Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

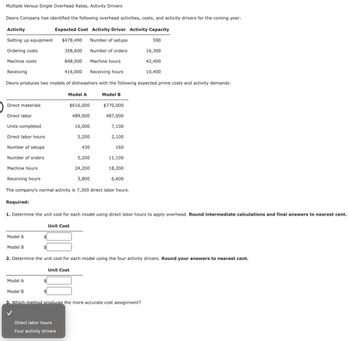

Transcribed Image Text:Multiple Versus Single Overhead Rates, Activity Drivers

Deoro Company has identified the following overhead activities, costs, and activity drivers for the coming year:

Activity

Expected Cost Activity Driver Activity Capacity

Setting up equipment

$478,490

Number of setups

590

Ordering costs

358,600

Number of orders

16,300

Machine costs

848,000

Machine hours

42,400

Receiving

416,000

Receiving hours

10,400

Deoro produces two models of dishwashers with the following expected prime costs and activity demands:

Model A

Model B

Direct materials

$616,000

$770,000

Direct labor

489,000

487,000

Units completed

16,000

7,100

Direct labor hours

5,200

2,100

Number of setups

430

160

Number of orders

5,200

11,100

Machine hours

24,200

18,200

Receiving hours

3,800

6,600

The company's normal activity is 7,300 direct labor hours.

Required:

1. Determine the unit cost for each model using direct labor hours to apply overhead. Round intermediate calculations and final answers to nearest cent.

Unit Cost

Model A

Model B

2. Determine the unit cost for each model using the four activity drivers. Round your answers to nearest cent.

Unit Cost

Model A

Model B

3. Which method produces the more accurate cost assignment?

Direct labor hours

Four activity drivers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Similar questions

- Plata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forwardUse the following information for Exercises 9-63 and 9-64: Palladium Inc. produces a variety of household cleaning products. Palladiums controller has developed standard costs for the following four overhead items: Next year, Palladium expects production to require 90,000 direct labor hours. Exercise 9-64 Performance Report Based on Actual Production Refer to the information for Palladium Inc. above. Assume that actual production required 93,000 direct labor hours at standard. The actual overhead costs incurred were as follows: Required: Prepare a performance report for the period based on actual production.arrow_forward

- Medical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardSteeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardPrimera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Actual results reported by department and product during the year are as follows: Required: 1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?arrow_forward

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardGreen Bay Cheese Company estimates its overhead to be $375,000. It expects to have 125,000 direct labor hours costing $1,500,000 in labor and utilizing 15,000 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardBusiness Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forward

- Minor Co. has a job order cost system and applies overhead based on departmental rates. Service Department 1 has total budgeted costs of 168,000 for next year. Service Department 2 has total budgeted costs of 280,000 for next year. Minor allocates service department costs solely to the producing departments. Service Department 1 cost is allocated to producing departments on the basis of machine hours. Service Department 2 cost is allocated to producing departments on the basis of direct labor hours. Producing Department 1 has budgeted 8,000 machine hours and 12,000 direct labor hours. Producing Department 2 has budgeted 2,000 machine hours and 12,000 direct labor hours. What is the total cost allocation from the two service departments to Producing Department 1? a. 173,600 b. 140,000 c. 134,400 d. 274,400arrow_forwardIdentify cost graphs The following cost graphs illustrate various types of cost behavior: For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases: A. Total direct materials cost B. Electricity costs of 1,000 per month plus 0.10 per kilowatt-hour C. Per-unit cost of straight-line depreciation on factory equipment D. Salary of quality control supervisor, 20,000 per month E. Per-unit direct labor costarrow_forwardOverhead application rate Roll Tide Manufacturing Inc. uses a job order cost system and standard costs. It manufactures one product, whose standard cost follows: The standards are based on normal capacity of 2,700 direct labor hours. Actual activity for March follows: Required: 1. Compute the variable and fixed factory overhead rates per unit. 2. Compute the variable and fixed overhead rates per direct labor hour. 3. Determine the total fixed factory overhead based on normal capacity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning