FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

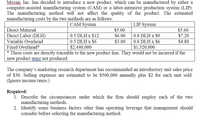

Transcribed Image Text:Mozaic Inc. has decided to introduce a new product, which can be manufactured by either a

computer-assisted manufacturing system (CAM) or a labor-intensive production system (LIP).

The manufacturing method will not affect the quality of the product. The estimated

manufacturing costs by the two methods are as follows:

www

CAM System

LIP System

Direct Material

$5.00

$5.60

Direct Labor (DLH)

0.5 DLH x $12

$6.00

0.8 DLH x $9

$7.20

Variable Overhead

0.5 DLH x $6

$3.00

0.8 DLH x $6

$4.80

Fixed Overhead*

$2,440,000

$1,320,000

* These costs are directly traceable to the new product line. They would not be incurred if the

new product were not produced.

The company's marketing research department has recommended an introductory unit sales price

of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold.

(Ignore income taxes.)

Required:

1. Describe the circumstances under which the firm should employ each of the two

manufacturing methods.

2. Identify some business factors other than operating leverage that management should

consider before selecting the manufacturing method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- DK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: a) Given the managing director's concern about DK's approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product Y Budgeted annual production (units) 15,000 24,000 20,000 $ per unit $ per unit $ per unit Direct materials 35 40 45…arrow_forwardAn operations manager is deciding on the level of automation for a new process. The fixed cost for automation includes the equipment purchase price, installation, and initial spare parts. The variable costs per unit for each level of automation are primarily labor related. Each unit can be sold for $81. As in many cases, you have the default alternative of doing nothing ($0 fixed cost, $0 variable costs). Hint: For these questions, also consider the “Do Nothing” option as a viable option when making your decision. Alternative Fixed Costs Variable Costs per Unit A $100,000 $54 B $272,000 $31 C $560,000 $20 Recommended: graph each alternative with units on the x-axis and $ on the y-axis. Also, include revenue on the chart. Identify the break-even points and points of indifference.arrow_forwardi need the answer quicklyarrow_forward

- hello, help please with B and Carrow_forwardWaterways Corporation uses very stringent standard costs in evaluating its manufacturing efficiency. These standards are not "ideal" at this point, but the management is working toward that as a goal. At present, the company uses the following standards. Materials Item Per unit Cost Metal 1 lb. 63¢ per lb Plastic 12 oz. $1.00 per Ib. Rubber 4 oz. 88¢ per Ib. Direct labor Item Per unit Cost Labor 15 min. $9.00 per hr. Predetermined overhead rate based on direct labor hours = $424 The January figures for purchasing, production, and labor are: The company purchased 228,200 pounds of raw materials in January at a cost of 79¢ a pound. Production used 228,200 pounds of raw materials to make 115,000 units in January. Direct labor spent 18 minutes on each product at a cost of $8.80 per hour. Overhead costs for January totaled $54,597 variable and $72,000 fixed. Answer the following questions about standard costs. Your answer is partially correct. What is the materials price variance? (Round…arrow_forwardThe Borstal Company has to choose between two machines that do the same job but have different lives. The two machines have the following costs: Year Machine A 0 OLN3+ 1 2 4 $48,000 11,600 11,600 11,600 + replace Machine A Machine B These costs are expressed in real terms. a. Suppose you are Borstal's financial manager. If you had to buy one or the other machine and rent it to the production manager for that machine's economic life, what annual rental payment would you have to charge? Assume a 12% real discount rate and ignore taxes. (Do not round intermediate calculations. Enter your answers as a positive value rounded to 2 decimal places.) Machine B $58,000 11,200 11, 200 11,200 11,200 + replace Annual Rental Paymentarrow_forward

- Industrial Robots does not manufacture its own motors or computer chips. Its premium product differs from its standard product in having heavier-duty motors and more computer chips for greater flexibility. As a result, Industrial Robots manufactures a higher fraction of the standard product’s value itself, and it purchases a higher fraction of the premium product’s value. Use the following data to allocate $850,000 in overhead on the basis of labor cost and materials cosarrow_forwardJT Engineering makes widgets. Widgets first go through Smelting and then go through Polishing. JT has decided to do away with the polishing step, electing to sell unpolished widgets to its customers. How will this process modification impact JT's manufacturing costs and flow of costs? O It will decrease manufacturing costs and eliminate the need for Work in Process accounts. O It will increase manufacturing costs and eliminate the need for Work in Process accounts. O It will decrease manufacturing costs and eliminate the need for a Work in Process-Polishing account. O It will increase manufacturing costs and eliminate the need for a Work in Process-Polishing account.arrow_forwardDK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period.e a) Given the managing director's concern about DK's approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product- Budgeted annual production (units) 15,000- 24,000 20,000 $ per unita $ per unite $ per unita Direct materials 354 40 45a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education