FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

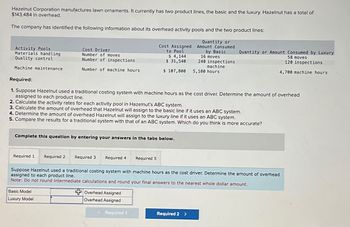

Transcribed Image Text:Hazelnut Corporation manufactures lawn ornaments. It currently has two product lines, the basic and the luxury. Hazelnut has a total of

$143,484 in overhead.

The company has identified the following information about its overhead activity pools and the two product lines:

Quantity or

Amount Consumed

by Basic

Activity Pools

Materials handling

Quality control

Machine maintenance

Cost Driver

Number of moves

Number of inspections

Number of machine hours

Required 1

Complete this question by entering your answers in the tabs below.

Basic Model

Luxury Model

Required 2 Required 3 Required 4

Required:

1. Suppose Hazelnut used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead

assigned to each product line.

2. Calculate the activity rates for each activity pool in Hazelnut's ABC system.

3. Calculate the amount of overhead that Hazelnut will assign to the basic line if it uses an ABC system.

4. Determine the amount of overhead Hazelnut will assign to the luxury line if it uses an ABC system.

5. Compare the results for a traditional system with that of an ABC system. Which do you think is more accurate?

Cost Assigned

to Pool

Overhead Assigned

Overhead Assigned

$ 4,144

$ 31,540

$ 107,800

Required 5

< Required 1

16 moves

240 inspections

machine

Suppose Hazelnut used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead

assigned to each product line.

Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.

5,100 hours

Required 2 >

Quantity or Amount Consumed by Luxury

58 moves

120 inspections

4,700 machine hours

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to predetermined overhead rate and activity rate

VIEW Step 2: 1. Working for overhead assigned to product using traditional costing method

VIEW Step 3: 2. Working for Overhead costs assigned using activity based costing

VIEW Step 4: 3 & 4 .Working for Overhead costs assigned using activity based costing

VIEW Step 5: 5. Comparision between traditional costing and ABC

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Kilbourne Appliances produces two models of beverage coolers for homes and offices, the KA-15 and the KA-24. Data on operations and costs for March follow. Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead costs Total costs Required A Required B KA-15 Required C Product costs per unit 600 360 750 $ 82,000 16,500 Required: a. Compute the individual product costs per unit assuming that Kilbourne Appliances uses the number of units to allocate overhead to the products. b. Compute the individual product costs per unit assuming that Kilbourne Appliances uses direct labor cost. c. Compute the individual product costs per unit assuming that Kilbourne Appliances uses direct material costs to allocate overhead to the products. KA-24 400 540 1,750 $ 130,000 38,500 KA-15 KA-24 $ 222,520.00 $ 251,180.00 Total 1,000 900 2,500 $ 212,000 55,000…arrow_forwardPlease help me on this question with a full explanation.arrow_forwardThis section has a nine-part comprehensive problem with multiple questions to address. Download the Chapter 9 Comprehensive Problem Template below to complete all parts. You will need your Bergevin and MacQueen book for reference. Redlands Inc. reported standard and actual costs for the product that it manufactures: Item Direct material price Direct materials quantity Direct labor price Direct labor quantity Factory overhead cost Machine hours per unit Number of finished products made Number of finished products sold Sales price per unit Standard $3 per lb. 2 lbs. $5 3 hours $2 per machine hour 2 machine hours 10 10 $40 Actual $2 per lb. 4 lbs. $7 2 hours 3 machine hours 12 11 $40arrow_forward

- Please do not give solution in image format thankuarrow_forwardRequired information [The following information applies to the questions displayed below.] Benton Corporation manufactures computer microphones, which come in two models: Standard and Premium. Data for a representative quarter for the two models follow: Units produced Production runs per quarter Direct materials cost per unit Direct labor cost per unit Standard 11,600 Premium 2,900 50 $ 30 50 25 $ 64 75 Manufacturing overhead in the plant has three main functions: supervision, setup labor, and incoming material inspection. Data on manufacturing overhead for a representative quarter follow: Supervision Setup labor Incoming inspection Total overhead $ 239,250 278,400 200,100 $ 717,750 Required: a. Compute the unit costs for the two products, Standard and Premium, using the current costing system at Benton (using direct labor costs as the allocation basis for overhead). b. Compute the unit costs for the two products, Standard and Premium, using the proposed ABC system at Benton. Note: For…arrow_forwardBell Corporation manufactures computers. Assume that Bell: • allocates manufacturing overhead based on machine hours • estimated 8,000 machine hours and $86,000 of manufacturing overhead costs actually used 16,000 machine hours and incurred the following actual costs: (Click the icon to view the actual costs.) What is Bellredetermined overhead allocation rate? ● O A. $5.31/ machine hour B. $5.38/ machine hour C. $10.75/ machine hour O D. $10.63/ machine hour Data table Indirect labor Depreciation on plant Machinery repair Direct labor Plant supplies Plant utilities Advertising Sales commissions $ 12,000 49,000 12,000 71,000 3,000 9,000 34,000 27,000arrow_forward

- Altex Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, Robert Hermann, has developed the following information. Estimated wheels produced Direct labor hours per wheel (a1) Your answer is incorrect. Car 40,000 Overhead rate $ 1 Total estimated overhead costs for the two product lines are $846,800. Truck 11,000 Calculate overhead rate. (Round answer to 2 decimal places, e.g. 12.25.) 1 per direct labor hourarrow_forwardAltex Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, Robert Hermann, has developed the following information. Car Truck Estimated wheels produced 36,000 15,000 Direct labor hours per wheel 3 Total estimated overhead costs for the two product lines are $ 858,600. Your answer is incorrect. Calculate overhead rate. (Round answer to 2 decimal places, e.g. 12.25.) Overhead rate $ 10.60 per direct labor hour eTextbook and Media Solution X Your answer is incorrect. Compute the overhead cost assigned to the car wheels and truck wheels, assuming that direct labor hours is used to allocate overhead costs. Car wheels 36000 Truck wheels 45000 %24arrow_forwardPlease answer all the part with detailed working, please provide answer in text form without imagearrow_forward

- please provide answer with compulsory explanation , computation for each parts , steps clearly and completely answer in text form please remember need explanation and computation for every calculationarrow_forwardRex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $157,850 4,100 $ Machine Hours 324,622 14,114 2$ Inspections 119,000 3,400arrow_forward. The company has traditionally used a plantwide manufacturing overhead rate based on machine hours to allocate manufacturing overhead to its products. The company estimates that it will incur screenshots attached thanks for help appreciataed irwgoirhw rhjiwarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education