FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

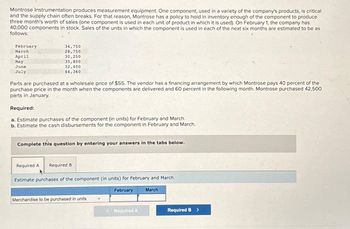

Transcribed Image Text:Montrose Instrumentation produces measurement equipment. One component, used in a variety of the company's products, is critical

and the supply chain often breaks. For that reason, Montrose has a policy to hold in inventory enough of the component to produce

three month's worth of sales (one component is used in each unit of product in which it is used). On February 1, the company has

40,000 components in stock. Sales of the units in which the component is used in each of the next six months are estimated to be as

follows:

February

March

April

May

June

July

34,750

28,750

30,250

35,800

32,400

44,360

Parts are purchased at a wholesale price of $55. The vendor has a financing arrangement by which Montrose pays 40 percent of the

purchase price in the month when the components are delivered and 60 percent in the following month. Montrose purchased 42,500

parts in January.

Required:

a. Estimate purchases of the component (in units) for February and March.

b. Estimate the cash disbursements for the component in February and March.

Complete this question by entering your answers in the tabs below.

Required A Required B

Estimate purchases of the component (in units) for February and March.

Merchandise to be purchased in units

February

< Required A

March

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Iguana, Inc., manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $12.00 per hour. Iguana has the following inventory policies: Ending finished goods inventory should be 40 percent of next month’s sales. Ending direct materials inventory should be 30 percent of next month’s production. Expected unit sales (frames) for the upcoming months follow: March 275 April 250 May 300 June 400 July 375 August 425 Variable manufacturing overhead is incurred at a rate of $0.30 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,200 ($600 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $650 per month plus $0.60 per unit sold.Iguana, Inc., had $10,800 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the…arrow_forwardMontrose Instrumentation produces measurement equipment. One component, used in a variety of the company's products, is critical and the supply chain often breaks. For that reason, Montrose has a policy to hold in inventory enough of the component to produce three month's worth of sales (one component is used in each unit of product in which it is used). On February 1, the company has 31,000 components in stock. Sales of the units in which the component is used in each of the next six months are estimated to be as follows: February 32,500 March 26,500 April 28,000 May 33,550 June 30,150 July 42,110 Parts are purchased at a wholesale price of $46. The vendor has a financing arrangement by which Montrose pays 40 percent of the purchase price in the month when the components are delivered and 60 percent in the following month. Montrose purchased 38,000 parts in January. Required: Estimate purchases of the component (in units) for February and March. Estimate the cash…arrow_forwardRegular Company produces audio equipment, specifically headphones and speakers. A new CEO has just been hired and announces a new policy that if a product cannot earn a markup of at least 25 percent, it will be dropped. The markup is computed as product gross profit divided by reported product cost. Manufacturing overhead for year 1 totaled $996,000. Overhead is allocated to products based on direct materials cost. Data for year 1 show the following: Headphones Speakers Sales revenue $ 2,247,640 $ 2,141,940 Direct materials 730,000 930,000 Direct labor 492,000 252,000 Required: a-1. Calculate the markup for both headphones and speakers. a-2. Based on the CFO's new policy, which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the speakers from the product line. The company cost analyst estimates that overhead without the speaker line will be $630,000. The revenue and costs for…arrow_forward

- outback Co. was organized to sell a single product that carries a 45 day warranty against defects. Engineering estimates indicates that 12% of the units sold will prove defective and require an average repair cost of $20 per unti. During outbacks first month of operations, total sales were 200 untis; by the end of the month, nine defective units had been repaired. The Liability for product warrantees at month end should be. a.$180 b.$660 c.$300 d.$480arrow_forwardElijah Electronics makes wireless headphone sets. The firm produced 27,000 wireless headphone sets during its first year of operation. At year-end, it had no inventory of finished goods. Elijah sold 25,380 units through regular market channels, but 270 of the units produced were so defective that they had to be sold as scrap. The remaining units were reworked and sold as seconds. For the year, the firm spent $144,000 on prevention costs and $72,000 on quality appraisal. There were no customer returns. An income statement for the year follows. Sales Regular channel $5,076,000 Seconds 128,250 Scrap 9,450 $5,213,700 Cost of goods sold Original production costs $1,725,840 Rework costs 37,800 Quality prevention and appraisal 216,000 $1,979,640 Gross margin $3,234,060 Selling and administrative expenses (all fixed) 882,000 Profit before income taxes $2,352,060 Compute the total pre-tax…arrow_forwardUse this information for Timmer Corporation to answer the question that follows. Timmer Corporation just started business in January. There were no beginning inventories. During the year, it manufactured 11,700 units of product and sold 8,000 units. The selling price of each unit was $25. Variable manufacturing costs were $3 per unit, and variable selling and administrative costs were $4 per unit. Fixed manufacturing costs were $23,400 and fixed selling and administrative costs were $7,900. What would Timmer's income from operations be for the year using absorption costing? O a. $120,100 b. $128,000 c. $96,080 Od. $144,000arrow_forward

- Hello Company makes three different products. Due to the constraints of their manufacturing equipment and warehouse facility, the company is only able to produce, store, and sell a total of 50,000 units each month. The production of Products A and B varies each month; however, Product C is a special order for one customer who purchases the same number of units every month. Pete Davila, the CEO, has |provided the following data from last month for each product. Income Statement Product A Product B Product C Мax Cарacity 5,000 8.00 $ 2.00 $ Units 43,000 10.00 $ 3.00 $ 20,000 $ 2,000 50,000 Price per unit Variable expense per unit $ $ $ 50.00 15.00 $ 20.00 Total Fixed Costs 40,000 $ 10,000 Product Sales $ 430,000 $ 40,000 $ 100,000 $ 570,000 (169,000) 401,000 (70,000) 331,000 Variable Costs (129,000) (10,000) 30,000 $ (30,000) 70,000 $ Contribution Margin $ 301,000 $ Fixed Costs (20,000) 281,000 (40,000) (10,000) (10,000) 60,000 $ Operating income (loss) Required Using the Data Table…arrow_forwardScholes Systems supplies a particular type of office chair to large retailers such as Target, Costco, and Office Max. Scholes is concerned about the possible effects of inflation on its operations. Presently, the company sells 81,000 units for $65 per unit. The variable production costs are $35, and fixed costs amount to $1,410,000. Production engineers have advised management that they expect unit labor costs to rise by 15 percent and unit materials costs to rise by 10 percent in the coming year. Of the $35 variable costs, 40 percent are from labor and 20 percent are from materials. Variable overhead costs are expected to increase by 20 percent. Sales prices cannot increase more than 10 percent. It is also expected that fixed costs will rise by 5 percent as a result of increased taxes and other miscellaneous fixed charges. The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits must increase by 7 percent…arrow_forwardThe words in blue may be incorrect!! Please show your work. Thank you! Again, the words in BLUE may be WRONG.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education