FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

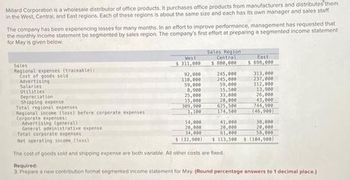

Transcribed Image Text:Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them

in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff

The company has been experiencing losses for many months. In an effort to improve performance, management has requested that

the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement

for May is given below.

Sales

Regional expenses traceable):

Cost of goods sold

Advertising

Salaries

Utilities

Depreciation

Shipping expense

Total regional expenses

Regional income (less) before corporate expenses

Corporate expenses

Advertising (general)

General administrative expense

Mest

$311,000

92,000

110,000

59,000

8.900

25,000

15,000

309,900

1.100

14,000

20,000

34,000

5 (32,900)

Sales Region

Central

$800,000

245,000

245,000

59,000

15,500

33,000

28,000

hiso

2

East

1.698,000

Total corporate expenses

Net operating income (loss)

The cost of goods sold and shipping expense are both variable. All other costs are fixed

313,000

237,000

112,000

13,900

26,000

43,000

744,900

(46,900)

41,000

30,000

20,000

20,000

61,000

50,000

$113,500 $ (104,900)

Required:

3. Prepare a new contribution format segmented income statement for May (Round percentage answers to 1 decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- McNulty, Inc., produces desks and chairs. A new CFO has just been hired and announces a new policy that if a product cannot earn a margin of at least 35 percent, it will be dropped. The margin is computed as product gross profit divided by reported product cost. Manufacturing overhead for year 1 totaled $1,071,000. Overhead is allocated to products based on direct labor cost. Data for year 1 show the following. Chairs Desks Sales revenue $1,580,800 $2,786,000 Direct materials 595,000 910,000 Direct labor 230,000 400,000 Required: a-1. Based on the CFO's new policy, calculate the profit margin for both chairs and desks. a-2. Which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the chair product. The company cost analyst estimates that overhead without the chair line will be $760,000. The revenue and costs for desks are expected to be the same as last year. What is the…arrow_forwardKeggler's Supply is a merchandiser of three different products. The company's February 28 inventories are footwear, 19,000 units, sports equipment, 81,500 units; and apparel, 49,000 units. Management belleves each of these inventories is too high. As a result, a new policy dictates that ending inventory in any month should equal 29% of the expected unit sales for the following month. Expected sales in units for March, April, May, and June follow. Footwear Sports equipment Apparel Required: 1. Prepare a merchandise purchases budget (in units) for each product for each of the months of March, April, and May. Budgeted Sales in Units March April May 15,000 24,500 31,000 71,500 88,000 95,000 40,500 37,500 33,000 24,000 FOOTWEAR Budgeted sales for next month Ratio of ending inventory to future sales Required units of available merchandise Budgeted purchases SPORTS EQUIPMENT Budgeted sales for next month Ratio of ending inventory to future sales Budgeted purchases APPAREL Merchandise…arrow_forwardMontrose Instrumentation produces measurement equipment. One component, used in a variety of the company's products, is critical and the supply chain often breaks. For that reason, Montrose has a policy to hold in inventory enough of the component to produce three month's worth of sales (one component is used in each unit of product in which it is used). On February 1, the company has 40,000 components in stock. Sales of the units in which the component is used in each of the next six months are estimated to be as follows: February March April May June July 34,750 28,750 30,250 35,800 32,400 44,360 Parts are purchased at a wholesale price of $55. The vendor has a financing arrangement by which Montrose pays 40 percent of the purchase price in the month when the components are delivered and 60 percent in the following month. Montrose purchased 42,500 parts in January. Required: a. Estimate purchases of the component (in units) for February and March. b. Estimate the cash disbursements…arrow_forward

- Montrose Instrumentation produces measurement equipment. One component, used in a variety of the company's products, is critical and the supply chain often breaks. For that reason, Montrose has a policy to hold in inventory enough of the component to produce three month's worth of sales (one component is used in each unit of product in which it is used). On February 1, the company has 31,000 components in stock. Sales of the units in which the component is used in each of the next six months are estimated to be as follows: February 32,500 March 26,500 April 28,000 May 33,550 June 30,150 July 42,110 Parts are purchased at a wholesale price of $46. The vendor has a financing arrangement by which Montrose pays 40 percent of the purchase price in the month when the components are delivered and 60 percent in the following month. Montrose purchased 38,000 parts in January. Required: Estimate purchases of the component (in units) for February and March. Estimate the cash…arrow_forwardMillard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement for May is given below. Sales Regional expenses (traceable): Cost of goods sold Advertising Salaries Utilities Depreciation Shipping expense Total regional expenses Regional income (loss) before corporate expenses Corporate expenses: Advertising (general) General administrative expense Total corporate expenses Net operating income (loss) Variable expenses: Total variable expenses Traceable fixed expenses: Total traceable fixed expenses Common fixed expenses: Total common…arrow_forwardGibson Boot Co. sells men’s, women’s, and children’s boots. For each type of boot sold, it operates a separate department that has its own manager. All departments are housed in a single store. In recent years, the children’s department has operated at a net loss and is expected to continue to do so. Last year’s income statements follow. Men’s Department Women’s Department Children’s Department Sales $ 660,000 $ 480,000 $ 200,000 Cost of goods sold (269,500 ) (179,600 ) (100,875 ) Gross margin 390,500 300,400 99,125 Department manager’s salary (60,000 ) (49,000 ) (29,000 ) Sales commissions (114,200 ) (83,600 ) (31,900 ) Rent on store lease (29,000 ) (29,000 ) (29,000 ) Store utilities (12,000 ) (12,000 ) (12,000 ) Net income (loss) $ 175,300 $ 126,800 $ (2,775 ) Required a. Calculate the contribution to profit. Determine whether to eliminate the children’s…arrow_forward

- Stryker corp. Has two major business segments- east and west. In April, the east business segment had sales revenue of 500,000, variable expenses of 280,000 and traceable fixed expenses of 80,000. During the same month, the west business segment had sales revenues of 970,000, variable expenses of 514,000 and traceable fixed expenses of 184,000. The common fixed expenses total 280,000 and were allocated as follows: 112,000 to the east business segment and 168,000 to the west business segment. A properly constructed segmented income statement in a contribution format would show that the segment margin of the east business segment is: 108,000 28,000 140,000 280,000arrow_forwardHello Company makes three different products. Due to the constraints of their manufacturing equipment and warehouse facility, the company is only able to produce, store, and sell a total of 50,000 units each month. The production of Products A and B varies each month; however, Product C is a special order for one customer who purchases the same number of units every month. Pete Davila, the CEO, has |provided the following data from last month for each product. Income Statement Product A Product B Product C Мax Cарacity 5,000 8.00 $ 2.00 $ Units 43,000 10.00 $ 3.00 $ 20,000 $ 2,000 50,000 Price per unit Variable expense per unit $ $ $ 50.00 15.00 $ 20.00 Total Fixed Costs 40,000 $ 10,000 Product Sales $ 430,000 $ 40,000 $ 100,000 $ 570,000 (169,000) 401,000 (70,000) 331,000 Variable Costs (129,000) (10,000) 30,000 $ (30,000) 70,000 $ Contribution Margin $ 301,000 $ Fixed Costs (20,000) 281,000 (40,000) (10,000) (10,000) 60,000 $ Operating income (loss) Required Using the Data Table…arrow_forwardABC is an online-to-offline platform that sells e-commerce products to offline customers through a network of agents. ABC gives a commission to agents for each sale made. ABC has 4 main product categories: electronics, fashion, supermarket, and others. Please refer to the exhibits for data sets pertaining to the questions below. Today is May 16th. 1. What is the average growth in average sales per agent per month from March to May target? Answer: %2. Which one is the category with the highest and lowest average month-on- month sales growth from March to May target? Answer: Highest: Lowest:3. Today is May We have got the interim result of the sales figures in the first half of May. Typically, the first half of the month constitutes of 40% of sales. Using this assumption, will we reach our May target? What % over the target will we over/under-deliver? Answer: under/over-deliver by % of target4. Using that assumption, which category (or categories) will not reach the targeted sales…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education