FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

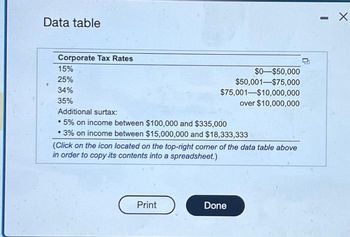

Transcribed Image Text:Data table

Corporate Tax Rates

15%

25%

34%

35%

$0-$50,000

$50,001 $75,000

$75,001-$10,000,000

over $10,000,000

Additional surtax:

• 5% on income between $100,000 and $335,000

• 3% on income between $15,000,000 and $18,333,333

(Click on the icon located on the top-right corner of the data table above

in order to copy its contents into a spreadsheet.)

Print

Done

-

X

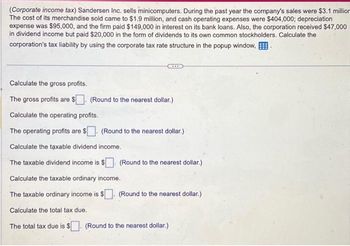

Transcribed Image Text:(Corporate income tax) Sandersen Inc. sells minicomputers. During the past year the company's sales were $3.1 million

The cost of its merchandise sold came to $1.9 million, and cash operating expenses were $404,000; depreciation

expense was $95,000, and the firm paid $149,000 in interest on its bank loans. Also, the corporation received $47,000

in dividend income but paid $20,000 in the form of dividends to its own common stockholders. Calculate the

corporation's tax liability by using the corporate tax rate structure in the popup window,

Calculate the gross profits.

The gross profits are $. (Round to the nearest dollar.)

Calculate the operating profits.

The operating profits are $[

Calculate the taxable dividend income.

The taxable dividend income is $

Calculate the taxable ordinary income.

The taxable ordinary income is $. (Round to the nearest dollar.)

Calculate the total tax due.

The total tax due is $

(Round to the nearest dollar.)

(Round to the nearest dollar.)

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Corporate income tax) Last year Sanderson, Inc. had sales of $3.0 million. The firm's cost of goods sold came to $2.0 million, its operating expenses excluding depreciation of $100,000 were $400,000, and the firm paid $150,000 in interest on its bank loans. Also, the corporation received $50,000 in dividend income (from a company in which it owned less than 20 percent of its shares but paid $25,000 in the form of dividends to its own common stockholders. Use the corporate tax rates shown in the popup window,, to calculate the corporation's tax liability. What are the firm's average and marginal tax rates? Etext pages @ 2 The firm's tax liability for the year is $. (Round to the nearest dollar.) S W * X H Get more help - # 3 E D 80 13 C $ 4 900 000 14 R F V % 5 FS T G A 6 B MacBook Air F6 Y H & 7 N F7 U J * 8 DII Fa I M l 9 MOSISO D K DD 19 O V H - C 0 L F10 P > Clear all - : ; I F11 { [ command option + 11 = ? Check answer "1 1 13) F12 } 1 deletarrow_forward(Corporate income tax) The Robbins Corporation is an oil wholesaler. The firm's sales last year were $1.01 million, with the cost of goods sold equal to $590,000. The firm paid interest of $211,250 and its cash operating expenses were $104,000. Also, the firm received $45,000 in dividend income from a firm in which the firm owned 22% of the shares, while paying only $11,000 in dividends to its stockholders. Depreciation expense was $48,000. Use the corporate tax rates shown in the popup window, , to compute the firm's tax liability. What are the firm's average and marginal tax rates? ☑ The Robbins Corporation's tax liability for the year is $ (Round to the nearest dollar.) Data table Taxable Income Marginal Tax Rate $0-$50,000 15% $50,001 - $75,000 25% $75,001-$100,000 34% $100,001 - $335,000 39% $335,001-$10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001-$18,333,333 38% Over $18,333,333 35% (Click on the icon in order to copy its contents into a spreadsheet.)arrow_forwardGive me answerarrow_forward

- (Corporate income tax) Last year Sanderson, Inc. had sales of $3.2 million. The firm's cost of goods sold came to $2.1 million, its operating expenses excluding Kdepreciation of $100,000 were $402,000, and the firm paid $152,000 in interest on its bank loans. Also, the corporation received $55,000 in dividend income (from a company in which it owned less than 20 percent of its shares) but paid $26,000 in the form of dividerids to its own common stockholders. Use the corporate tax rates shown in the popup window, to calculate the corporation's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $ (Round to the nearest dollar.) w an example Data table Taxable Income $0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 Marginal Tax Rate 15% 25% 34% 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38 % 35% Over $18,333,333 (Click on the icon in order to copy its contents into a spreadsheet.)…arrow_forwardMoncton Meats is a corporation that earned $3 per share before it paid any taxes. The firm retained $1 of after-tax earnings for reinvestment, and distributed what remained in dividend payments. You hold 20,000 shares of Moncton Meats in a tax-free savings account. If the corporate tax rate was 30% and dividend earnings were taxed at 20%, what was the value of your dividend earnings received after all taxes are paid?arrow_forwardMacon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $38 million. Included in the income was interest expense of $3,300,000. The company's tax rate was 40%. Total assets were $465 million, current liabilities were $109,000,000, and $67,000,000 of the current liabilities are noninterest bearing. What are the invested capital and ROI for Macon? Enter your answer in whole dollar. Round "ROI" answer to two decimal places.arrow_forward

- Need sum helparrow_forwardGibson Company sales for the Year 1 were $2 million. The firm’s variable operating cost ratio was 0.45, and fixed costs (that is, overhead and depreciation) were $700,000. Its average (and marginal) income tax rate is 40 percent. Currently, the firm has $2.4 million of long-term bank loans outstanding at an average interest rate of 13.0 percent. The remainder of the firm’s capital structure consists of common stock (140,000 shares outstanding at the present time). Calculate Gibson’s degree of combined leverage for Year 1. Round your answer to two decimal places. Gibson is forecasting a 8 percent increase in sales for next year (Year 2). Furthermore, the firm is planning to purchase additional labor-saving equipment, which will increase fixed costs by $130,000 and reduce the variable cost ratio to 0.430. Financing this equipment with debt will require additional bank loans of $400,000 at an interest rate of 13.0 percent. Calculate Gibson’s expected degree of combined leverage for…arrow_forwardMarine Outlets, Inc. had $ 14 million in sales last year, COGS of $ 8 million, depreciation expense of $ 2 million, $ 1 million in interest payments on long-term debt. If the firm's “tax rate” is 35%, how much is the Firm's Net Income?arrow_forward

- Broward Manufacturing recently reported the following information: Net income ROA BEP: 26.73 Interest expense $102,120 Accounts payable and accruals $950,000 Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). Do not round intermediate calculations. Round your answers to two decimal places. ROE: 73.60 ROIC: 44.55 % % $276,000 % 8%arrow_forward(Corporate income tax) The Robbins Corporation is an oil wholesaler. The company's sales last year were $1 04 milion, with the cost of goods sold equal to $636,000. The fimm pad interest of $223,000, and is cash operating expenses were $150,000 Also, the fimm received $32,000 in dividend income while paying only $14.000 in dividends to its preferred stockholders Depreciation expense was $156,000 Compute the firm's tax liability by using the corporate tax rate structure in the popup window. Based on your answer, does management need to take any additional action? - X Calculate the gross profits The gross profits are $ (Round to the nearest dollar) Data table (Cick on the following on in order to copy its contents into a spreadsheet) Corporate Tax Rates 15% 25% 34% 35% $0-$50,000 $50,001-$75,000 $75,001-$10,000,000 over $10,000,000 Additional surtax *5% on income between $100,000 and $335.000 3% on ncome between $15,000 000 and $18.333,333arrow_forwardMars Corporation has Revenues of $50 million, Tax Expense of $5 million, total Other Expenses of $15 million, and Net Income of $30 million. What is Mars Corporation's income tax RATE? 25.0% 10.0% 14.3% 16.7%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education