FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

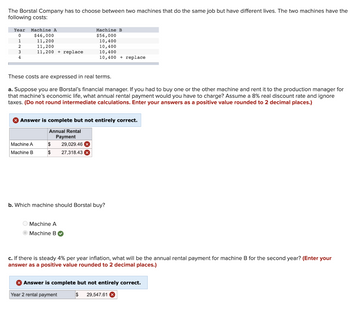

Transcribed Image Text:The Borstal Company has to choose between two machines that do the same job but have different lives. The two machines have the

following costs:

Year Machine A

0

1

2

3

4

$46,000

11, 200

11,200

11,200 replace

Machine A

Machine B

Machine B

$56,000

These costs are expressed in real terms.

a. Suppose you are Borstal's financial manager. If you had to buy one or the other machine and rent it to the production manager for

that machine's economic life, what annual rental payment would you have to charge? Assume a 8% real discount rate and ignore

taxes. (Do not round intermediate calculations. Enter your answers as a positive value rounded to 2 decimal places.)

$

29,029.46 x

$ 27,318.43 x

10,400

10,400

> Answer is complete but not entirely correct.

Annual Rental

Payment

10,400

10,400 replace

O Machine A

Machine B

b. Which machine should Borstal buy?

c. If there is steady 4% per year inflation, what will be the annual rental payment for machine B for the second year? (Enter your

answer as a positive value rounded to 2 decimal places.)

> Answer is complete but not entirely correct.

Year 2 rental payment

$ 29,547.61

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with requirement 2 please.arrow_forwardI could use a hand with thisarrow_forwardElroy Racers makes bicycles. It has always purchased its bicycle tires from the M. Wilson Tires at $25 each but is currently considering making the tires in its own factory. The estimated costs per unit of making the tires are as follows: Direct materials $8 Direct labor $5 Variable manufacturing overhead $7 The company’s fixed expenses would increase by $60,000 per year if managers decided to make the tire.(b)What qualitative factors should Elroy Racers consider in making this decision?arrow_forward

- You own a firewood business that involves chopping down trees, sawing them into lumber and transporting to the market. You can cut the trees into 2X4s where they are cut down or after being transported to the market. Cutting down trees Sawing trees into lumber Transporting trees to $65 per ton the market $38 per ton $110 per ton Transporting 2X4s to $45 per ton the market a. Where should you locate the sawmill to minimize costs? Why? b. Where should you locate the sawmill if the price of lumber is $190 per ton? $215?arrow_forwardAn operations manager is deciding on the level of automation for a new process. The fixed cost for automation includes the equipment purchase price, installation, and initial spare parts. The variable costs per unit for each level of automation are primarily labor related. Each unit can be sold for $81. As in many cases, you have the default alternative of doing nothing ($0 fixed cost, $0 variable costs). Hint: For these questions, also consider the “Do Nothing” option as a viable option when making your decision. Alternative Fixed Costs Variable Costs per Unit A $100,000 $54 B $272,000 $31 C $560,000 $20 Recommended: graph each alternative with units on the x-axis and $ on the y-axis. Also, include revenue on the chart. Identify the break-even points and points of indifference.arrow_forwardA firm has fixed costs of $25,000 associated with the manufacture of lawn mowers that cost $480 per mower to produce. The firm sells all the mowers it produces at $580 each. Find the cost, revenue and profit equations. Find the break-even quantity. (Let x be the number of mowers.)C(x) = R(x) = P(x) = break even quantity= ? mowersarrow_forward

- The Borstal Company has to choose between two machines that do the same job but have different lives. The two machines have the following costs: Year Machine A 0 OLN3+ 1 2 4 $48,000 11,600 11,600 11,600 + replace Machine A Machine B These costs are expressed in real terms. a. Suppose you are Borstal's financial manager. If you had to buy one or the other machine and rent it to the production manager for that machine's economic life, what annual rental payment would you have to charge? Assume a 12% real discount rate and ignore taxes. (Do not round intermediate calculations. Enter your answers as a positive value rounded to 2 decimal places.) Machine B $58,000 11,200 11, 200 11,200 11,200 + replace Annual Rental Paymentarrow_forwardOlsen Company produces two products. Product A has a contribution margin of $30 and requires 10 machine hours. Product B has a contribution margin of $24 and requires 4 machine hours. Determine the more profitable product assuming the machine hours are the constraint. Unit contribution margin per bottleneck hour:Product A $_____Product B $_____ Product ____ is most profitable.arrow_forwardPlease answer fast i give you upvote.arrow_forward

- Pina Colada Racers makes bicycles. It has always purchased its bicycle tires from the Ivanhoe Tires at $25 each but is currently considering making the tires in its own factory. The estimated costs per unit of making the tires are as follows: Direct materials Direct labor Variable manufacturing overhead Total relevant cost $8 $4 The company's fixed expenses would increase by $63,000 per year if managers decided to make the tire. (a1) Calculate total relevant cost to make or buy if the company needs 10,300 tires a year. Make $7 $ Buyarrow_forwardHimalayan Engineering Works currently takes four days to convert the raw material and components to finished goods. The firm is considering in buying a set of new machines which will reduce the conversion time to 1.5 days. If the firm decides to buy the machines, how does this decision affect the working capital requirement? Working Capital requirement will increase Working Capital requirement will decrease No change in working capital requirement Change in conversion time has no relationship with working capital requirementarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education