FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I would like help answering this accounting problem. Screen shots are included. Thank you

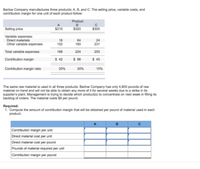

Transcribed Image Text:Barlow Company manufactures three products: A B, and C. The seling price, variable costs, and

contribution margin for one unit of each product follow:

Product

Seling price

$210

$320

$300

Variable expenses:

Direct materials

Other variable expenses

16

152

64

160

24

231

Total variable expenses

168

224

255

Contribution margin

$ 42

$ 96

$ 45

Contribution margin ratio

20%

30%

15%

The same raw material is used in all three products. Barlow Company has only 4,800 pounds of raw

material on hand and will not be able to obtain any more of it for several weeks due t

supplier's plant. Management is trying to decide which product(s) to concentrate on next woek in filing its

backlog of orders. The material costs $8 per pound.

a strike in i

Required:

1. Compute the amount of contribution margin that wil be obtained per pound of material used in each

product.

Contribution margin per unit

Direct material cost per unit

Direct material cost per pound

Pounds of material required per unit

Contribution margin per pound

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forwardcan you help me on how to do my assignment?arrow_forwardHow do you find UBS Accounting software? What are the users comment of this accounting software (like/dislike/criticism)?arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education