FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please do not give solution in image format thanku

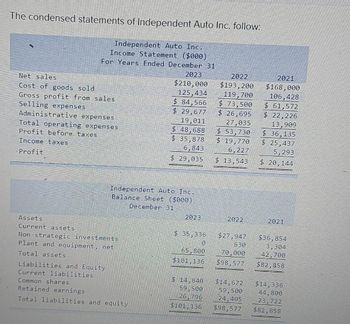

Transcribed Image Text:The condensed statements of Independent Auto Inc. follow:

Independent Auto Inc.

Income Statement ($000)

For Years Ended December 31

Net sales

Cost of goods sold

Gross profit from sales

Selling expenses

Administrative expenses

Total operating expenses

Profit before taxes

Income taxes

Profit

Assets

Current assets

Non-strategic investments

Plant and equipment, net

Total assets

2023

$210,000

125,434

Liabilities and Equity

Current liabilities

Common shares

Retained earnings

Total liabilities and equity

$ 84,566

$ 29,677

19,011

Independent Auto Inc.

Balance Sheet $000)

December 31

$ 48,688

$ 35,878

6,843

$ 29,035

2023

$ 35,336

0

65,800

$101, 136

$ 14,840

59 500

26, 796

$101.136

2022

$193,200

119,700

$ 73,500

$ 26,695

27,035

$ 53, 730

$ 19,770

6,227

$ 13.543

2022

$27,947

630

70,000

$98,577

$14,672

59,500

24,405

$98,577

2021

$168,000

106,428

$ 61,572

$22,226

13,909

$ 36,135

$25,437

5,293

$ 20,144

2021

$36,854

3,304

42,700

$82,858

$14,336

44,800

23,722

$82,858

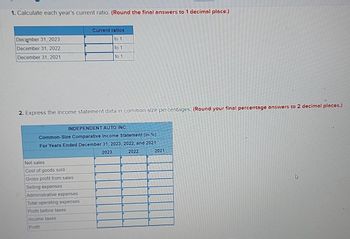

Transcribed Image Text:1. Calculate each year's current ratio. (Round the final answers to 1 decimal place.)

December 31, 2023

December 31, 2022

December 31, 2021

2. Express the income statement data in common-size percentages. (Round your final percentage answers to 2 decimal places.)

Current ratios

to 1

to 1

to 1

INDEPENDENT AUTO INC.

Common-Size Comparative Income Statement (in %)

For Years Ended December 31, 2023, 2022, and 2021

2023

2022

Net sales

Cost of goods sold

Gross profit from sales

Selling expenses

Administrative expenses

Total operating expenses

Profit before taxes

Income taxes

Profit

2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- can you please write your solution out and not use excel.arrow_forwardCan you please enter the information clearly without so many spaces? The information is hard to read.arrow_forwardSelect the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education