FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

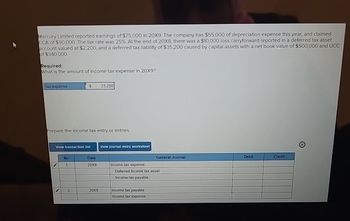

Transcribed Image Text:Mercury Limited reported earnings of $75,000 in 20X9. The company has $55,000 of depreciation expense this year, and claimed.

CCA of $90,000. The tax rate was 25%. At the end of 20X8, there was a $10,000 loss carryforward reported in a deferred tax asset.

account valued at $2,200, and a deferred tax liability of $35,200 caused by capital assets with a net book value of $500,000 and UCC

of $340,000.

Required:

What is the amount of income tax expense in 20X9?

Tax expense

$

Prepare the income tax entry or entries.

View transaction list

No

1

2

Date

20X9

23,250

20X9

View journal entry worksheet

Income tax expense

General Journal

Deferred income tax asset

Income tax payable

Income tax payable

Income tax expense

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sol Limited. reported earnings of $510,000 in 20X8. The company has $91,000 of depreciation expense this year, and claimed CCA of $142,000. The tax rate was 25%. At the end of 20X7, there was a $122,000 loss carryforward that was not recorded because use was considered less than probable. The company also reported a deferred tax liability of $71,000 caused by capital assets with a net book value of $1,310,000 and UCC of $1,010,000. The tax rate had been 20% in 20X7. Required:What is the amount of income tax expense in 20X8? Prepare the income tax entry or entries. - Record the entry income tax expense. - Record the entry loss carryforward.arrow_forwardNeed Helparrow_forwardFor its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income $ 300,000 Permanent difference (15,000 ) 285,000 Temporary difference-depreciation (20,000 ) Taxable income $ 265,000 Tringali's tax rate is 25%. Assume that no estimated taxes have been paid. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?arrow_forward

- Q.11.arrow_forwardA chemical company has a total income of 1.62 million per year and total expenses of 716057 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.24 with a MACRS recovery period of 7 years, and a straight-line recovery period of 9.4 years. Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the straight-line method?-arrow_forwardces Petrilli Ltd. had a taxable loss of $4,500,000 in 20X8 and a further loss of $230,000 in 20X9. The tax rate in 20X8 was 32% and in 20X9, 33%. All rates are enacted in the year to which they pertain. In the three years before the losses, the company had the following taxable income and tax rates: Taxable income Tax rate 20X5 20X6 $1,584,000 $1,710,000 Refund amount $ 36% There are no temporary differences other than those created by income tax losses. The company was struggling due to a competitor entering the market. Required: 1. What is the amount of refund that will be claimed in 20X8? 0 38% 20X7 $689,600 40% The amount of the tax loss carryforward 2. What is the amount of the loss carryforward in 20X8? $4,500,000arrow_forward

- During the current year, Dale Corporation sold a segment of its business at a gain of $315,000.Until it was sold, the segment had a current period operating loss of $112,500. The company had$1,275,000 from continuing operations for the current year.Prepare the lower part of the income statement, beginning with the $1,275,000 income fromcontinuing operations. Follow tax allocation procedures, assuming that all changes in incomeare subject to a 20% income tax rate. Disregard earnings per share disclosures. (Round all calculations to nearest dollar amount.)arrow_forward(Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,522,000 in revenues, $3,362,000 in cost of goods sold, $458,000 in operating expenses which included depreciation expense of $140,000, and a tax liability equal to 34 percent of the firm's taxable income. Sandifer Manufacturing Co. plans to reinvest $52,000 of its earnings back into the firm. What does this plan leave for the payment of a cash dividend to Sandifer's stockholders? Complete the income statement for Sandifer Manufacturing Co.: (Round to the nearest dollar.) Revenues = Less: Cost of Goods Sold = Less: Operating Expenses Less: Interest Expense Less: Income Taxes = = $ $ $ $ Equals: Gross Profit = ... Equals: Net Operating Income = 0 Equals: Earnings before Taxes Equals: Net Income = = $ GA GA $arrow_forwardDuring 2018, Raines Umbrella Corporation had sales of $749,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $576,000, $101,000, and $131,000, respectively. In addition, the company had an interest expense of $99,000 and a tax rate of 40 percent. (Ignore any tax loss carryback or carryforward provisions.) Assume Raines Umbrella Corporation paid out $16,000 in cash dividends. If spending on net fixed assets and net working capital was zero, and if no new stock was issued during the year, what is the firm's net new long-term debt?arrow_forward

- During the current year, Newtech Corporation sold a segment of its business at a loss of $225,000. Until it was sold, the segment had a current period operating loss of $200,000. The company had $750,000 from continuing operations for the current year. Prepare the lower part of the income statement, beginning with the $750,000 income from continuing operations. Follow tax allocation procedures, assuming that all changes in income are subject to a 40% income tax rate. Disregard earnings per share disclosures. Newtech Corporation Partial Income Statement Income from continuing operations Discontinued operations Current Year Loss from operations of discontinued segment (net of tax) $ 200,000 Loss on disposal of discontinued segment (net of tax) Net income $ 750,000 0 0 $ 0arrow_forwardLi Corporation reported pretax book income of $605,000. Tax depreciation exceeded book depreciation by $401,000. Li's beginning book (tax) basis in its fixed assets was $1,905,000 ($1,704,000) and its ending book (tax) basis is $1,805,000 ($1,206,000). In addition, the company received $305,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $69,000. Assuming a tax rate of 21 percent, compute the company's deferred income tax expense or benefit. Note: Enter all numbers as a positive number and indicate whether a deferred tax expense or a deferred tax benefit. Deferred income tax expensearrow_forwardAt the beginning of 20x5, Rundle Ltd. reported a deferred tax liabilty of $300,000. The net book value of the capital assets was $2,600,000, while UCC was $1,600,000. In 20x5, depreciation was $400,000, while CCA was $625,000. The tax rate changed in 20x5 to be 35 %. What is the adjustment required to the deferred taxes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education