Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

|

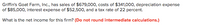

Griffin's Goat Farm, Inc., has sales of $679,000, costs of $341,000, |

| What is the net income for this firm? (Do not round intermediate calculations.) |

Transcribed Image Text:Griffin's Goat Farm, Inc., has sales of $679,000, costs of $341,000, depreciation expense

of $85,000, interest expense of $52,500, and a tax rate of 22 percent.

What is the net income for this firm? (Do not round intermediate calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Please show stepwise and correct. Thanks.arrow_forwardA firm has net income of $21,350, depreciation of $2,780, interest of $640, and taxes of $10,990. The EBITDA multiple is 10.2. What is the value of the firm?arrow_forwardThis year, FCF Inc. has earnings before interest and taxes of $9,630,000, depreciation expenses of $1,200,000, capital expenditures of $1,700,000, and has increased its net working capital by $600,000. If its tax rate is 35%, what is its free cash flow?arrow_forward

- The firm’s NOPAT= $115, depreciation expense is $12.5, amortization expense is $0, and interest expense is $15 and tax rate = 30%. What is the firm’s EBITDA?arrow_forwardWater and Power Co. (W&P) currently has $575,000 in total assets and sales of $1,400,000. Half of W&P’s total assets come from net fixed assets, and the rest are current assets. The firm expects sales to grow by 22% in the next year. According to the AFN equation, the amount of additional assets required to support this level of sales is . (Note: Round your answer to the nearest whole number.) W&P was using its fixed assets at only 95% of capacity last year. How much sales could the firm have supported last year with its current level of fixed assets? (Note: Round your answer to the nearest whole number.) $1,547,368 $1,768,421 $1,473,684 $1,694,737 When you consider that W&P’s fixed assets were being underused, its target fixed assets to sales ratio should be %. (Note: Round your answer to two decimal places.) When you consider that W&P’s fixed assets were being underused, how much fixed assets must W&P raise to…arrow_forwardGreedy Ventureshad revenues of $925,000 in 2014. Its operating expenses (excluding depreciation) amounted to $325,000, depreciation charges were $125,000, and interest costs totaled $55,000. If the firm pays a marginal tax rate of 34 percent, calculate its net income after taxes.arrow_forward

- Polymer Coating Enterprises has an operating income of $100,000 on revenues of $1,000,000. Average invested assets are $500,000 and the Company has an 8% cost of capital. What is the residual income?arrow_forwardHammett, Inc., has sales of $90,509, costs of $33,530, depreciation expense of $10,890, and interest expense of $3,410. If the tax rate is 37 percent, what is the operating cash flow, or OCF?arrow_forwardProvide the Correct answerarrow_forward

- You are given the following information for Troiano Pizza Company: sales = $84,700; costs = $58,900; addition to retained earnings = $8,100; dividends paid = $3,500; interest expense = $3,210; tax rate = 23 percent. Calculate the depreciation expense for the company. Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forwardEdwards Electronics recently reported $15,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? Select the correct answer. a. $6,324.00 b. $6,349.50 Oc$6,273.00 O d. $6,298.50 e. $6,375.00arrow_forwardSoy sauce company ABC has operating profits of Rp. 100 million, taxes of Rp. 17 million, interest expense of Rp. 34 million, and preferred dividends of Rp. 5 million. What is ABC net profit after taxes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education