FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

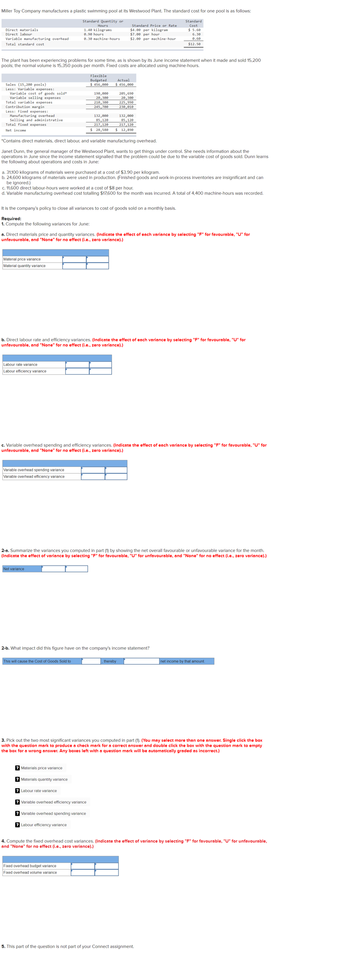

Transcribed Image Text:Miller Toy Company manufactures a plastic swimming pool at its Westwood Plant. The standard cost for one pool is as follows:

Standard Quantity or

Hours

1.40 kilograms

Standard

Cost

$5.60

0.90 hours

0.30 machine-hours

Direct materials

Direct labour

Variable manufacturing overhead

Total standard cost

Sales (15,200 pools)

Less: Variable expenses:

Variable cost of goods sold*

Variable selling expenses

Total variable expenses

Contribution margin

Less: Fixed expenses:

Manufacturing overhead

Selling and administrative

The plant has been experiencing problems for some time, as is shown by its June income statement when it made and sold 15,200

pools; the normal volume is 15,350 pools per month. Fixed costs are allocated using machine-hours.

Total fixed expenses

Net income

Material price variance

Material quantity variance

Labour rate variance

Labour efficiency variance

Variable overhead spending variance

Variable overhead efficiency variance

*Contains direct materials, direct labour, and variable manufacturing overhead.

Janet Dunn, the general manager of the Westwood Plant, wants to get things under control. She needs information about the

operations in June since the income statement signalled that the problem could be due to the variable cost of goods sold. Dunn learns

the following about operations and costs in June:

a. 31,100 kilograms of materials were purchased at a cost of $3.90 per kilogram.

b. 24,600 kilograms of materials were used in production. (Finished goods and work-in-process inventories are insignificant and can

be ignored.)

c. 11,600 direct labour-hours were worked at a cost of $8 per hour.

d. Variable manufacturing overhead cost totalling $17,600 for the month was incurred. A total of 4,400 machine-hours was recorded.

It is the company's policy to close all variances to cost of goods sold on a monthly basis.

Required:

1. Compute the following variances for June:

Net variance

Flexible

Budgeted

$ 456,000

190,000

20,300

a. Direct materials price and quantity variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for

unfavourable, and "None" for no effect (i.e., zero variance).)

This will cause the Cost of Goods Sold to

210,300

245,700

132,000

85,120

217,120

$28,580

b. Direct labour rate and efficiency variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for

unfavourable, and "None" for no effect (i.e., zero variance).)

? Materials price variance

Standard Price or Rate

$4.00 per kilogram

$7.00 per hour

$2.00 per machine-hour

?Materials quantity variance

Actual

$ 456,000

c. Variable overhead spending and efficiency variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for

unfavourable, and "None" for no effect (i.e., zero variance).)

? Labour rate variance

? Variable overhead efficiency variance

?Variable overhead spending variance

205,690

20,300

225,990

230,010

132,000

85, 120

217,120

$ 12,890

2-a. Summarize the variances you computed in part (1) by showing the net overall favourable or unfavourable variance for the month.

(Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).)

? Labour efficiency variance

2-b. What impact did this figure have on the company's income statement?

Fixed overhead budget variance

Fixed overhead volume variance

6.30

0.60

$12.50

3. Pick out the two most significant variances you computed in part (1). (You may select more than one answer. Single click the box

with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty

the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

thereby

net income by that amount.

4. Compute the fixed overhead cost variances. (Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable,

and "None" for no effect (i.e., zero variance).)

5. This part of the question is not part of your Connect assignment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 8 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

if you can double check 1a and 1b 2a and i need answer 4 as well

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

if you can double check 1a and 1b 2a and i need answer 4 as well

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company makes 36,000 motors to be used in the production of its blender. The average cost per motor at this level of activity is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead An outside supplier recently began producing a comparable motor that could be used in the blender. The price offered to the company for this motor is $23.95. There would be no other use for the production facilities and none of the fixed manufacturing overhead cost could be avoided. The annual financial advantage (disadvantage) for the company as a result of making the motors rather than buying them from the outside supplier would be: Multiple Choice O O O ($68,400) $214,200 $9.50 $ 8.50 $ 3.45 $ 4.40 90,000 $158,400arrow_forwardWerner Company produces and sells disposable foil baking pans to retailers for $2.65 per pan. The variable cost per pan is as follows: Direct materials Direct labor Variable factory overhead Variable selling expense Fixed manufacturing cost totals $143,704 per year. Administrative cost (all fixed) totals $19,596. Required: $0.27 0.51 0.69 0.18 Compute the number of pans that must be sold for Werner to break even. pans Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent. Unit variable cost Unit variable manufacturing cost Which is used in cost-volume-profit analysis? Unit variable cost ✓ How many pans must be sold for Werner to earn operating income of $7,000? pans How much sales revenue must Werner have to earn operating income of $7,000?arrow_forwardWitt Recreation Company (WRC) makes e-bikes. The company currently manufactures two models, the Coaster and the Traveler, in one of the WRC factories. Both models require the same assembling operations. The difference between the models is the cost of materials. The following data are available for the second quarter. Number of bikes assembled Materials cost per bike Other costs: Direct labor Depreciation and lease Supervision and control Factory administration Operation cost Materials cost Total cost Unit cost Coaster 750 $626 Coaster Traveler 450 $ 1,202 Required: Witt Recreation Company uses operations costing and assigns conversion costs based on the number of units assembled. Compute the cost of each model assembled in the second quarter. Note: Do not round intermediate calculations. Round your final answers to nearest whole number. Total 1,200 Traveler $ 299,400 382,400 247,400 340,400 Totalarrow_forward

- The Rosa model of Mohave Corporation is currently manufactured as a very plain umbrella with no decoration. The company is considering changing this product to a much more decorative model by adding a silk-screened design and embellishments. A summary of the expected costs and revenues for Mohave's two options follows: Estimated demand Estimated sales price Estimated manufacturing cost per unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit manufacturing cost Additional development cost Rosa Umbrella 29,000 units $31.00 $ 21.50 4.50 3.50 6.00 $ 35.50 Decorated Umbrella 29,000 units $ 41.00 $ 23.50 7.00 5.50 6.00 $ 42.00 $ 12,000 Required: 1. Determine the increase or decrease in profit if Mohave sells the Rosa Umbrella with the additional decorations. 2. Should Mohave add decorations to the Rosa umbrella? 3-a.Suppose the higher price of the decorated umbrella is expected to reduce estimated demand for this product to 27,000 units.…arrow_forwardThe machining division of Cullumber International has a capacity of 2,000 units. Its sales and cost data are: Selling price per unit $80 Variable manufacturing costs per unit 25 Variable selling costs per unit 3 Total fixed manufacturing overhead 183,200 The machining division is currently selling 1,800 units to outside customers, and the assembly division of Cullumber International wants to purchase 400 units from machining. If the transaction takes place, the variable selling costs per unit on the units transferred to assembly will be $0/unit, and not $3/unit. If Cullumber's assembly division is currently buying from an outside supplier at $75 per unit, what will be the effect on overall company profits if internal sales for 400 units take place at the optimum transfer price? The company profits would by $arrow_forwardNutterco, Inc., produces two types of nut butter: peanut butter and cashew butter. Of the two,peanut butter is the more popular. Cashew butter is a specialty line using smaller jars and fewerjars per case. Data concerning the two products follow: Annual overhead costs are listed below. These costs are classified as fixed or variable with respect to the appropriate activity driver. Required:1. Prepare a traditional segmented income statement, using a unit-level overhead rate based ondirect labor hours. Using this approach, determine whether the cashew butter product lineshould be kept or dropped.2. Prepare an activity-based segmented income statement. Repeat the keep-or-drop analysisusing an ABC approach.arrow_forward

- Smart Stream Inc. uses the total cost concept of applying the cost-plus approach to product pricing. The costs of producing and selling 8,000 units of cellular phones are as follows: Variable costs: Fixed costs: Direct materials $ 87 per unit Factory overhead $349,300 Direct labor 40 Selling and admin. exp. 122,700 Factory overhead 26 Selling and admin. exp. 21arrow_forwardIndustrial Robots does not manufacture its own motors or computer chips. Its premium product differs from its standard product in having heavier-duty motors and more computer chips for greater flexibility. As a result, Industrial Robots manufactures a higher fraction of the standard product’s value itself, and it purchases a higher fraction of the premium product’s value. Use the following data to allocate $850,000 in overhead on the basis of labor cost and materials cosarrow_forwardThe Chopin Company has decided to introduce a new product. The new product can be manufactured by either a computer-assisted manufacturing (CAM) or a labor-intensive production (LIP) system. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs for each of the two methods are as follows. CAM System: Direct Material = $5.0 Direct Labor (DLH) = 0.5 DLH X $12 = $6 Variable Overhead = 0.5DLHx$6 = $3 Fixed Iverhead* = $ 2,440,000 LIP System: Direct Material = $5.6 Direct Labor (DLH) = 0.8 DLH X $9 = $7.2 Variable Overhead = 0.8 DLH X $6 = $4.8 Fixed Overhead* = $1,320,000 *These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company’s marketing research department has recommended an introductory unit sales price of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold. (Ignore income taxes.) Required: Calculate the estimated…arrow_forward

- Woodruff Company is currently producing a snowmobile that uses five specialized parts. Engineering has proposed replacing these specialized parts with commodity parts, which will cost less and can be purchased in larger order quantities. Current activity capacity and demand (with specialized parts required) and expected activity demand (with only commodity parts required) are provided. Activities Activity Driver ActivityCapacity Current ActivityDemand Expected ActivityDemand Material usage Number of parts 200,000 200,000 200,000 Installing parts Direct labor hours 20,000 20,000 16,000 Purchasing parts Number of orders 7,600 6,498 3,990 Additionally, the following activity cost data are provided: Material usage: $11 per specialized part used; $27 per commodity part; no fixed activity cost. Installing parts: $21 per direct labor hour; no fixed activity cost. Purchasing parts: Four salaried clerks, each earning a $47,000 annual salary; each clerk is capable of processing 1,900…arrow_forwardThe grinding machines are potentially the constraint in the production facility. A total of 52,400 minutes are available per month on these machines. Direct labor is a variable cost in this company. How many minutes of grinding machine time would be required to satisfy demand for all four products? A.23,940 B.5,200 C.52,400 D.17,190arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education