FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:MTI makes three types of lawn tractors: M3100, M4100, and M6100. In the past, it allocated overhead to products using machine-hours.

Last year, the company produced 8,000 units of M3100, 17,500 units of M4100, and 10,000 units of M6100 and had the following

revenues and costs:

Sales revenue

Direct costs

Direct materials

Direct labor

Variable overhead

Setting up machines

Processing sales orders

Warehousing

Operating machines

Shipping

Contribution margin

Plant administration

Gross profit

MTI

Activity

Setting up machines

Processing sales orders

Warehousing

Operating machines.

Income Statement

M3100

$ 9,400,000

3,300,000

610,000

M4100

$ 15,700,000

Cost Driver

Production runs

4, 800, 800

860, 000

M6100

$ 14,200,000

Sales orders received

Units held in inventory

Machine-hours

3,100,000

1,730, 000

MTI's controller has heard about activity-based costing and puts together an employee team to recommend cost allocation bases. The

employee team recommends the following.

M3100

9

170

90

6, 200

Total

$ 39, 300,000

M4100

18

390

180

9,900

11, 200,000

3,200,000

2,352,000

1,794, 000

2,204,000

1, 175,000

994,900

$ 16, 381, 000

6,400,000

$ 9,981,000.

M6100

21

220

110

8,900

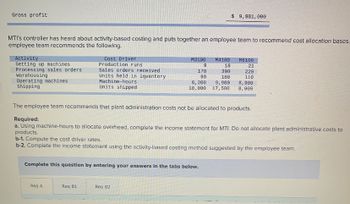

Transcribed Image Text:Gross profit

MTI's controller has heard about activity-based costing and puts together an employee team to recommend cost allocation bases.

employee team recommends the following.

Activity

Setting up machines

Processing sales orders.

Warehousing

Operating machines

Shipping

Cost Driver

Production runs

Sales orders received

Units held in inventory

Machine-hours

Units shipped

Req A

Req B1

M3100

M4100

18

390

180

6, 200

9,900

10,000 17,500

9

170

90

Complete this question by entering your answers in the tabs below.

Req B2

$ 9,981, 000

The employee team recommends that plant administration costs not be allocated to products.

Required:

a. Using machine-hours to allocate overhead, complete the income statement for MTI. Do not allocate plant administrative costs to

products.

b-1. Compute the cost driver rates.

b-2. Complete the income statement using the activity-based costing method suggested by the employee team.

M6100

21

220

110

8,900

8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tool Time manufactures carpenter-grade screwdrivers. The company is trying to decide whether to continue to make the case in which the screwdrivers are sold, or to outsource the case to another company. The direct material and direct labor cost to produce the cases total $2.40 per case. The overhead cost is $1.00 per case which consists of $0.40 in variable overhead that would be eliminated if the cases are bought from the outside supplier. The $0.60 of fixed overhead is based on expected production of 400,000 cases per year and consists of the salary of the case production manager of $80,000 per year, along with the remainder consisting of rent, insurance, and depreciation on equipment that will have no resale value. The manager will be laid off if the cases were bought externally. The outside supplier has offered to supply the cases for $3.40 each. How much will Tool Time save or lose if the cases are bought externally? Save $0.40 per case Lose $0.20 per case…arrow_forwardHercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Rate Activity Fabrication $32 per machine hour $14 per direct labor hour Assembly Setup $54 per setup Inspecting $22 per inspection Production scheduling $15 per production order Purchasing $12 per purchase order The activity-base usage quantities and units produced for each product were as follows: Treadmill Activity Base Elliptical Machines Machine hours 1,723 1,017 Direct labor 408 159 Setups 42 13 Inspections 614 368 Production orders 77 15 Purchase orders 171 104 Units produced 315 211 Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product. If required, round the per unit answers…arrow_forwardHazelnut Corporation manufactures lawn ornaments. It currently has two product lines, the basic and the luxury. Hazelnut has a total of $143,484 in overhead. The company has identified the following information about its overhead activity pools and the two product lines: Quantity or Amount Consumed by Basic Activity Pools Materials handling Quality control Machine maintenance Cost Driver Number of moves Number of inspections Number of machine hours Required 1 Complete this question by entering your answers in the tabs below. Basic Model Luxury Model Required 2 Required 3 Required 4 Required: 1. Suppose Hazelnut used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Calculate the activity rates for each activity pool in Hazelnut's ABC system. 3. Calculate the amount of overhead that Hazelnut will assign to the basic line if it uses an ABC system. 4. Determine the amount of overhead Hazelnut will assign…arrow_forward

- Harbour Company makes two models of electronic tablets, the Home and the Work. Basic production information follows: Direct materials cost per unit Direct labor cost per unit Sales price per unit Expected production per month Harbour has monthly overhead of $168,340, which is divided into the following activity pools: Setup costs Quality control Maintenance Total Number of setups Number of inspections Number of machine hours $86,400 54,940 27,000 $ 168,340 The company also has compiled the following information about the chosen cost drivers: Home 37 340 1,600 Required 1 Home Required 2 Required 3 $ 41 16 360 770 units Work 71 330 1,100 Home Model Work Model Total Overhead Cost Required: 1. Suppose Harbour uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Calculate the production cost per unit for each of Harbour's products under a traditional costing system. 3. Calculate Harbour's gross margin per…arrow_forwardRundle Manufacturing produces two keyboards, one for laptop computers and the other for desktop computers. The production process is automated, and the company has found activity-based costing useful in assigning overhead costs to its products. The company has identified five major activities involved in producing the keyboards. Activity Materials receiving & handling Production setup Assembly Quality inspection Packing and shipping Activity measures for the two kinds of keyboards follow: Laptops Desktops Required Labor Cost $ 1,310 1,200 Laptop keyboards Desktop keyboards Allocation Base Cost of material Number of setups Number of parts Inspection time Number of orders Material Number of Number of Cost $ 6,300 7,600 Cost Per Unit Setups 29 13 Parts 49 26 Allocation Rate 3% of material cost $102.00 per setup $3.00 per part $ 1.60 per minute $9.00 per order Inspection Time 7,400 minutes 4,800 minutes a. Compute the cost per unit of laptop and desktop keyboards, assuming that Rundle made…arrow_forwardParker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($500,040 926,000 units) Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of Labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 1.200,000 12,200,000 $7,320,000 324,000 $3,855,600 $1,300,000 $ 381,000 Required: Calculate Parker Plastic's direct labor rate and efficiency variances Direct Labor Rate Variance Direct Labor Efficiency Vince Standard Quantity 13 square foot 0.25 hour 0.25 hour Standard Price (Rate) $ 0.70 per square foot $ 12.20 per hour $ 1.40 per hour Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting…arrow_forward

- Solomon Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Activities Unit Level Batch Level Product Level Facility Level Cost $ 78, 300 $ 28,910 $ 15,000 $ 180,000 Cost driver 2,700 labor hours 49 setups Percentage of use 18,000 units Production of 730 sets of cutting shears, one of the company's 20 products, took 180 labor hours and 5 setups and consumed 16 percent of the product - sustaining activities. Required Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? How much overhead is allocated to the cutting shears using activity-based costing? Compute the overhead cost per unit for cutting shears first using activity-based costing and then using direct labor hours for allocation if 730 units…arrow_forwardOffice Products Inc. manufactures and sells various high-tech office automation products. Two divisions of Office products Inc. are the Computer Chip Division and the Computer Division. The Computer Chip Division manufactures one product, a "super chip," that can be used by both the Computer Division and other external customers. The following information is available on this month's operations in the Computer Chip Division: Selling price per chip Variable cost per chip Fixed production cost Fixed SG & A costs Monthly capacity External sales Internal sales $50 $20 $60,000 $90,000 $50 $45 $20 10,000 chips 6,000 chips 0 chips Presently the Computer Division purchases no chips from the Computer Chip Division, but instead pays $45 to an external supplier for the 4,000 chips it needs each month. Assume that next month's costs and levels of operation in the Computer and the Computer Chip Divisions are similar to this month. What is the minimum of the transfer price range for a possible…arrow_forward5. Werner Corporation has a target capital structure that consists of 60 percent debt and 40 percent equity. Werner can borrow at an interest rate of 12 percent. Also, Werner has determined its cost of equity to be 16 percent. Werner's tax rate is 40 percent. What is Wemer's weighted average cost of capital?arrow_forward

- Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the parts for its engines, including the carburetors. An outside supplier offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $30 per unit. To evaluate this offer, Troy Engines, Limited, summarized the cost of producing the carburetor internally as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead, traceable Fixed manufacturing overhead, allocated Total cost Per Unit $ 12 8 2 9* Required 1 Required 2 Required 3 Required 4 12 $43 *One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value). Required: 1. If the company has no alternative use for the facilities being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 12,000 carburetors from the outside supplier? 2. Should the outside supplier's offer be accepted?…arrow_forwardplease answer do not image.arrow_forwardBody-Solid Inc. manufactures elliptical exercise machines and treadmills. The products are prouced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $25 per machine hour Assembly $12 per direct labor hour Setup $52 per setup Inspecting $25 per inspection Production scheduling $13 per production order Purchasing $10 per purchase order The activity - base usage quantities and units produced for each product were as follows: Activity Base Elliptical Machines Treadmill Machine hours 1,845 1,089 Direct labor hours 472 184 Setups 58 18 Inspections 630 378 Production orders 63 13 Purchase orders 181 110 Units produced 272 182 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education