FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

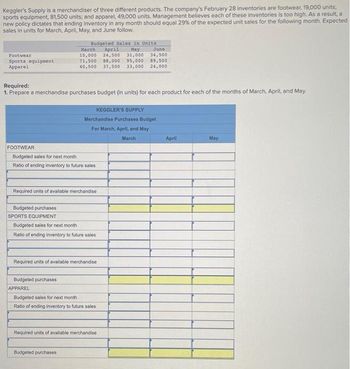

Transcribed Image Text:Keggler's Supply is a merchandiser of three different products. The company's February 28 inventories are footwear, 19,000 units,

sports equipment, 81,500 units; and apparel, 49,000 units. Management belleves each of these inventories is too high. As a result, a

new policy dictates that ending inventory in any month should equal 29% of the expected unit sales for the following month. Expected

sales in units for March, April, May, and June follow.

Footwear

Sports equipment

Apparel

Required:

1. Prepare a merchandise purchases budget (in units) for each product for each of the months of March, April, and May.

Budgeted Sales in Units

March April May

15,000 24,500 31,000

71,500 88,000 95,000

40,500 37,500 33,000 24,000

FOOTWEAR

Budgeted sales for next month

Ratio of ending inventory to future sales

Required units of available merchandise

Budgeted purchases

SPORTS EQUIPMENT

Budgeted sales for next month

Ratio of ending inventory to future sales

Budgeted purchases

APPAREL

Merchandise Purchases Budget

For March, April, and May

March

Required units of available merchandise

KEGGLER'S SUPPLY

Budgeted sales for next month

Ratio of ending inventory to future sales

Budgeted purchases

June

34,500

89,500

Required units of available merchandise

April

May

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Acme Ltd. manufactures point of sale terminals used by businesses to process transactions. At the close of business on 30 September, the company had 450 terminals in inventory. The company's policy is to maintain an ending inventory of terminals equal to 30 per cent of next month's sales. Each terminal manufactured requires 25 minutes of assembly and inspecting time at a cost of 70 cents per minute. The company expects the following sales activity: October 8 000 units November 12 000 units December 13 000 units January 10 000 units What is the total projected direct labour cost for November and December? O $302 000 O None of the other alternatives $210 000 O $427 000arrow_forwardAll sales are made on credit terms of net 30 days and are collected the following month and no bad debts are anticipated. The accounts receivable on the balance sheet at the end of September thus will be collected in October. The October sales will be collected in November, and so on. Inventory on hand represents a minimum operating level (or “safety” stock), which the company intends to maintain. Cost of goods sold average 80 percent of sales. Inventory is purchased in the month of sale and paid for in cash. Other cash expenses average 7 percent of sales. Depreciation is $10,000 per month. Assume taxes are paid monthly and the effective income tax rate is 40 percent for planning purposes. The annual interest rate on outstanding long-term debt and bank loans (notes payable) is 12%. There are no capital expenditures planned during the period, and no dividends will be paid. The company’s desired end-of-month cash balance is $80,000. The president hopes to meet any cash shortages during…arrow_forwardThe trailer company exspects to sell 9000 for $155 each for a total of $1,395,000 in January and 4500 units for $225 each for a total of $1,012,500 in February. The company exspects the cost of goods sold to average 70% of sales revenue, and the company exspects to sell 4700 units in march for $290 each. Trailer's target ending inventory is $9000 plus 50% of next months cost of goods sold. Prepare Trailer's inventory, purchases, and cost of goods sold budget for January and February. Trailer Company Inventory, Purchases, and Cost of Goods Sold Budget Two months Ended January 31 and February 28 January february cost of goods sold Plus: Desired ending merchandise inventory Total merchandise inventory required Less: Beginning merchandise inventory Budgeted purchasesarrow_forward

- Manjiarrow_forwardYorkley Corporation plans to sell 41,000 units of its single product in March. The company has 2,800 units in its March 1 finished-goods inventory and anticipates having 2,400 completed units in inventory on March 31. On the basis of this information, how many units does Yorkley plan to produce during March?arrow_forwardkeep costs down, CGC maintains a warehouse but no showroom or retail sales outlets. CGC has the following information for the second quarter of the year: 1. Expected monthly sales for April, May, June, and July are $180,000, $150,000, $270,000, and $50,000, respectively. 2. Cost of goods sold is 45 percent of expected sales. 3. CGC's desired ending inventory is 55 percent of the following month's cost of goods sold. 4. Monthly operating expenses are estimated to be: . Salaries: $33,000. ° Delivery expense: 8 percent of monthly sales. • Rent expense on the warehouse: $2,500. • Utilities: $500. • Insurance: $330. • Other expenses: $430. Required: 1. Compute the budgeted cost of purchases for each month in the second quarter. 2. Complete the budgeted income statement for each month in the second quarter. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the budgeted cost of purchases for each month in the second quarter. Total Cost of…arrow_forward

- Watt's Lighting Stores made the following sales projection for the next six months. All sales are credit sales. March April May June July August $ 42,000 48,000 37,000 46,000 54,000 56,000 Sales in January and February were $45,000 and $44,000, respectively. Experience has shown that of total sales, 10 percent are uncollectible, 30 percent are collected in the month of sale, 40 percent are collected in the following month, and 20 percent are collected two months after sale. Prepare a monthly cash receipts schedule for the firm for March through August. Credit sales Collections: In month of sale One month after sale Watt's Lighting Stores Cash Receipts Schedule January February March April May June July August Two months after sale $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 Total cash receiptsarrow_forwardSantorini Corporation has experienced a number of out of stock situations with respect to its finished goods inventories Inventory at the end of May, for example, was only 545 units an all time low Management desires to implement a policy whereby finished goods inventory is 60 % of the following month's sales Budgeted sales for June, and July are expected to be 3200 units, and 4400 units respectively Required Determine the number of units that Santorini must produce in June.arrow_forwardCherboneau Novelties produces drink coasters (among many other products). During the current year (year 0), the company sold 522,000 units (packages of 6 coasters). In the coming year (year 1), the company expects to sell 544,000 units, and, in year 2, it expects to sell 648,000 units. The target ending finished goods inventory for each month is equal to the next month's sales. However, because of production issues, the ending inventory in the current year is expected to be only 13,000 units. Each unit requires 0.5 pound of cork. At the end of the current year, management expects to have 19,250 pounds of cork in inventory. Management has set a target to have cork on hand equal to one half of next month’s sales requirements. Sales and production take place evenly throughout the year. Required: a. Compute the total targeted production of the finished coaster for the coming year. b. Compute the required amount of cork to be purchased for the coming year. (540,000 units for a is incorrect…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education