Stockholders' Equity

Accounts payable

$12,000

$6,000

Bonds payable

27,000

19,000

Common stock

140,000

115,000

Retained earnings

28,000

55,000

Total liabilities and stockholder's equity

$207,000

$195,000

Additional information:

1

Net loss for 2025 is $12,000. Net sales for 2025 are $250,000.

2.

Cash dividends of $15,000 were declared and paid in 2025.

3.

Land was sold for cash at a loss of $2,000. This was the only land transaction during the year.

4.

Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash.

5.

$12,000 of bonds were retired during the year at carrying (book) value.

6.

Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was $25,000.

Prepare a statement of cash flows for the year ended December 31, 2025 using the indirect method. (Show amounts that decrease cash

flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000). Do not leave any answer field blank. enter O for amounts.)

Transcribed Image Text:A1 BEAUTY SUPPLY CORPORATION

Statement of Cash Flows - Indirect Method

Adjustments to reconcile net income to

$

>

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- perform a DuPont analysis?arrow_forwardThe comparative statement of financial position for Moose Jaw Ltd. is as follows:Moose Jaw Ltd.Comparative Statement of Financial PositionAs at December 312021 2020Cash $20,500 $12,500Accounts receivable 34,000 25,500Inventories 20,000 30,000Prepaid insurance 2,500 2,000Equipment 102,000 90,000Accumulated depreciation - equipment (22,500) (12,500)Total assets $156,500 $147,500Accounts payable $23,000 $20,000Interest payable 2,000 3,000Wages payable 4,000 2,000Income taxes payable 4,000 5,000Long-term note payable 30,000 34,500Common shares 65,000 65,000Retained earnings 28,500 18,000Total liabilities and equity $156,500 $147,500More information about Moose Jaw’s operations for 2021:• A machine which the company paid $10,000 for was sold for a gain of$1,000. The equipment’s accumulated depreciation was $7,000.• The company had net income for of $13,500.RequiredConstruct the operating activities section of Moose Jaw Ltd.’s statement of cashflows using the indirect method. Use proper…arrow_forwardCoronado Industries Comparative Balance Sheets . December 31, 2022 2021 Assets: Current Assets: Cash $ 1380000 $1100000 Accounts Receivable (net) 3100000 2170000 Inventory 3950000 2510000 Prepaid Expenses 704000 631000 Total Current Assets 9134000 6411000 Long-Term Investments 450000 Plant Assets: Property, Plant & Equipment 4360000 2879000 Accumulated Depreciation (901000 ) (539000 ) Total Plant Assets 3459000 2340000 Total Assets $13043000 $8751000 . Equities: Current Liabilities: Accounts Payable $2550000 $2190000 Accrued Expenses 617000 566000 Dividends Payable 403000 Total Current Liabilities 3570000 2756000 Long-Term Notes Payable 1648000 Stockholders' Equity:…arrow_forward

- Suppose the following information was taken from the 2022 financial statements of FedEx Corporation, a major global transportation/delivery company. (in millions)20222021Accounts receivable (gross)$ 3,650$ 4,530Accounts receivable (net)3,4004,450Allowance for doubtful accounts25080Sales revenue32,97035,470Total current assets7,1427,304 Answer each of the following questions.(a)Calculate the accounts receivable turnover and the average collection period for 2022 for FedEx. (Round answers to 1 decimal place, e.g. 12.5. Use 365 days for calculation.) Accounts receivable turnoverenter the accounts receivable turnover in times rounded to 1 decimal place timesThe average collection period for 2022enter the average collection period for 2022 in days rounded to 1 decimal place daysarrow_forwardA comparative balance sheet and an income statement for Rowan Company are given below: Rowan CompanyComparative Balance Sheet(dollars in millions) EndingBalance BeginningBalance Assets Current assets: Cash and cash equivalents $ 70 $ 91 Accounts receivable 536 572 Inventory 620 580 Total current assets 1,226 1,243 Property, plant, and equipment 1,719 1,656 Less accumulated depreciation 640 480 Net property, plant, and equipment 1,079 1,176 Total assets $ 2,305 $ 2,419 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 205 $ 180 Accrued liabilities 94 105 Income taxes payable 72 88 Total current liabilities 371 373 Bonds payable 180 310 Total liabilities 551 683 Stockholders' equity: Common stock 800 800 Retained earnings 954 936 Total…arrow_forwardThe comparative balance sheet of Gus Company at December 31, 2024 and 2023 appears below:Assets:12/31/202412/31/2023Cash$ 53,000 $ 120,000 Accounts receivable (net)37,000 48,000 Inventories108,500 100,000 Equipment573,200 450,000 Accumulated depreciation-equipment (142,000) (176,000) $629,700 $542,000 Liabilities & Stockholders Equity: Accounts payable$ 62,500 $ 43,800 Bonds payable, due June 20240 100,000 Common stock, $10 par335,000 285,000 Paid-in capital in excess of par - Common stock74,000 55,000 Retained earnings 158,200 58,200 $629,700 $542,000 The income statement for the year ended December 31, 2024 appears below:Sales $625,700 Cost of merchandise sold 340,000 Gross profit 285,700 Operating expenses (includes $26,000 depreciation expense) 94,000 Operating Income 191,700 Interest expense 6,000Income before income tax 185,700 Income tax 60,700 Net income $125,000 Also in 2024, fully depreciated equipment costing $60,000 was scrapped at no salvage…arrow_forward

- Assets Fixed assets: Property, plant equipment (net) Total fixed assets Current assets: Inventory and Accounts Receivable (net) Cash and cash equivalents Total current assets Total assets 20X8 750,000 750,000 574,800 235,600 81,200 891,600 1,641,600 Sanborn Corporation Comparative Balance Sheets in € December 31, 20X8 and 20X7 Liabilities 20X7 720,000 720,000 594,800 229,200 40,800 864,800 1,584,800 Stockholders' Equity Stockholders' equity: Common stock 10 par value Retained earnings Total equity Long-term liabilities: Bonds payable Total stockholders' long-term liabilities Current liabilities: Notes payable Accounts payable Total current liabilities Total liabilities Total liabilities stockholders' equity 20X8 400,000 374,000 774,000 400,000 400,000 200,000 267.600 467,600 867,600 & 1,641,600 20X7 400,000 307,600 707,600 400,000 477,200 877,200 877,200 1,584,800 Comment on the results in requirements 1 and 2 by identifying favourable and unfavourable changes in the components and…arrow_forwardPlease do not give solution in image format thankuarrow_forwardUsing the information provided below:Rubialac PaintsSelected Income Statement Items, 2020Cash Sales $2,500,000Credit Sales $9,500,000Total Sales $12,000,000COGS 7,000,000 Rubialac PaintsSelected Balance Sheet Accounts12/31/2020 12/31/19 ChangeAccounts Receivable $550,000 $400,000 $150,000Inventory $275,000 $250,000 $25,000Accounts Payable $150,000 $110,000 $40,000 What is the inventory turnover for Rubialac Paints? What is the average production cycle for the firm? What is the average collection cycle? What could Eagle Paints do to reduce the average collection cycle?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education