Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

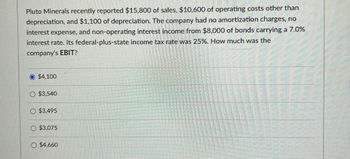

Transcribed Image Text:Pluto Minerals recently reported $15,800 of sales, $10,600 of operating costs other than

depreciation, and $1,100 of depreciation. The company had no amortization charges, no

interest expense, and non-operating interest income from $8,000 of bonds carrying a 7.0%

interest rate. Its federal-plus-state income tax rate was 25%. How much was the

company's EBIT?

$4,100

O $3,540

$3,495

O $3,075

O $4,660

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- A chemical company has a total income of 1.62 million per year and total expenses of 716057 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.24 with a MACRS recovery period of 7 years, and a straight-line recovery period of 9.4 years. Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the straight-line method?-arrow_forwardProvide the Correct answerarrow_forwardEdwards Electronics recently reported $15,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? Select the correct answer. a. $6,324.00 b. $6,349.50 Oc$6,273.00 O d. $6,298.50 e. $6,375.00arrow_forward

- McEwen mining recently reported $130000 off sales$68500 of operating cost other than depreciation and $10200 off depreciation. The company has $20000 of outstanding bonds that carry a 6% interest rate and its tax rate was 35%. what was the firms net incomearrow_forwardMainline Clinic, a for-profit business, had revenues of $11.1 million last year. Expenses other than depreciation totaled 67 percent of revenues, and depreciation expense was $1.3 million. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Mainline must pay taxes at a rate of 39 percent of pretax (operating) income. Now, suppose the company changed its depreciation calculation procedures (still within GAAP) such that its depreciation expense doubled. How would this change affect Mainline’s net income? If net income would go down, enter the amount of the change as a negative number. If net income would go up, enter the amount of the change as a positive number.arrow_forwardNonearrow_forward

- Tool Manufacturing has an expected EBIT of $74,000 in perpetuity and a tax rate of 21 percent. The company has $131,500 in outstanding debt at an interest rate of 6.8 percent and its unlevered cost of capital is 13 percent. What is the value of the company according MM Proposition I with taxes? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Company valuearrow_forwardDelta Products recently reported $4,250,000 of sales, $3,200,000 of operating costs other than depreciation, and $250,000 of depreciation. The company had $750,000 of outstanding bonds that carry a 4.25% interest rate, and its federal-plus-state income tax rate was 35%. In order to sustain its operations and thus generate sales and cash flows in the future, the Delta Products spent $350,000 to buy new fixed assets and to invest $75,000 in net operating working capital. How much free cash flow did Delta Products generate?arrow_forwardMao Construction recently reported $20.50 million of sales, $12.60 million of operating costs other than depreciation, and $3.00 million of depreciation. It had $8.50 million of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 40%. What was Mao's operating income, or EBIT, in millions? * $4.90 $3.97 $3.57 $4.41 O $3.21arrow_forward

- XYZ Ltd.has a net income of $ 56,780. They paid $2000 in interest payments to bondholders and $4,000 in taxes to the government. What is the company's EBIT ? a $80,000 b $56,780 c $62,780 d $46,000arrow_forwardKobe Capital Corp. recently reported $19,500 of sales, $8,100 of operating costs other than depreciation, and $1,750 of depreciation. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its income tax rate was 40%. How much was the firm's earnings before taxes (EBT)? Your answer should be between 8505 and 10280, rounded to even dollars (although decimal places are okay), with no special characters.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education