Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

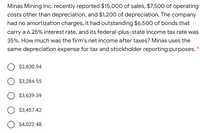

Transcribed Image Text:Minas Mining Inc. recently reported $15,000 of sales, $7,500 of operating

costs other than depreciation, and $1,200 of depreciation. The company

had no amortization charges, it had outstanding $6,500 of bonds that

carry a 6.25% interest rate, and its federal-plus-state income tax rate was

35%. How much was the firm's net income after taxes? Minas uses the

same depreciation expense for tax and stockholder reporting purposes.

$3,830.94

$3,284.55

$3,639.39

$3,457.42

O $4,022.48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Sol Limited. reported earnings of $510,000 in 20X8. The company has $91,000 of depreciation expense this year, and claimed CCA of $142,000. The tax rate was 25%. At the end of 20X7, there was a $122,000 loss carryforward that was not recorded because use was considered less than probable. The company also reported a deferred tax liability of $71,000 caused by capital assets with a net book value of $1,310,000 and UCC of $1,010,000. The tax rate had been 20% in 20X7. Required:What is the amount of income tax expense in 20X8? Prepare the income tax entry or entries. - Record the entry income tax expense. - Record the entry loss carryforward.arrow_forwardNeed Helparrow_forwardMercury Limited reported earnings of $75,000 in 20X9. The company has $55,000 of depreciation expense this year, and claimed. CCA of $90,000. The tax rate was 25%. At the end of 20X8, there was a $10,000 loss carryforward reported in a deferred tax asset. account valued at $2,200, and a deferred tax liability of $35,200 caused by capital assets with a net book value of $500,000 and UCC of $340,000. Required: What is the amount of income tax expense in 20X9? Tax expense $ Prepare the income tax entry or entries. View transaction list No 1 2 Date 20X9 23,250 20X9 View journal entry worksheet Income tax expense General Journal Deferred income tax asset Income tax payable Income tax payable Income tax expense Debit Creditarrow_forward

- A chemical company has a total income of 1.62 million per year and total expenses of 716057 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.24 with a MACRS recovery period of 7 years, and a straight-line recovery period of 9.4 years. Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the straight-line method?-arrow_forwardProvide the Correct answerarrow_forwardSee the explanation below to work the problem. XYZ Company, a 'for-profit' business, had revenues of $12 million in 2022. Expenses other than depreciation totaled 75 percent of revenues. XYZ Company, must pay taxes at a rate of 40 percent of pretax (operating) income. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Depreciation originally was $1.5 million; however, a change in the depreciation schedule (still within GAAP) has now made the depreciation expense DOUBLE. Based on this change in depreciation expense, what would XYZ's net income now be? Select one or more: a. so b. $3,000,000 c. $1,500,000 Od. Not enough information to tellarrow_forward

- Edwards Electronics recently reported $15,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? Select the correct answer. a. $6,324.00 b. $6,349.50 Oc$6,273.00 O d. $6,298.50 e. $6,375.00arrow_forwardI am confused about this Questionarrow_forward2. For the year 2021, Rattner Robotics had $5 million in operating income (EBIT). Its depreciation expense was $1.5 million, its interest expense was $1 million, and its corporate tax rate was 35%. At the end of year 2021, it had $10 million in operating current assets, $3 million in accounts payable, $1 million in accruals, and $2 million in notes payable. Assume Rattner has no excess cash and no other current liabilities. Assume that Rattner's only noncash item was depreciation. a) What was the company's net income for the year 2021?tion bona 158 b) What was its net operating working capital (NOWC) for the year 2021? c) Rattner reported $4 million in capital expenditure for the year of 2021. Rattner's NOWC for the prior year (year 2020) is $5.5 million. What is the company's free cash flow (FCF) for the year of 2021? (Hint: you need your results from part b to calculate this question).arrow_forward

- Mao Construction recently reported $20.50 million of sales, $12.60 million of operating costs other than depreciation, and $3.00 million of depreciation. It had $8.50 million of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 40%. What was Mao's operating income, or EBIT, in millions? * $4.90 $3.97 $3.57 $4.41 O $3.21arrow_forwardSol Limited. reported earnings of $510,000 in 20X8. The company has $91,000 of depreciation expense this year, and claimed CCA of $142,000. The tax rate was 25%. At the end of 20X7, there was a $122.000 loss carryforward that was not recorded because use was considered less than probable. The company also reported a deferred tax liability of $71,000 caused by capital assets with a net book value of $1,310,000 and UCC of $1,010,000. The tax rate had been 20% in 20X7 Required: What is the amount of income tax expense in 20X8? Tax expense Prepare the income tax entry or entries. View transaction list No 1 Date 20X8 View journal entry worksheet Income tax expense Income tax payable Deferred income tax asset General Journal Debit Credit 114,750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education