FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

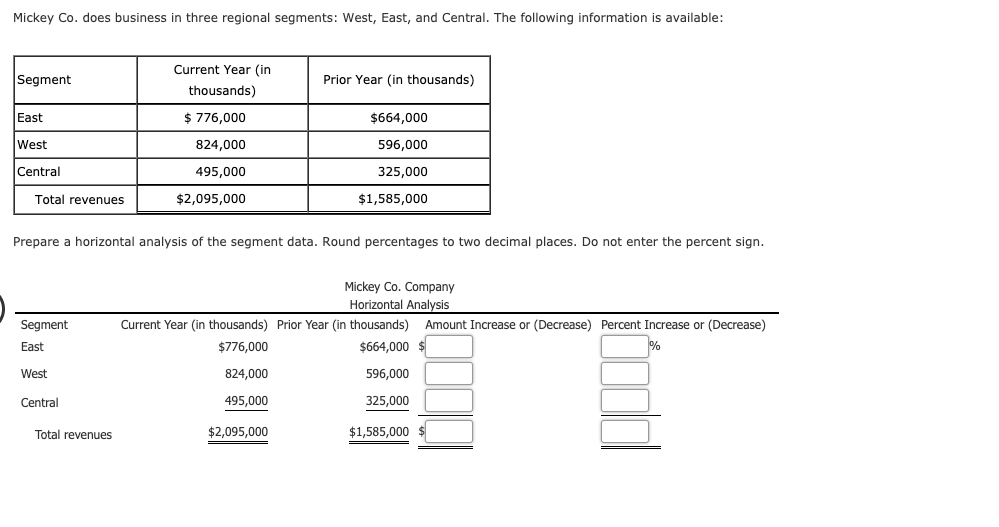

Transcribed Image Text:Mickey Co. does business in three regional segments: West, East, and Central. The following information is available:

Current Year (in

Prior Year (in thousands)

Segment

thousands)

$ 776,000

East

$664,000

West

824,000

596,000

Central

495,000

325,000

$2,095,000

$1,585,000

Total revenues

Prepare a horizontal analysis of the segment data. Round percentages to two decimal places. Do not enter the percent sign.

Mickey Co. Company

Horizontal Analysis

Segment

Current Year (in thousands) Prior Year (in thousands)

Amount Increase or (Decrease) Percent Increase or (Decrease)

$664,000 $

%

East

$776,000

West

824,000

596,000

325,000

495,000

Central

$2,095,000

$1,585,000

Total revenues

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Prepare a horizontal analysis of Nebraska Technologies's income statements. For decreases or negative numbers use a minus sign. Round percentages to one decimal place. Year 1 Increase (Decrease) Percent Favorable/Unfavorable 1 2 3 4 5 6 7 Sales Wage expense Rent expense Utilities expense Total operating expenses Net income Year 2 $158,400.00 $80,000.00 28,000.00 30,000.00 $138,000.00 $162,500.00 $92,500.00 30,000.00 25,000.00 $147,500.00 $20,400.00 $15,000.00arrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forwardPayton Company has the following segment revenues for the two most recent fiscal years. Segment China Canada Other countries Total revenues Segment Prepare a vertical analysis of the segment data. Calculate the percentage to four decimal places, then round your answer to one decimal place. China Canada Other countries Current Year (in millions) $745 339 211 $1,295 Total revenues Payton Company Vertical Analysis Current Year Amount (in millions) $745 339 211 $1,295 Current Year Percent % Prior Year (in millions) $660 244 166 $1,070 % Prior Year Amount (in millions) $660 244 166 $1,070 Prior Year Percent % %arrow_forward

- The income statements for Galaxy Tennis for the years ending December 31, 2021 and 2020, are provided below.Required:1. Complete the “Amount” and “%” columns to be used in a horizontal analysis of Galaxy Tennis income statement. (Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) GALAXY TENNIS Income Statements For the Years Ended December 31 Increase (Decrease) 2021 2020 Amount % Net sales $6,030,000 $6,170,000 Cost of goods sold 2,810,000 2,900,000 Gross profit 3,220,000 3,270,000 Operating expenses 1,490,000 1,374,000 Operating income 1,730,000 1,896,000 Other income (expense) 56,000 77,000 Income before tax 1,786,000 1,973,000 Income tax expense 382,000 431,000 Net income $1,404,000 $1,542,000arrow_forwardPlease do not give solution in image format thankuarrow_forwardPayton Company has the following segment revenues for the two most recent fiscal years. Segment Current Year (in millions) Prior Year (in millions) China $770 $650 Canada 326 240 Other countries 212 168 Total revenues $1,308 $1,058 Prepare a vertical analysis of the segment data. Calculate the percentage to four decimal places, then round your answer to one decimal place. Payton Company Vertical Analysis Current Year Prior Year Current Year Percent Prior Year Segment Amount Amount Percent (in millions) (in millions) China $770 $650 % Canada 326 240 Other countries 212 168 Total revenues $1,308 $1,058 Previous Nextarrow_forward

- Using the attached financial statements attached, ratios need to be calculated for all boxes that are greyed out. Please provide details of how these ratios are calculated.arrow_forwardCompare Income Statements and Balance Sheets of Competitors a. Following are selected income statements from two pharmaceutical companies, Pfizer and Dr. Reddy's, for their respective 2018 fiscal years. Express each income statement amount as a percentage of sales. Note: Round percentage to one decimal point (for example, round 18.566% to 18.6%). Income Statement ($ millions) Sales Pfizer Dr. Reddy's $46,136 0% $1,876 09 Cost of goods sold 11,248 0% 1,009 0% Gross profit 34,888 0% 867 0% Total expenses Net income 26,841 $8,047 0% 0% 878 $(11) 0% 0% b. Following are selected balance sheets from two pharmaceutical companies, Pfizer and Dr. Reddy's, for their respective 2018 fiscal years. Express each balance sheet amount as a percentage of total assets. Note: Round percentage to one decimal point (for example, round 18.566% to 18.6%). Balance Sheet ($ millions) Pfizer Dr. Reddy's Current assets $42,936 0% $1,448 0% Long-term assets Total assets 109,496 $152,432 0% 1,781 096 0% $3,229 09…arrow_forwardPlease do not give image format and explanationarrow_forward

- Compute the following for Stanley Limited. Round your answers to two decimal places. All answers MUST be expressed in the unit as specified in the question, if any. Show your workings. (a) Gross Profit Rate (in %) (b) Current Ratio (c) Quick Ratio B Stanley Limited Statement of Financial Position 31 December 2021 ($ in million) Stanley Limited Income Statement For the year ended 31 December 2021 ($ in million) Question B5 (continued) (d) Accounts Receivable Turnover Rate (e) Return on Equity (%) (f) Debt Ratio (in %) (g) Price-Earnings Ratioarrow_forwardeBook Inventory $5,000 $4,900 65,000 29,000 230,000 froze Income Statement Pietro Frozen Foods, Inc., produces frozen pizzas. For next year, Pietro predicts that 54,100 units will be produced, with the following total costs: Direct materials Direct labor Variable overhead Fixed overhead Next year, Pietro expects to purchase $120,500 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows: Direct materials nirxas. F en pizzes Work-in-Process Inventory $14,000 $16,000 Beginning Ending Next year, Pietro expects to produce 54,100 units and sell 53,400 units at a price of $18.00 each. Beginning inventory of finished goods is $42,500, and ending inventory of finished goods is expected to be $34,000. Total selling expense is projected at $27,000, and total administrative expense is projected at $108,000. Required: erat. Contin no Ing. 1. Prepare an income statement in good form. Round the percent to four decimal places before…arrow_forwardComplete this question by entering your answers in the tabs below. Analysis Analysis Bal Sheet Inc Stmt Prepare a vertical analysis of an income statements for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) Revenues Sales (net) Other revenues Total revenues Expenses Cost of goods sold FANNING COMPANY Vertical Analysis of Income Statements Year 4 Selling, general, and administrative expense Interest expense Income tax expense Total expenses Net income Amount $ 231,900 9,300 241,200 118,800 54,200 6,800 22,800 202,600 $ 38,600 Percentage of Total Analysis Bal Sheet % % Year 3 Amount $ 211,200 6,400 217,600 102,100 49,100 6,000 21,800 179,000 $ Percentage of Total % % 38,600 Analysis Inc Stmt > Show lessarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education